S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

1 Apr, 2022

By Lauren Seay

Several U.S. states are taking the matter of credit unions acquiring banks into their own hands.

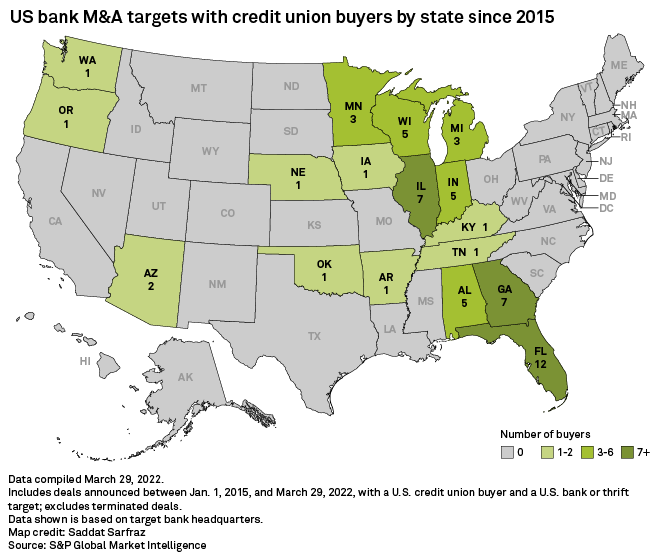

Mississippi on March 10 became the first state to pass legislation banning credit unions from purchasing banks. The bill, which goes into effect on July 1, requires state-chartered banks to sell to a buyer insured by the Federal Deposit Insurance Corp. Some states are looking to Mississippi for inspiration as federal efforts to impede these transactions have failed to gain traction and five such deals have been announced so far in 2022.

"There are a lot of eyes looking at what was accomplished in Mississippi," said Scott Latham, president and CEO of the Alabama Bankers Association, or ABA, in an interview.

Credit unions find bank acquisitions appealing as they hunt for scale and look to diversify. The banking industry and its lobbyists, however, say credit unions' tax-exempt status gives them an unfair advantage as purchasers. But taking credit unions out of the mix limits the number of potential purchasers for smaller community banks and may prevent banks from getting the best sale prices, credit union deal advisers say.

Looking to Mississippi for inspiration

Latham said he has kept in touch with the Mississippi Bankers Association, or MBA, about the issue and "closely followed" the legislation. Alabama has had five such deal announcements since 2015, spurring the ABA to voice concerns about the "troubling trend" to the state's regulatory agency and lawmakers in the hope of accomplishing something similar to its neighbor state of Mississippi.

"Our preference is that those deals not happen at all," Latham said.

The Community Bankers Association of Illinois, or CBAI, is also inspired by Mississippi's approach as it pursues legislation in its home state, Jerry Peck, senior vice president of governmental relations, said in an interview.

The CBAI in January proposed a bill to state legislators seeking to charge credit union buyers a fee amounting to 10% of the book value of the selling bank's assets or liabilities, whichever is greater. The bill is currently stalled, but state legislators have offered to hold a hearing on it this summer, Peck said.

However, the exit fee, which was inspired by a previous effort from the Independent Community Bankers of America, is not the only option the group is open to, Peck said.

"I'd like to find out what [Mississippi's] secret sauce was because that's an impressive thing that they've done," Peck said. "Maybe what Mississippi did makes more sense. We've looked for other possible solutions so we're not necessarily wed to the exit fee as our final position."

The advocacy group has started conversations with local stakeholders, such as the state bank regulator, about Mississippi's approach. While the CBAI would prefer legislation similar to Mississippi's to stop these deals altogether, the group believes an exit fee would at least slow these transactions down. Illinois has seen seven such deals since 2015, tied for the second most of all states.

"We would rather they not happen at all so our thought in imposing the fee was that, that would be a disincentive to the credit unions buying up the banks," Peck said.

The impacts of stifling these transactions

A number of states have already barred credit unions from purchasing banks or have pending litigation regarding the legality of such transactions. Both Colorado and Iowa's respective state banking regulators said in 2020 that they will not approve credit union purchases of state-chartered banks. Coupled with the stances in Colorado and Iowa, Mississippi's recent move bans these deals from three states now.

Tennessee and Nebraska may also head toward bans on these deals, depending on the outcome of respective ongoing litigation in each state. In November 2021, a Tennessee judge passed a temporary injunction to block Orion FCU from purchasing Financial Federal Bank following a request from the commissioner of the Tennessee Department of Financial Institutions. A hearing is set to be held.

The Nebraska Department of Banking and Finance in December 2021 denied Premier Bank permission to sell its assets to GreenState CU, but the bank has appealed the decision in district court.

The ongoing situations in both Tennessee and Nebraska make 2022 a "pivotal year," said Michael Bell, a partner and co-leader of the financial institutions practice group at law firm Honigman LLP.

"2022 is a pivotal year for this lobby versus lobby argument," Bell said in an interview. "It's a big year to hopefully put it to bed and move on to better, more important things." Bell believes the number of states prohibiting these transactions will remain in the minority.

When it comes to halting these transactions, Bell said it harms community banks looking to sell rather than credit unions themselves.

"When you go to sell, is it better to have more possible buyers or less possible buyers? To enhance the value, you want more possibilities versus less," Bell said. "When you're a community-based financial institution, you have a limited amount of buyers today and this law effectively took away shareholder and management rights at these small banks to choose possible buyers, and it has eliminated an entire category of buyers."

Mississippi's 'secret sauce'

The issue of nixing an entire group of buyers for selling banks is one the MBA discussed with its members before pursuing the legislation, said Gordon Fellows, president and CEO of the MBA, in an interview.

"The folks that were the most worried about that eventually got to the point where they kind of thought, 'I also compete against small community banks, and I don't want to have that community bank purchased by a credit union because I don't want to have to compete against their subsidized rates. ... Even though maybe it's good for me to have that option, I don't want my competitors to have that option,'" Fellows said.

Still, Fellows acknowledged that other states could have trouble garnering support from community banks around the issue of eliminating credit unions as buyers entirely.

MBA's move was three years in the making, as the group began discussions about potential legislation in 2019, but the issue was sidelined in 2020 after COVID-19 hit. The group picked up the issue again in 2021 and quickly gained support from state legislators after drafting the bill and submitting it to the two chairmen of the state legislature's banking committee.

Mississippi's approach was a proactive one as there has never been a credit union-bank deal announced in the state. Since the legislation passed on March 10, "plenty" of states have reached out to learn more about how to do something similar, Fellows said.

"We certainly will do everything we can to help all the other state banking associations get familiar with the approach we took, and then they'll get to make kind of their own decisions on if they want to take a similar approach or something different," Fellows said. "I anticipate we'll continue to be having more conversations with other states that are thinking about it."