Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

30 Mar, 2021

By Chris Rogers

The Ever Given was refloated in the Suez Canal as of 6 a.m. UTC on March 29, according to the Suez Canal Authority. A complete refloating, testing and onward travel to the Great Bitter Lake is needed before traffic on the canal will be restarted.

The six-day delay had caused a backlog of around 370 vessels as of March 29, Reuters reports. Estimates of how long it will take to clear the canal vary.

The all-time record for vessels passing through the canal was 75 vessels, according to the Suez Canal Authority. Assuming this rate can be maintained, that would suggest at least 15 days of crossings above the "normal" 50-60 vessels per day run rate (based on around 1,500 vessels per month transiting the canal) to clear the current backlog.

Other estimates are significantly shorter. Hapag-Lloyd AG has indicated a removal of the backlog within four days is possible, particularly given some vessels have decided to use the southern Africa routing that adds around 10-14 days to shipping. A.P. Møller - Mærsk A/S, meanwhile, has estimated a clearance time of nearer six days as of 6 p.m. UTC on March 29.

The knock-on effect to supply chains is also complicated by the congestion at many ports in Asia and Europe. While the absence of a week's worth of Suez-routed arrivals may help clear immediate backlogs, a wave of new arrivals and the need to rapidly move products onward from ports.

Manufacturing and retail inventory patterns already disrupted by the coronavirus pandemic may also face shortages further down the line. Indeed, Maersk has indicated as of March 27 that the closure causes "further disruptions and backlogs in global shipping that could take months to unravel."

The long-term lessons from the Ever Given's grounding and other disruptions to large container vessel operations also need to be incorporated into supply chain planning, as discussed in Panjiva's research of March 24.

The impact of the delays on northerly routes through the Suez Canal will be more keenly felt in Europe than in North America. The Ever Given, for example, was scheduled to sail from mainland China, Taiwan and Malaysia to the Netherlands (Rotterdam), Germany (Hamburg) and the U.K. (Felixstowe) before returning in mid-April. All shipments from Asia to Europe handled by the 2M, Ocean and THE alliances, meanwhile, follow West-bound routes via the Suez Canal.

For shipments to the U.S., the container lines generally prefer trans-Pacific (to U.S. West Coast) or trans-Panama (U.S. East Coast) routes running through the Suez canal from Asia, though there are exceptions, particularly on runs from south and western Asia.

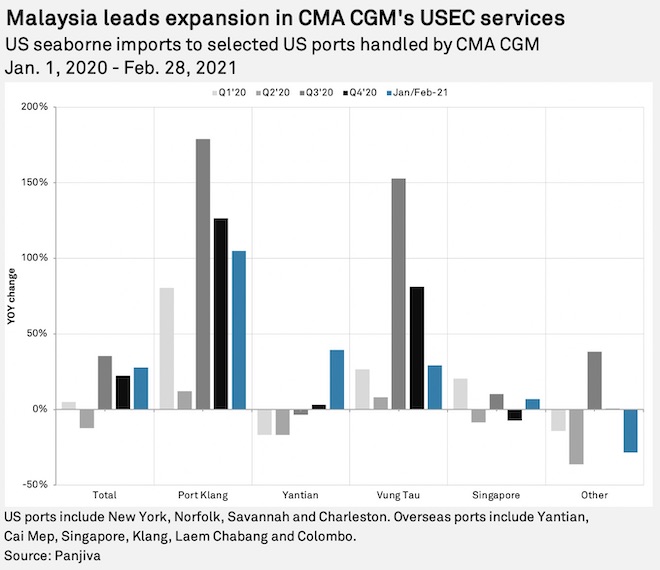

Within the Ocean Alliance, Evergreen Marine Corp. (Taiwan) Ltd., CMA CGM SA and Cosco Shipping Holdings Co. Ltd. run a "pendulum" service — PE1 — that calls at Yantian in China, Cai Mep in Vietnam, Singapore, Klang in Malaysia, Laem Chabang in Thailand and Colombo in Sri Lanka before heading to New York; Norfolk, Va.; Savannah, Ga.; and Charleston, S.C., with vessels operated by CMA CGM currently.

Panjiva's data shows that volumes on the port pairings handled by CMA CGM have experienced significant growth recently. U.S. seaborne imports increased 27.7% year over year in January and February combined, including a 39.3% rise in shipments loaded in Yantian, China, and a 105% jump in imports from Port Klang. Leading U.S. importers on the pairings in the past 12 months include furniture retailer IKEA AB (via Yantian) and medical supplies firm Owens & Minor Inc. (via Port Klang).

Pendulum services have become less popular recently due to the complexities of scheduling in the face of port congestion during the pandemic. Indeed, Maersk and MSC have recently canceled their pendulum services.

Other U.S.-bound routes via the Suez Canal have typically focused on shipments from India to the U.S. East Coast. Again within the Ocean Alliance, CMA CGM's India America Express route calls at Nhava Sheva and Mundra in India and Port Qasim in Pakistan before heading to New York, Norfolk, Charleston and Savannah.

Similarly, with the 2M Alliance, Maersk operates the MECL1 West-bound service from Jawaharlal Nehru and Pipava in India, Port Qasim in Pakistan, Jebel Ali in the United Arab Emirates, Salalah in Oman and Algeciras in Spain before heading to Newark, Charleston, Savannah and Houston in the U.S.

ZIM Integrated Shipping Services Ltd., which is affiliated with 2M, runs two routes from Asia to North America via the Suez Canal including the AGX (China, Singapore, Sri Lanka and Oman) and Z7S (China, Vietnam and Singapore) services to the U.S. East Coast.

Operations by Ocean Network Express Pte. Ltd. and Hapag-Lloyd within THE Alliance have similar routings to the U.S. East Coast, too, including EC4 (Taiwan, Mainland China, Hong Kong, Vietnam, Singapore), EC5 (Vietnam, Thailand, Singapore, Malaysia, Sri Lanka and the UAE) and IEX (India, Pakistan, Saudi Arabia and Egypt).

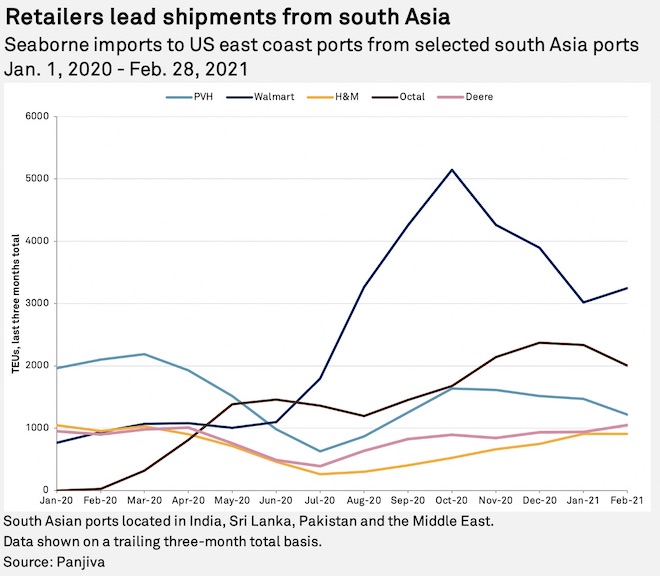

U.S. East Coast ports imports from western India, Sri Lanka, Pakistan and the Middle East are likely to be the most exposed to the closure of the Suez Canal. Leading importers in the U.S. who are potentially exposed to such routings include apparel and retail firms PVH Corp. and H & M Hennes & Mauritz AB (publ), with 5,215 20-foot equivalent units, or TEUs, and 2,580 TEUs, respectively, shipped in the 12 months to Feb. 28. Retailers more broadly may also feel an impact, with shipments of 11,780 TEUs linked to Walmart Inc.

There will also likely be a knock-on effect for capital goods supply chains, with 6,720 TEUs of imports linked to plastics producer Octal Corp. and 3,290 TEUs associated with agricultural machinery producer Deere & Co.

Christopher Rogers is a senior researcher at Panjiva, which is a business line of S&P Global Market Intelligence, a division of S&P Global Inc. This content does not constitute investment advice, and the views and opinions expressed in this piece are those of the author and do not necessarily represent the views of S&P Global Market Intelligence. Links are current at the time of publication. S&P Global Market Intelligence is not responsible if those links are unavailable later.