Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

27 Jan, 2021

Dozens of the world's largest companies representing trillions of dollars in market capitalization pledged to use a uniform set of "Stakeholder Capitalism Metrics" in their mainstream disclosures amid broader global efforts to streamline and standardize reporting on environmental, social and governance topics.

The World Economic Forum and its International Business Council made the announcement Jan. 26, as leaders from governments and the private sector worldwide convened for a virtual version of the annual Davos conference.

The 21 core stakeholder capitalism metrics are based on existing voluntary standards and offer "universal, comparable disclosures" that companies can report on "regardless of industry or region," according to a news release.

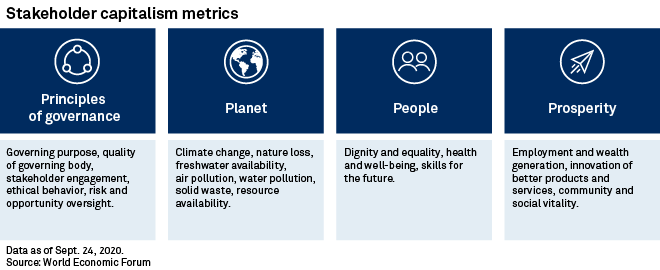

The metrics include nonfinancial disclosures centered around four pillars: people, planet, prosperity and principles of governance. They seek to address to United Nations Sustainable Development Goals, known as the SDGs, which launched in 2015 with an aim to create a safer, more prosperous planet by eradicating poverty, eliminating hunger and providing clean water and sanitation worldwide by 2030.

The new stakeholder capitalism metrics include climate change, greenhouse gas emissions, pay equality, remuneration policies, board diversity and employment statistics by age, gender and region.

Growing momentum behind stakeholder capitalism

The announcement during Davos follows the September 2020 news that the world's big four accounting firms — Deloitte Touche Tohmatsu Ltd., KPMG International Co-op, Ernst & Young LLP and PricewaterhouseCoopers LLP — and the World Economic Forum's International Business Council had developed the 21 core and 34 expanded ESG metrics.

Stakeholder capitalism is the idea that corporations have responsibilities that extend beyond just their investors to include their societies, communities and employees. The approach gained huge momentum after BlackRock Inc.'s Larry Fink, head of the world's largest asset manager, in his 2018 letter to shareholders urged corporate CEOs to look beyond financial performance to show how their businesses made a positive contribution to society. In his 2021 annual letter, also released Jan. 26, Fink told CEOs that their shareholders will benefit "if you can create enduring, sustainable value for all of your stakeholders."

During a panel discussion about stakeholder capitalism at Davos that same day, Fink pointed to "an extraordinary shift" in investor preferences that he largely attributed to stakeholder capitalism.

"Across every industry you see a widening gap between the best-performing companies in the industry and the worst-performing companies," Fink said, adding: "We're seeing now valuation shifts and that is because of companies' role in their stakeholders' [lives] and how they are building a better community around their stakeholders."

Converging ESG standards

The sustainability world has grappled for years with how to feed the growing appetite for ESG disclosure among investors, rating agencies and other stakeholders. Critics of the sustainability movement contend the lack of definition around ESG leaves room for green-washing. There is widespread agreement among ESG skeptics and proponents alike that data quality remains patchy, standardization is lacking when it comes to disclosure and there is a dizzying jumble of different reporting frameworks that make apples-to-apples comparisons across companies nearly impossible.

Brian Moynihan, Bank of America Corp. CEO and chairman of the International Business Council, said the new stakeholder capitalism metrics will help achieve convergence between the many standards, frameworks and ratings systems for ESG-related metrics. They will also bring much-needed private investment to the SDGs.

"We're doing this because we need $6 trillion a year for the SDGs to be implemented, and the only way you'll do that is [if] private companies are driving it," Moynihan said during the same panel discussion. Bank of America was among the companies that agreed to begin using the 21 core metrics in mainstream reports.

Other companies that pledged to use the core metrics include financial institutions Allianz SE, Banco Santander SA, Banco Bilbao Vizcaya Argentaria SA, Credit Suisse Group AG, Mastercard Inc. and UBS Group AG, as well as tech giants Dell Technologies Inc., HP Inc. and International Business Machines Corp. and consumer names like Nestlé SA. A number of fossil fuel companies also pledged to use the metrics, including BP PLC, Eni SpA, Royal Dutch Shell PLC, Equinor ASA and Total SE.