Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

12 Aug, 2021

|

Florida is emerging as a top solar state in the Southeast as policy and demand align to encourage investment. |

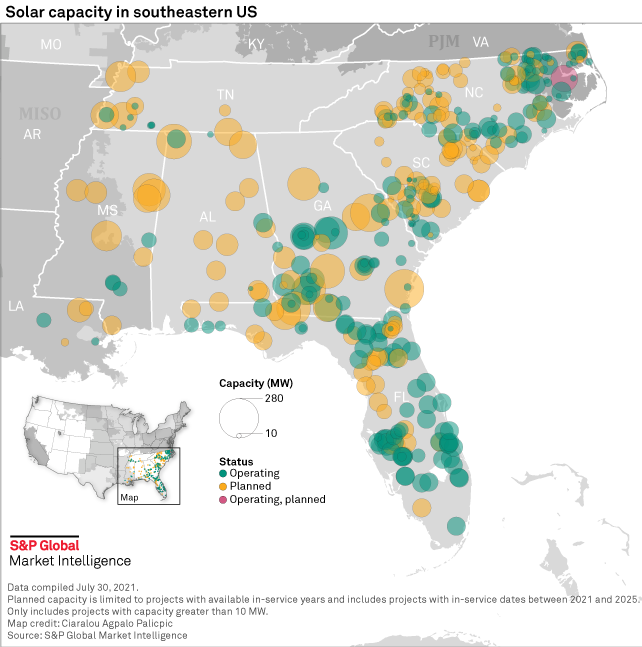

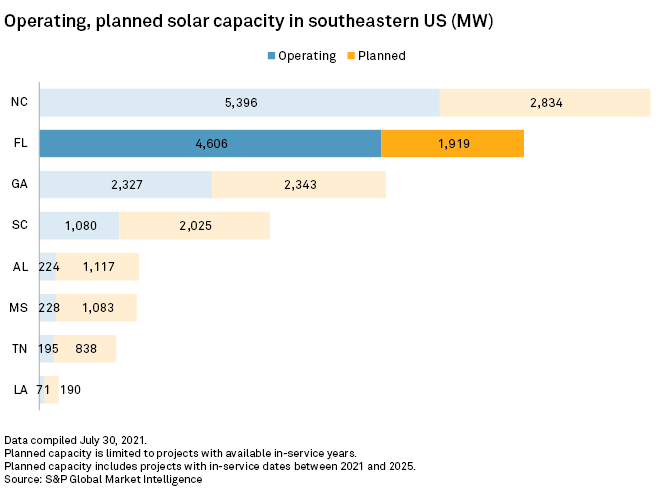

Florida is emerging as a Southeast leader in solar capacity as state policy encourages larger-scale development, utilities pursue aggressive expansion plans and prices remain competitive. A recent report forecasts Florida is set to eclipse most other Southeastern states in installed capacity this year, surpassing North Carolina.

State regulators anticipate more than 13,000 MW of solar generation installed across the state over the next decade or so, according to a 2020 report from the Florida Public Service Commission, with the lion's share expected to be utility-owned solar.

Total solar capacity in the Southeast in 2020 was 12,696 MW, according to a June report from the Southern Alliance for Clean Energy, or SACE, and is expected to more than double to 27,500 MW by the end of 2024. On a full-year operational equivalent basis, SACE recorded 3,909 MW of solar capacity for Florida.

The drop in solar cost — for both utility-scale and distributed — along with the investment tax credit extension are two of the biggest contributors to Florida's solar growth, Bryan Jacob, SACE solar program director, said in an interview. Those elements aren't unique to Florida. The state's solar base rate adjustment mechanism, which streamlined approval for adding solar projects to rate base, has made the state especially attractive for investor-owned utilities, Jacob said.

"Utility-scale solar is now the most affordable new electricity generation infrastructure and we are seeing all utilities — municipal, electric cooperatives and investor-owned utilities — in Florida rapidly investing in this resource," said Heather Campbell, Florida program director for Vote Solar, in an interview. "Some are also setting aggressive renewable energy goals, [for example,] Florida Power & Light Co."

Regulatory support

In 2019, the Florida Supreme Court unanimously ruled that Florida Power & Light could rate base more than $860 million for eight already-constructed solar projects, which regulators had approved in 2016. The Florida Industrial Power Users Group, or FIPUG, brought the challenge to court, arguing regulators should not have signed off on the rate decision because the projects weren't needed. Regulators agreeing to allow utilities to recover costs of solar investment through that mechanism has further incentivized larger-scale development in the state. Florida's net metering policy is also playing a role, Jacob added.

Some of Florida's advancement ahead of other Southeastern states is major project announcements, including approval of Duke Energy Florida LLC's "Clean Energy Connection" program in January for ten projects totaling 750 MW. With that approval, Duke Energy Florida increased its short-term plans in the state, while utilities in North Carolina and South Carolina, including other Duke Energy subsidiaries, reduced immediate short-term plans, according to the SACE report.

"Florida utilities continue to scale up their plans each year, while North Carolina utilities are scaling back their near-term plans," the SACE report read, noting that North Carolina has been the leader in installed solar capacity among Southeastern states, but Florida may stand a chance of overtaking it, at least briefly.

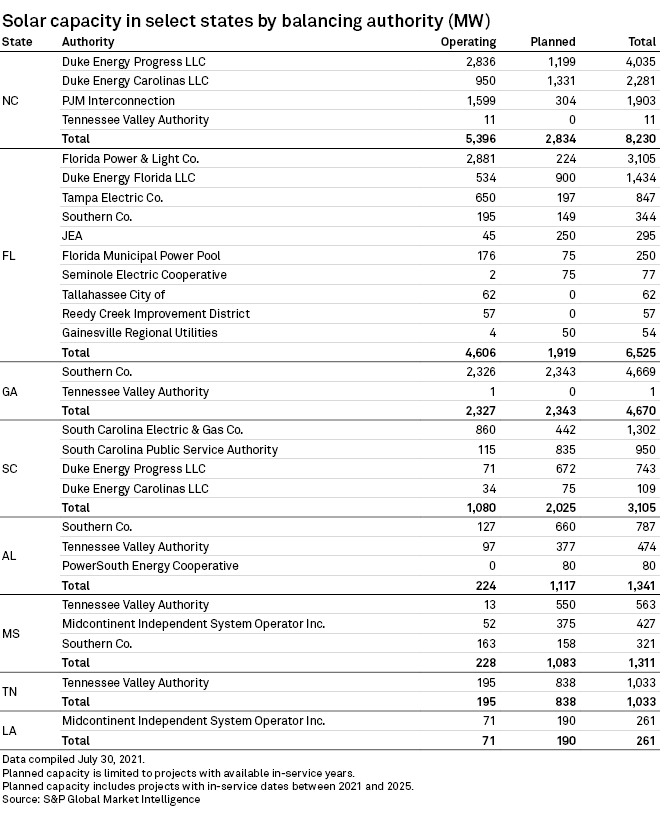

Duke Energy Corp. represented about 40% of solar in the Southeast in 2020, according to SACE, and is expected to remain the region leader.

The current integrated resource plans from Duke Energy Progress LLC and Duke Energy Carolinas LLC, which cover operations in South Carolina as well, reflect higher long-term solar ambitions through 2035 but lower solar expansion through 2024 compared to prior plans, according to the SACE report, accounting for some of Florida's short-term advantages over the Carolinas.

While Duke Energy may command much of the solar capacity in North Carolina among balancing authorities, NextEra Energy Inc. subsidiary FPL leads in Florida, according to S&P Global Market Intelligence data, operating 2,881 MW of solar in the state, with plans for at least 2,105 by 2025. Duke Energy Florida LLC operates 534 MW with plans to expand to 1,434 by 2025.

FPL has a "watts per customer" solar ratio slightly higher than the regional average, according to the SACE report, and the most recent combined 10-year site plan for NextEra shows sustained growth anticipated by its previously announced "30-by-30" solar plan. The company is also requesting a solar base rate adjustment mechanism in 2024 and 2025 and its preliminary estimate is that it would result in base rate adjustments of approximately $140 million in 2024 and $140 million in 2025 assuming the full amount of new solar capacity allowed under the mechanism is ultimately constructed.

In June, FPL announced that it installed the first components at the world's largest solar-powered battery facility. FPL operates 41 solar projects across the state and is building nine more, including facilities to replace 1,638 MW generated by two aging units slated for retirement at the gas-fired Manatee plant.

FPL announced in July that it had sold out the "nation's largest community solar program" within 13 months and had a waitlist of nearly 2,000 residential customers. Its commercial, industrial and government portion of the program sold out after just one month, according to the company's announcement.

Behind-the-meter solar growth

The price of distributed solar has also fallen dramatically — at times by more than 50% — in the last decade, Campbell said, and more families are investing in rooftop solar, including during the coronavirus pandemic which saw record overall home improvements, including renewable energy infrastructure.

But while Florida's customer-owned solar grew in 2020, states such as New York and Illinois still outpaced it, Campbell said. Florida has double the amount of utility-scale solar compared to customer-owned, due in part to policies providing more benefit to investor-owned utilities than individuals.

"We have a lot of growing left to do on the small-scale generation side," Campbell said. "Protecting our net metering statute is the key to ensuring energy equity in Florida by allowing small businesses and homeowners to choose to power their private properties with solar energy and be appropriately reimbursed for their clean contributions to the grid."

Across the U.S., supportive policies at the state and federal level are expected to continue to boost the development of renewable energy, according to the U.S. Energy Information Administration's July report, with large-scale U.S. solar growth forecast to exceed wind for the first time in 2022.