S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

28 Dec, 2023

By Bill Holland

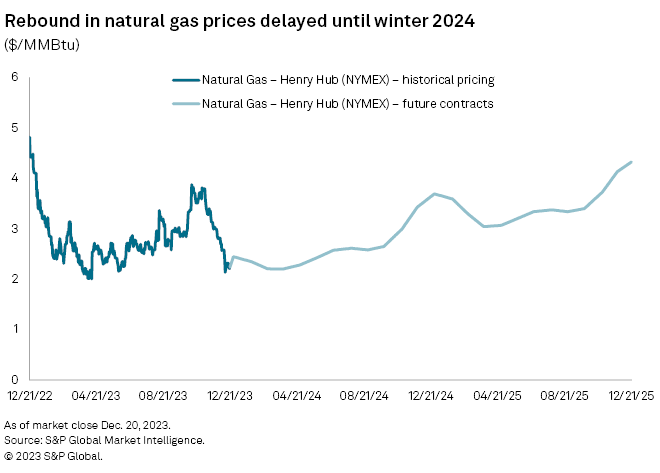

US shale gas producers entered 2023 looking for a rebound in commodity gas prices in 2024. Now, that price shift appears to be delayed until late in the year or into 2025.

The combination of warmer-than-normal winter weather and new volumes coming to the market ahead of the opening of more LNG terminals on the US Gulf Coast has capped gas prices below $3/MMBtu as the sector heads toward peak winter demand.

"A slow start to winter, above average US natural gas inventories, European natural gas inventory levels near full capacity, and a delay in US LNG facility Golden Pass all have contributed to the significant decline in natural gas prices since Halloween," Rob Thummel, senior portfolio manager and managing director at energy fund manager Tortoise, said in a Dec. 20 email. However, the gas market could easily go higher with one major winter storm, Thummel said.

The low price environment means lower cash flows and income for shale gas producers, cutting into their ability to reward shareholders with stock buybacks and dividends.

"Lower commodity pricing is going to reduce most companies' abilities to match its payout levels from prior periods (especially on the gas side), and not surprisingly as we have seen a pullback in the equities," Truist oil and gas analyst Neal Dingmann said in a note to clients.

The key question for investors is whether to buy into shale gas now while commodity and share prices seem low or wait to see if prices push stock values and investor returns higher.

Investors come back with prices

Oil and gas analyst Gabriele Sorbara with Siebert Williams Shank said he thinks investors will come back in the second half of 2024. "We anticipate investor interest in the gassy names to pick up at some point during the year (possibly in the 2Q24/3Q24 timeframe) ahead of the LNG projects expected to come online by year-end," Sorbara told clients.

"While we do not expect many gassy E&Ps to reduce activity materially below previously messaged 2024 plans, some may be forced to cut spending to maintain [free cash flow] neutrality. Yet, no one wants to be first, as it would be detrimental to capital efficiencies and 2025 programs," Sorbara said. The analyst recommended that clients wait until late in 2024 to buy more shale gas stock.

What is not expected to slow down is the pace of M&A, as oil and gas companies try to quickly add scale and efficiencies, analysts said.

Low prices stimulate M&A deals

While the megadeals in the Permian Basin by Exxon Mobil Corp. and Chevron Corp. have set the pace, the consolidation trend is carrying over into natural gas operators. For one, Tokyo Gas Co. Ltd. on Dec. 16 announced that its US affiliate would buy private Haynesville Shale producer Rockcliff Energy LLC for $2.7 billion.

Low commodity prices may help drive deals in 2024, according to Truist's Dingmann. A previous deal between Tokyo Gas and Rockcliff "fell apart earlier this year when gas was at ~$3/Mcf, giving some credibility that lower gas prices may loosen up the markets and allow for more M&A," Dingmann said Dec. 17.

"We continue to believe the recent move in the gas strip has caused a shakeup in any potential deals as privates feel a capital funding pinch, likely making some companies more attainable for the publics," Dingmann said.

The market is awash in rumored deals, including a shale gas megadeal combining Appalachian and Haynesville Shale gas producers Chesapeake Energy Corp. and Southwestern Energy Co. A merger would create an LNG powerhouse anchored in the Haynesville, on the doorstep of the Gulf Coast's growing LNG complex. Another report floated in December was that Appalachian producer EQT Corp. is looking to sell its nonoperated minority interests in northeast Pennsylvania wells for $3 billion.

Cut production to increase prices

In the short term, producers need to cut more than 1 Bcf/d of production to put a floor under prices, Tudor Pickering Holt's head of research, Matt Portillo, told clients Dec. 18.

"Ultimately capex cuts will be needed to help put the market in better footing," Portillo said. "Client conversations last week suggested that producers considering production declines is constructive for the gas equities as the crystallization of capital plans and production declines will likely put a floor on stocks in 1H'24."

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.