S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

13 Apr, 2021

By Brian Scheid

After reaching their highest levels in over a decade early this year, stock market trading volumes have plunged even as equities have soared to new record highs.

In the past, new market highs reached during times of feeble trading volume have served as a sign that traders are not enthusiastic about a bull run. But equity analysts say the ongoing drop in volume may not signal a looming crash, due to a variety of changes the market has seen, from an unprecedented short squeeze on troubled stocks this year to the nature of trading in 2021.

"Traditionally, new highs on light volume would be deemed a negative signal for the market, especially when active managers dominated trading, but that is not necessarily the case today," said Michael O'Rourke, chief market strategist with JonesTrading. "So much of the trading today is passive investors or computer model-driven, the deceleration of volume does not give a clear market signal."

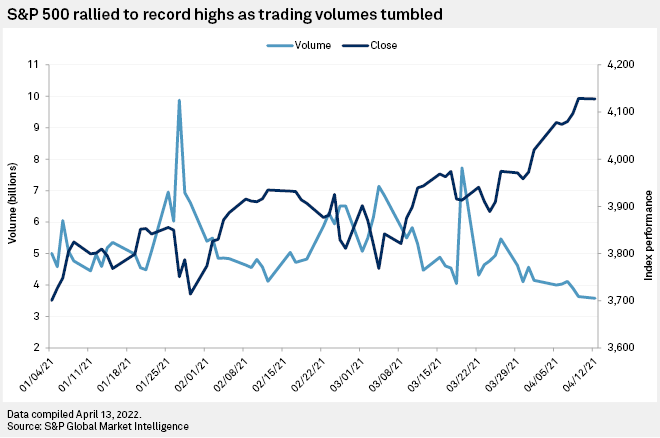

Daily trading volume on the S&P 500 climbed to nearly 9.88 billion trades on Jan. 27, nearly double its volume at the start of the year and its highest volume since May 2010.

Volume on the index has steadily fallen since, dipping below 3.58 billion trades on April 12. Meanwhile, the index has returned nearly 10.3% since the start of the year.

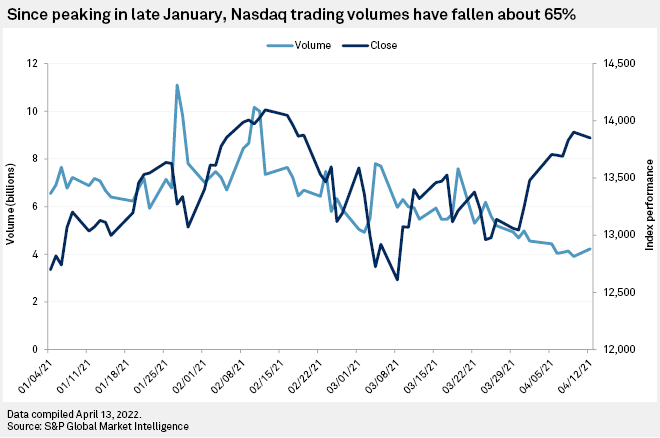

Similarly, the Nasdaq Composite index's trading volume climbed above 11.1 billion on January 27 and fell to 3.9 billion trades on April 9. The tech-heavy index's trading volume rose to 4.23 billion on April 12. The Nasdaq has returned 8.6% on the year.

Trading volumes spiked in January as mega-cap tech stocks peaked and as a wave of retail traders rushed into U.S. stock markets boosting the shares of GameStop Corp. and other distressed stocks widely shorted by hedge funds.

Ben Snider, a Goldman Sachs strategist, said that the drop in trading volumes might reflect "a near-term dearth of catalysts." With pandemic stimulus efforts and mass vaccinations already priced in and the market still waiting for the earnings season and the next fiscal package to take shape, investors may simply be waiting on the sidelines, he said.

"Stock market volumes are fading as Wall Street appears to have already priced in much of the reopening trade," said Edward Moya, a senior market analyst with OANDA. "Markets are forward-looking, and with all the good news priced in, we have to wait and see how soon we get infrastructure spending and how the inflation debate unfolds."

Moya attributed at least part of the spike in volume in January to market participants adjusting to Democrats taking control of Congress, leading to the passage of President Joe Biden's $1.9 trillion fiscal stimulus package and new stock market highs.

The rally in stocks has largely corresponded with a similar decline in the Cboe Volatility Index, or VIX, which was trading below 16.8 on April 13, its lowest level since Feb. 2020.

Dwindling trading volume and volatility during a historic market rally does not necessarily mean that a peak in equities is nearing, said Matt Weller, global head of research at GAIN Capital.

"Low volume alone is not necessarily a sign of an imminent bear market, especially while market breadth remains as healthy as it has," Weller said in an interview. "If we start to see the stock market sell-off on elevated volume though, that would be a potential sign of distribution and a reason for concern for bulls."

It is not unusual for trading volumes to fall as stocks rally, said Paul Schatz, president of Heritage Capital, in an interview. Stocks and volumes typically only go up together when there is what Schatz called a "mania" event, such as the recent GameStop short squeeze or the dot-com bubble in the late 1990s.

"Contrary to popular belief, bull markets see declining volume as it matures," Schatz said.