S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

4 Feb, 2021

By Kris Elaine Figuracion

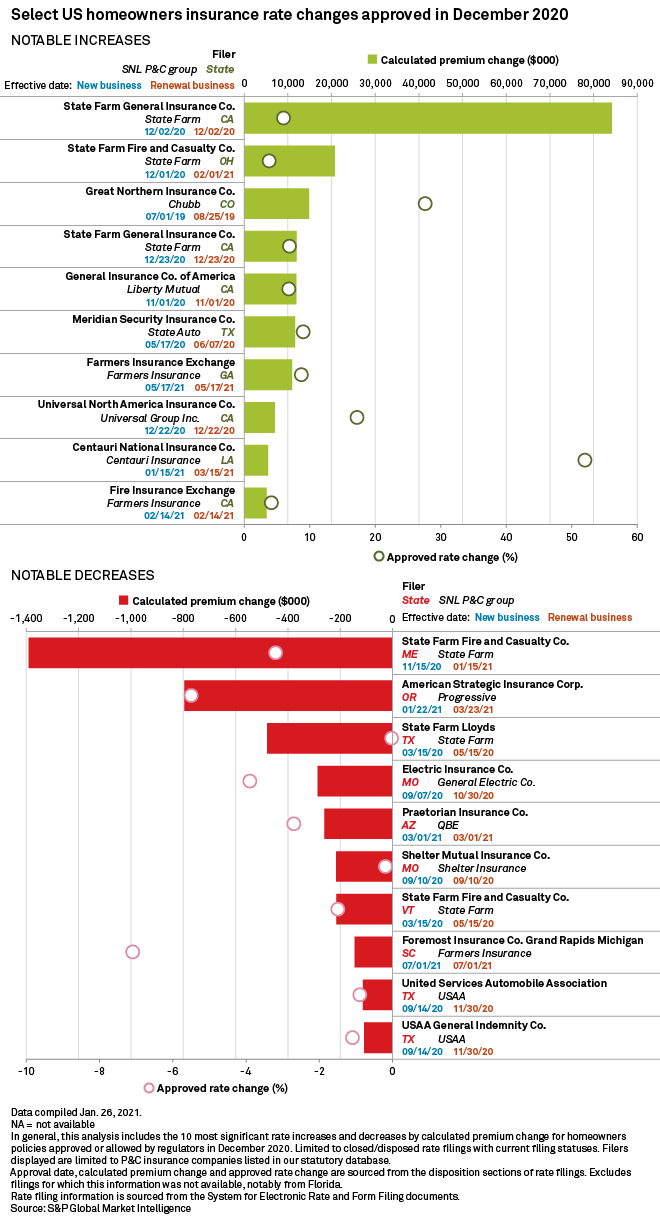

California regulators signed off on a pair of rate increases requested by State Farm General Insurance Co. in December 2020, one of which may be the most impactful homeowners hikes approved by any state regulator during the month.

Subsidiaries of State Farm Mutual Automobile Insurance Co. obtained five rate increase approvals across four states, which could boost calculated premiums by $123.4 million. About 78%, or $96.2 million, of the estimated premium increase is expected to come from the two rate hikes in the Golden State. The insurer also secured approvals to cut rates in four states, which could potentially reduce premiums by a total of $2.1 million, the largest estimated decrease during the month.

Liberty Mutual Holding Co. Inc. received approvals for 19 rate increases across eight states in December 2020, which collectively could increase premiums by $26.1 million.

Progressive Corp. received approval for a single rate reduction of 5.5% in Oregon that may decrease aggregate written premiums by about $800,000.

This S&P Global Market Intelligence analysis covers 299 homeowners rate change requests approved during December 2020. Out of these, 182 resulted in premium increases, 33 were rate cuts, and the rest had no effect on calculated premiums.