S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

29 Jun, 2021

By Brian Scheid

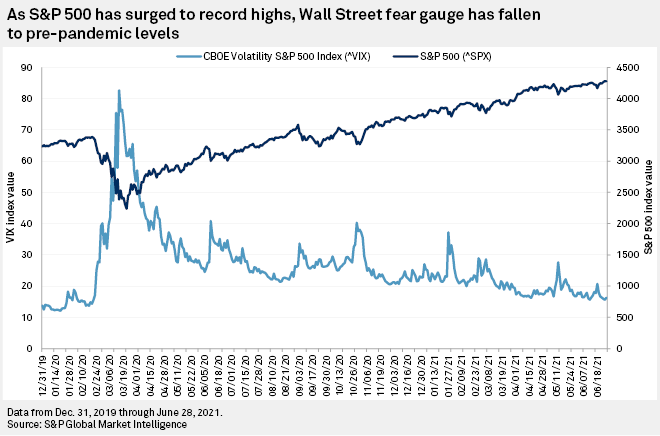

Wall Street's fear gauge has tumbled to pre-pandemic levels, an indication that equity investors have grown relatively comfortable that stocks will keep climbing even after a stretch of acute market volatility, market analysts said.

"Investors have been and are more comfortable with risk now," said Paul Schatz, president of investment management firm Heritage Capital.

On June 25, the Chicago Board Options Exchange Volatility Index, or VIX, closed at 15.62, its lowest settlement since Feb. 20, 2020. The index, which peaked at a record 82.69 on March 16, 2020, is a measure of stock market volatility expectations based on S&P 500 index options.

The VIX closed at 15.65 on June 11 before jumping to 20.7 as the Federal Reserve moved up its forecasts for the next potential rate hike. It closed at 15.76 on June 28. While well below its recent highs, the VIX remains above its recent averages of less than 15 from 2014 through 2019, analysts said.

The recent decline in the VIX is a sign that investors are seeking less protection from the options market for their investments in the stock market. The drop shows that fewer investors believe that a spike in cases of COVID-19 variants, skyrocketing inflation or a severe slowdown in the economic recovery will derail the current rally in stock markets, said Tom Essaye, a trader and founder of research firm The Sevens Report.

"This is a sign that investors are becoming more and more comfortable that we're not going to have any big surprises," Essaye said in an interview.

While the declining VIX signals investor complacency, it is not a sign of looming trouble, said Schatz of Heritage Capital, adding that he expects the VIX to keep falling as stocks continue to climb.

"The longer the bull market lasts, the lower and longer the VIX will remain compressed until the next big market event," Schatz said.

The S&P 500 closed June 25 at 4280.7, an all-time high and an increase of nearly 14% since the start of 2021. All 11 sectors of the S&P 500 have gained in 2021, led by the energy sector, which has climbed more than 46% on the year.

Prior to the pandemic, the VIX had rarely ventured higher than the teens, largely due to accommodative fiscal and monetary policy, which has been adjusted at times of greater market volatility, said Matthew Weller, global head of market research at financial services company GAIN Capital.

"In that light, it's not surprising to see the VIX drop back toward its recent range considering the current backdrop of supportive policy and a fast-growing global economy," Weller said. "While it will no doubt see short-term spikes in the coming months, those spikes may be relatively short-lived until stimulus starts to fade."

The drop in VIX is also a sign that investors, after more than a year of government stimulus and ultraloose Federal Reserve policy, are adjusting to the idea of fading fiscal and monetary support, said Marshall Gittler, head of investment research at BDSwiss.

"The economy is beginning to normalize — this quarter, GDP is forecast to return to pre-pandemic levels — and the market has gotten used to the idea that as the emergency recedes, the emergency support will also naturally fade," Gittler said.

Still, the VIX's recent fall may soon be followed by another journey up as potential market volatility shows up elsewhere, said Sherifa Issifu, associate, index investment strategy with S&P Dow Jones Indices.

Issifu pointed to CBOE's SKEW index, which measures perceived tail-risk in the S&P 500 and hit a record high of 170.55 on June 25. The index typically ranges from 100 to 150, and higher numbers tend to indicate greater perceived tail-risk — an event with a low probability of occurring but would cause a significant price swing to an asset — and the greater the chance of a black swan event.

"There are still signs of uncertainty in the market," Issifu said.