S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

20 Dec, 2024

By Rica Dela Cruz and Zuhaib Gull

The outlook for subordinated debt at US credit unions is poised for change, after stagnating in recent years, as interest rates decline and the industry adapts to recent challenges.

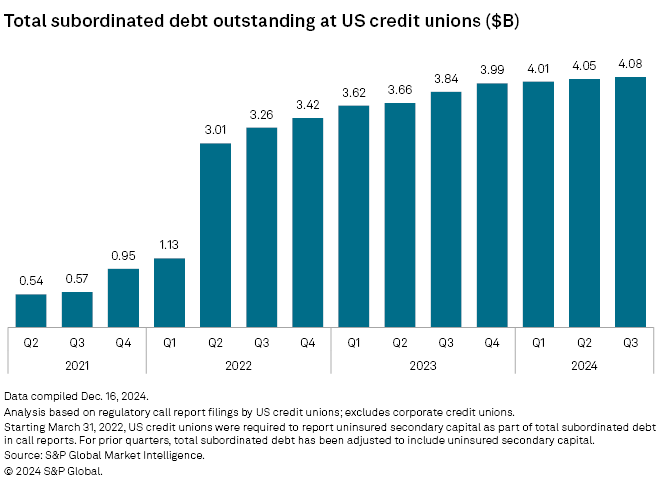

As of Sept. 30, the credit union industry had outstanding subordinated debt of $4.08 billion, compared to $4.05 billion in the previous quarter, S&P Global Market Intelligence data shows. This reflects a sequential increase of less than 1.1% in outstanding subordinated debt in the first three quarters of 2024.

Michael Macchiarola, CEO of boutique investment bank Olden Lane, expects that there will eventually be "another burst" of subordinated debt issuance by credit unions.

"There is plenty of capital expenditure going on, whether it be in the form of technology investments or M&A activity. Credit unions are generally quite focused on both right now," Macchiarola said. "The other end of that cycle will renew the industry's focus on outward expansion and replenishing capital. That transition may begin later in 2025 or 2026."

Financial institutions will issue more subordinated debt as interest rates decline, 2023 becomes more distant, and "existing tranches of subordinated debt reach the point where capital treatment is affected due to there being less than five years until maturity," said Gregory Parisi, a partner at Troutman Pepper Hamilton Sanders LLP.

Growth in subordinated debt has slowed since rising 166.6% quarter over quarter in the April–June period of 2022 after the National Credit Union Administration passed a final rule broadening subordinated debt eligibility.

"The rapid pace of the [Federal Reserve]'s tightening shocked the balance sheets of banks and credit unions," Macchiarola said. "Credit unions have taken time to adjust as repricing on the asset side catches up with the new cost of liabilities. ... Appetite to issue new sub debt has been limited during this adjustment period."

The Fed on Dec. 18 lowered the federal funds rate by 25 basis points to a range of 4.25% to 4.5%. It started an easing cycle in September with a 50-basis-point cut, followed by a 25-basis-point reduction in November.

Credit unions with the most subordinated debt

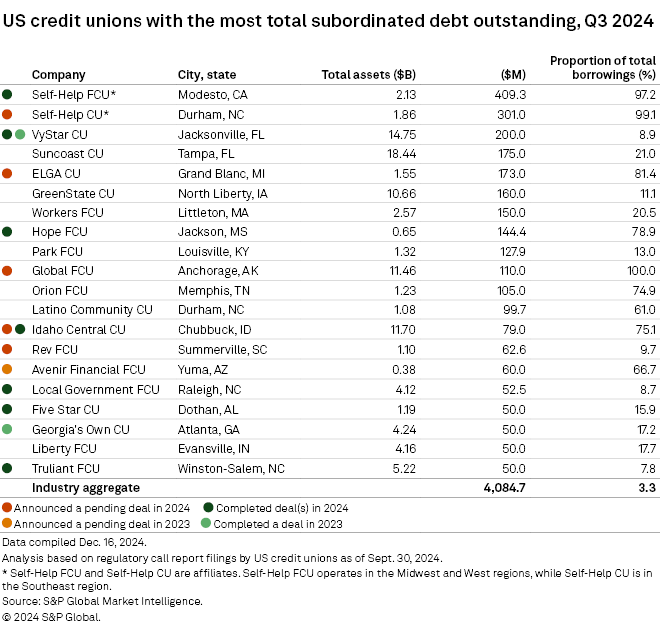

Among US credit unions, Self-Help FCU and Self-Help CU, which are affiliates, logged the highest levels of subordinated debt in the third quarter with $409.3 million and $301.0 million, respectively. Subordinated debt accounted for more than 97% of total borrowings at Self-Help FCU and Self-Help CU.

Many credit unions are already leveraging subordinated debt for growth, with over half of the top 20 credit unions by subordinated debt as of Sept. 30 having engaged in M&A activity since 2023.

In the third quarter, Rev FCU, which is in a pending deal to acquire Spencer, West Virginia-based First Neighborhood Bank, logged $62.6 million in subordinated debt. ELGA CU, which is acquiring Vero Beach, Florida-based Marine Bank & Trust Co., recorded $173.0 million in subordinated debt.

While financial institutions will continue to view deals as an attractive use of subordinated debt, refinancing needs will also play a major role in their decision to issue it.

"I think the biggest factors will be the need for institutions to refinance existing debt for which they start losing capital treatment, coupled with declining interest rates making refinancing more attractive again," Parisi said.