Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

19 Apr, 2021

|

| A storage site in Finland that will hold spent nuclear fuel from the new Olkiluoto 3 reactor. |

With its next generation of nuclear power plants, Europe is aiming to set new standards and herald a nuclear renaissance. But the economics of new nuclear are challenging and European countries have vastly different views on the technology.

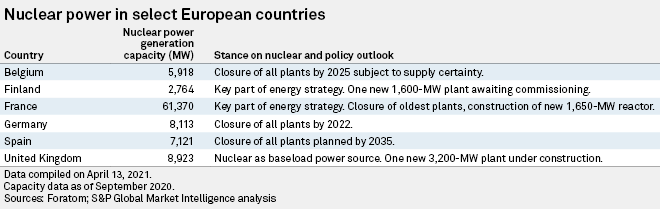

Some are in the midst of phasing out nuclear: Germany, for instance, decided on the closure of its entire fleet after the 2011 Fukushima disaster in Japan. For others, it remains a central piece of the energy landscape: France is Europe's largest nuclear operator and is adding more capacity.

Total nuclear generation capacity in the EU, U.K. and Switzerland amounts to more than 116 GW, according to the World Nuclear Association. This figure will fall over the coming years as countries shut reactors faster than new ones are built.

And just as nuclear policy varies across the continent, so too does public perception. "It is too easy to think of nuclear as black and white, good or bad. In the real world, we have to try and step back from that," said Angela Wilkinson, secretary general of the World Energy Council, a global network of energy leaders.

While renewables such as wind and solar have gained significance, the share of nuclear in Europe's power mix has been declining, said Antony Froggatt, energy policy adviser and senior research fellow at U.K.-based think tank Chatham House. "The push toward decarbonization has not led to an increase in fortunes for nuclear power," Froggatt said.

With a view to renewables growth and improved interconnection and grid balancing, Froggatt sees a declining importance of baseload power. The level of variable renewables that can comfortably sit on the grid is increasing, Froggatt said.

Others say nuclear, as a low-carbon power source,

'Extraordinarily expensive'

But the cost of building new nuclear plants is one issue. The International Energy Agency, generally supportive of the technology, estimates than new nuclear will be more expensive than renewables by 2040.

While extending the lifetime of existing reactors that have already been financed is cost-efficient and comparable to renewables, new-build plants are a different story, said Murielle Gagnebin, project manager at German think tank Agora Energiewende. "The market should decide this issue; governments shouldn't be pushing the technology if it doesn't make sense," Gagnebin said.

Renewables have plummeted in cost in the past decade thanks to scale effects and technology improvements, but new so-called third-generation European Pressurized Reactors, or EPRs, such as Hinkley Point C Nuclear Power Plant in the U.K.,

A striking example of that is France's 1.65-GW Flamanville Nuclear Plant, which is years behind schedule, plagued by structural problems and well over budget at €12.4 billion. French Environment Minister Barbara Pompili has called the project "a mess."

"The problem is not with the reactor," said Alain Vallée, president of Paris-based nuclear advisory firm NucAdvisor, who spent three decades at French nuclear giant Framatome and helped design the EPR product there. As France had not built a nuclear reactor for many years before Flamanville, there was a loss of competencies, both at the big-name nuclear companies and throughout the supply chain, which compounded delays with organizational problems, Vallée said, adding that if those things had been ironed out, costs at Flamanville could have been halved.

Like Flamanville, Hinkley is also behind schedule, with operator Electricité de France SA recently raising the project's cost estimate by £500 million to between £22 billion and £23 billion, in 2015 currency, as a result of COVID-19.

Greatrex expects the lessons from Hinkley to reduce the cost of another proposed EPR reactor in the U.K., Sizewell C in Suffolk.

The fortunes of new nuclear in the EU could also be swayed by the incoming green taxonomy, a rulebook for defining sustainable investments. Whether or not nuclear is included in the framework is unclear.

Nuclear an option for Finland

Over in Finland, another EPR, Olkiluoto Nuclear Power Plant, has been completed with over 10 years of delays and large cost overruns and is now waiting for fuel loading. Plans are underway for another plant of a different design on the northwestern Hanhikivi peninsula.

As an energy-intensive industrial economy reliant on power for heating during cold winters, Finland needs the baseload power. The country imports electricity, including from Norway and Sweden's hydropower plants, and building the reactor will not negate the need for more renewables, said Pasi Tuohimaa, spokesperson for plant operator Teollisuuden Voima Oyj. "In Finland we've never seen nuclear and renewables as opposites," Tuohimaa said.

|

| Olkiluoto 3 nuclear power plant in Finland, one of the EPR generation. Over 10 years behind schedule, it will soon start taking fuel. Source: Teollisuuden Voima Oyj |

Olkiluoto is also the first plant in the world that disposes of spent fuel locally, the spokesperson said. Posiva Oy is building a nearby containment facility to take waste from the mid-2020s.

A 2017 survey conducted by TNS Gallup found that 41% of Finns favor nuclear power, while 23% oppose it. Even the national Green party has warmed to nuclear. "Finnish people are practical," said Tuohimaa.

Meanwhile, most Germans, and the country's Greens, are opposed to nuclear power, often due to safety concerns. But rather than polls, Greatrex sees political lobbying by other energy groups as the main driver for Germany's nuclear exit. "German politics are absurd. They burn the dirtiest fossil fuel while closing down nuclear power stations. I don't think it's rational," he said, referring to the country's continued use of lignite coal.

Literacy on nuclear technology is often poor, according to Wilkinson of the World Energy Council. "A lot of people still think you can make a bomb from a nuclear reactor, but we left that world a long time ago," she said.

But in Europe, which Wilkinson describes as "a diverse and democratic neighborhood," opinions are being heard. "Not everything is about price and economic rationalities," she said.