S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

10 Nov, 2021

By Sanne Wass

A major failure in supply chain finance has proven to be just a bump in the road for the nascent sector.

Supply chain finance provider Greensill Capital (UK) Ltd.'s collapse in March has had little impact on the availability of this type of trade finance, as existing lenders are ramping up their capabilities while new players are entering the market. Mastercard Inc. and Standard Chartered PLC both introduced new supply chain finance offerings in October, as demand increases and memories of Greensill fade away.

"People have got over it," Mark Ling, head of trade and supplier finance at Banco Santander SA, said at an Oct. 19 conference organized by Global Trade Review. The wider market also acted "very, very quickly" to replace supply chain funds following Greensill's demise, he said.

The failure may even have helped support the long-term growth of the sector by encouraging greater standards and fixing flaws in approvals processes, according to Scott Ettien, global head of trade credit at insurance broker Willis Towers Watson. Total industry revenues for supply chain finance will post a compound annual growth rate of 3.2% to reach $11 billion in 2030, according to Boston Consulting Group, due to the appeal of a system that lets suppliers get paid quickly while preserving buyers' cashflow.

"Greensill is not a bad thing for the market," Ettien told S&P Global Market Intelligence. "It's a really good thing because it teaches."

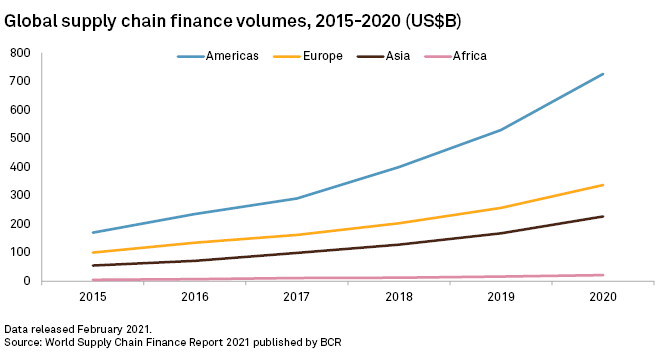

Supply chain finance volumes have grown significantly in recent years, reaching a total value of $1.31 trillion in 2020, according to the latest World Supply Chain Finance Report, published by intelligence company BCR in February.

The global revenue pool for supply chain finance grew approximately 7% year over year in the first half of 2021, according to Coalition Greenwich, an S&P Global-owned research company.

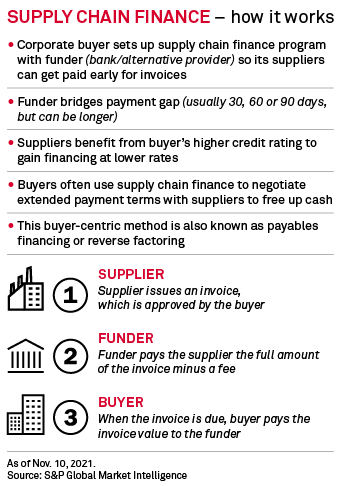

The increased pool has allayed concerns that Greensill's collapse would derail the market. Supply chain finance is commonly used to describe what is also known as reverse factoring. It allows a supplier to get paid by a third-party finance provider once the customer approves an invoice, thus benefiting from fast payments, as well as cheap funding because the cost is based on the customer's credit rating. Meanwhile, the customer can still wait until the invoice due date before giving money to the lender.

This form of lending came under the spotlight after Credit Suisse Group AG's fund management arm in March froze $10 billion of supply chain funds linked to U.K.-based Greensill, reportedly driven by concerns about the financier's exposure to a single client — steel magnate Sanjeev Gupta — and lapsing trade credit insurance policies, which give investors comfort that their money is safe.

The wider fallout was quickly curtailed by JPMorgan Chase & Co. and other lenders providing more than $6 billion of funding to Greensill's technology partner Taulia. The deal, within days of Greensill's collapse, ensured sufficient liquidity for programs formerly funded by the fallen company.

|

Since then, deal volumes have stayed steady, if not grown, Sam Fowler-Holmes, a partner at Sullivan & Worcester who advises on supply chain finance structures, said at the Global Trade Review conference.

For HSBC Holdings PLC, one of the world's largest trade finance providers, supply chain finance remains "a key growth area," according to Surath Sengupta, the bank's global head of financial institutions, portfolio and distribution, global trade and receivables finance.

"There is absolutely no change because of certain market events by certain organizations who operate in completely different market segments or as different types of businesses," he said in an interview. "That does not impact our strategy at all."

The positives

James Binns, global head of trade and working capital at Barclays PLC, also said the scandal had no impact on the bank's supply chain finance business or strategy.

"When supply chain finance is responsibly and properly implemented, and structured around confirmed payables or reverse factoring structures, I think it can be a very good thing for supply chains," he told S&P Global Market Intelligence.

The market impact of Greensill has been curbed by evidence that the company was operating what a U.K. parliamentary inquiry called "a significantly riskier form of lending than traditional supply chain finance." Confidence that Greensill was a market aberration meant that the committee saw no reason to bring supply chain finance within the regulatory perimeter for financial services.

Barclays' Binns said he is seeing a "flight to quality" among counterparties such as insurance and liquidity providers, to platforms and programs that are "responsible in their application of supply chain finance." That is, for example, programs that do not allow companies to extend payables beyond market norms, he said.

Looking to the future, digitization and a focus on sustainability will be key drivers of expansion for the market. Efforts to digitize supply chain finance programs will help to fuel further transparency on invoice flows and suppliers being financed as part of a program, while improving lenders' and investors' ability to assess risk, Ansari said.

Banks also see growth opportunities for programs that incorporates ESG criteria into the funding conditions, in particular in light of the pandemic, which has prompted a growing interest from corporates in the sustainability and resilience of their supply chains.