Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

30 Oct, 2023

By Siri Hedreen

Summit Carbon Solutions LLC is not giving up on obtaining the permits for a five-state, 2,000-mile CO2 pipeline on which it has sunk hundreds of millions of dollars for easement agreements, despite a competitor's decision to quit over the permitting uncertainty.

The possibility that Summit will run up against the same issues as Navigator CO2 Ventures LLC is a "fair question," CEO Lee Blank said in an interview. However, "I think the project has enough relevance and importance that I don't believe that will happen."

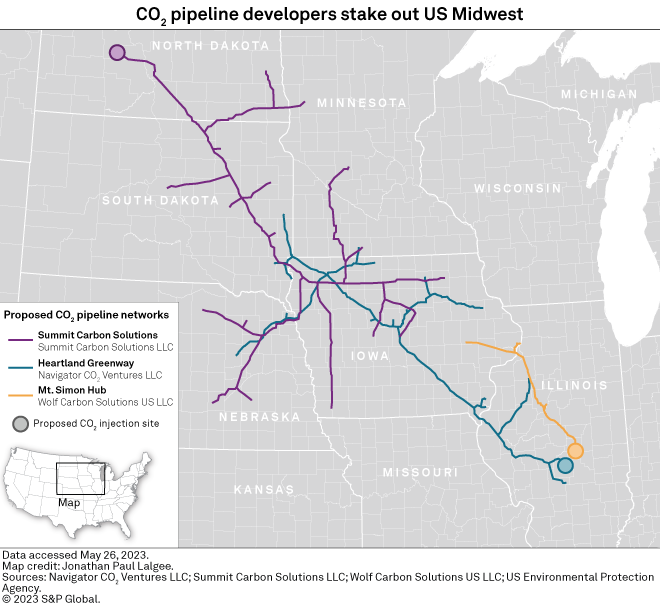

Iowa-headquartered farm management company Summit Agricultural Group, the investor backing Summit Carbon Solutions, secured financing in 2021 to build a carbon capture network, transporting emissions from ethanol plants across the US Midwest to a permanent storage site in North Dakota. About the same time, asset manager BlackRock Inc. and petroleum producer Valero Energy Corp. launched a similar project under the name Navigator that would store CO2 in Illinois. The proposed pipeline networks had overlapping routes in South Dakota, Nebraska, Iowa and Minnesota.

On Oct. 20, Navigator scrapped its 1,300-mile project, dubbed Heartland Greenway, a few weeks after South Dakota regulators denied the developer a siting permit. Navigator said the cancellation came down to the "unpredictable nature" of state and local regulatory proceedings, particularly in South Dakota and Iowa.

Summit has also had permit applications rejected by North Dakota and South Dakota regulators and is nearing the end of evidentiary hearings on its Iowa permit request. As had Heartland Greenway, the Summit project has run into opposition from landowners and advocacy groups over concerns that included the use of eminent domain to obtain rights-of-way and potential safety and environmental impacts of the pipeline project. Earlier in October, Summit postponed its expected startup date from 2024 to 2026.

Summit's strategy

Unlike Navigator, Summit has secured voluntary easement agreements along 75% of its pipeline route and is continuing negotiations, Blank said, adding that a portion of the remaining landowners have said they will grant right-of-way once the project is permitted.

According to Blank, Navigator had offered to pay landowners incrementally as their project reached certain milestones. Summit, meanwhile, has been paying landowners 100% upfront and has no way to recover those funds if the company does not exercise the easement. "That is all cash out the door, in the pockets of landowners," Summit spokesperson Sabrina Zenor said.

Navigator did not immediately confirm how many miles of right-of-way they had secured before canceling Heartland Greenway. In July, however, the pipeline developer told the South Dakota Public Utilities Commission that it had easement agreements for 30% of its proposed route in that state.

"We have spent a lot more capital than Navigator has spent," Blank said. "But we've also acquired a great deal more right-of-way because our model was just different, and more effective, in my opinion."

Summit said it has spent more than $300 million to date in right-of-way payments.

"Ultimately there will be some holdouts that are just simply against the project," Blank said. "But again, we would anticipate something in the very small single digits of those that just simply refuse to talk with us about an arrangement."

Summit still has state and local regulators to convince. In September, the North Dakota Public Service Commission granted Summit's petition for reconsideration of a new route that circumvents the capital city, Bismarck. A final decision on the revised application is still pending.

The company also plans to reapply for a siting permit in South Dakota after state regulators refused to overturn county ordinances imposing setback requirements, which were passed in anticipation of the pipeline development. Both Navigator and Summit had asked the commission to overrule the ordinances.

Summit is further behind on the permitting process with the Minnesota Public Utilities Commission, which only asserted its authority over CO2 pipelines in 2022. In Nebraska, CO2 pipelines are sited at the county level.

Midwest is fertile ground

The Midwest's CO2 pipeline developments are encouraged by federal subsidies, newly expanded under the Inflation Reduction Act of 2022, for carbon capture and the production of sustainable aviation fuel (SAF) such as ethanol.

To meet the emissions standards of the "clean" fuel, ethanol producers capture their carbon emissions while adhering to other sustainability requirements, such as limiting land use and using zero-carbon hydrogen to make fertilizer. As such, dozens of ethanol plants have signed agreements with Summit to offload their CO2.

"Without our project, there is no SAF," Blank said. "That's a pretty grand statement, but it's real."

Summit plans to earn revenue by selling tax credits awarded per metric ton of CO2 captured and carbon offsets on the voluntary carbon market, Blank said. In April, Summit and two other carbon removal companies signed a procurement agreement that will commit them to remove a combined 193,125 metric tons of CO2 from the atmosphere.

Blank did not rule out signing partnerships with some of the ethanol producers that had tapped Navigator to offtake their CO2 emissions.

"We designed our infrastructure project to handle more capacity than we had contracted previously," Blank said.

Another CO2 pipeline developer, Wolf Carbon Solutions US LLC, is also trying to permit a shorter pipe from Iowa to Illinois to transport CO2 on behalf of ethanol producer Archer Daniels Midland Co. (ADM). On Oct. 24, an Illinois Commerce Commission staffer recommended the regulators deny Wolf Carbon a permit due in part to the lack of a fully executed agreement with ADM. A final ruling is due in 2024.

Wolf Carbon said it was "disappointed" by the recommendation and responding to the commission's concerns.

"Our response will demonstrate that we have worked collaboratively with ADM for more than two years and that we are actively working toward a formal final agreement," company President Dean Ferguson said in an emailed statement on Oct. 27.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.