Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

13 Oct, 2022

By Karin Rives

As more Republican-led states join the movement to divest from banks over their environmental, social and governance policies, some critical investment assets remain conspicuously untouched: state pension funds.

Even states that pledged to bar their retirement funds from ESG-focused investment firms have thus far not put that policy into practice. Nor have their initiatives had much of an overall impact on the banks and investment firms that manage such funds, data from S&P Global Market Intelligence show.

Some of the state treasurers who were vocal about ESG boycotts said their hands are tied on public pensions because those funds are controlled by the legislature or, in the case of South Carolina, a state commission. South Carolina's Treasurer Curtis Loftis plans to eliminate $200 million in BlackRock Inc. investments by the end of this year, the state treasury office confirmed in an email. The Palmetto State joins Louisiana, Texas, Utah and West Virginia in restricting treasury funds, which typically handle deposits, transactions and other state cash management business.

Only Texas has extended the mandate to its $369 billion public retirement system. Except in Texas, "each state retirement fund conducts its own analysis to determine whether it will divest in accordance with the statute and its fiduciary obligations to the fund's participants," Kevin Lyons, a spokesperson for the Texas Comptroller, said in an email. So far, no pension manager has moved to restrict unwanted financial companies that the comptroller identified on a list published in August, Lyons said.

Texas created a carve-out in the 2021 law that preceded the boycott list to ensure that any divestments do not come in conflict with pension managers' fiduciary duty to serve investors, said Dave Wallack, executive director of For the Long Term, a nonprofit that works with treasurers on ESG issues.

Wallack does not expect GOP-led states to change the global trajectory toward more transparency on the impact banks and other corporations have on racial justice, the environment and other ESG priorities.

"Will it change the direction of the market? No," Wallack told S&P Global Commodity Insights. "There's an overwhelming demand for risk-based data. What Texas did was rip out the rear mirror trying to sell an agenda, but that car is still driving at 60 miles-per-hour down the road."

The world's largest asset manager, BlackRock, has been a top target for the treasurers who want to rid their states' investments of ESG considerations as well as for a blue state such as New York. Utah pulled $100 million from a BlackRock money market fund in January "because we have lost trust in BlackRock to act in our best interest," Brittany Griffin, policy and communications deputy for Utah Treasurer Marlo Oaks, wrote in an email.

Still, such state efforts have not made a dent in the company's overall business: While BlackRock's assets under management declined 11% between July 2021 and July 2022 due to the weaker financial market, the company saw a healthy net inflow of $90 billion during the second quarter of this year.

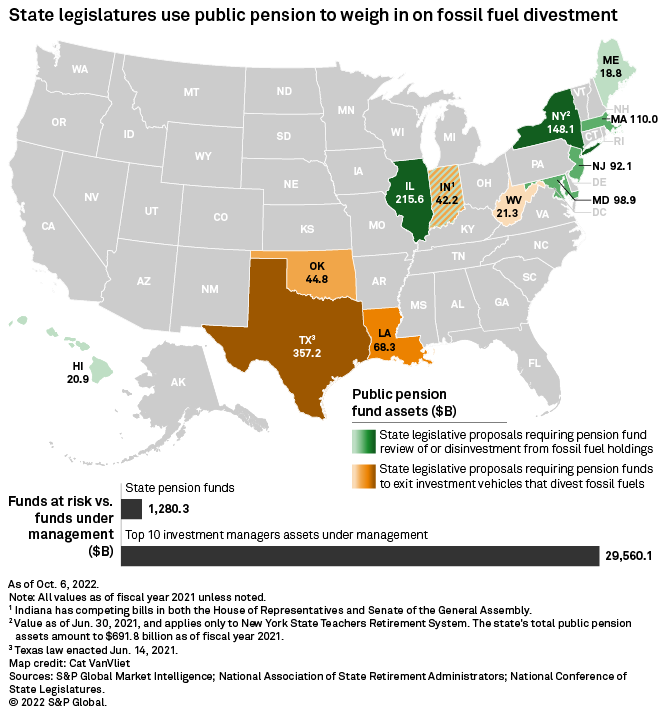

Pensions remain an issue for states

Public pension funds, including in Republican-leaning states, typically vote in favor of ESG policies and continue to push for sustainable investment practices, Morningstar found in an August study.

Still, at least one treasurer, South Carolina's Loftis, "has been in conversations" with the South Carolina Retirement System Investment Commission about expanding the treasury's ESG restrictions to the state's public retirement funds. The commission, in turn, is discussing the matter with BlackRock, a spokesperson for the treasurer's office said in an interview.

Whether to target bank investments in public pension funds also came up in early discussions when West Virginia's lawmakers crafted that state's bill to blacklist financial institutions over their corporate fossil fuel policies, according to West Virginia Deputy Treasurer and Communications Director Jared Hunt.

"Treasurer [Riley] Moore would certainly support that move," Hunt wrote in an email.

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.