Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

19 Oct, 2021

By J. Holzman

|

Visitors look at a photo of the mining area that stands at the Rossing Uranium Mine near Arandis, Namibia, on April 5, 2019. The price of uranium has risen rapidly in response to purchases by an asset management firm, Sprott Asset Management LP. |

Canadian investment fund Sprott Asset Management LP's new uranium trust has put its fingers on the scales of uranium prices once again.

The trust, formed in July through Sprott's acquisition of Uranium Participation Corp., a uranium holding company, restarted a uranium bull run earlier this month when it began buying again on the spot market. In September, the price sank when the trust took a hiatus from buying up the metal. Uranium producers are rubbing their hands over Sprott's plans to hoover up hefty tons of surplus uranium indefinitely. The fund holds 32.6 million pounds of uranium, roughly 76 percent of last year's sales by the largest yellow cake producer, JSC National Atomic Co. Kazatomprom.

"The news the hedge fund bought uranium brought more confidence to the sector in terms of demand. That's what really led to the volatility," Sid Rajeev, research director at Fundamental Research Corp., said in an interview. Rajeev covers junior uranium mining companies that are enjoying large equity gains in tandem with larger uranium producers and uranium ETFs.

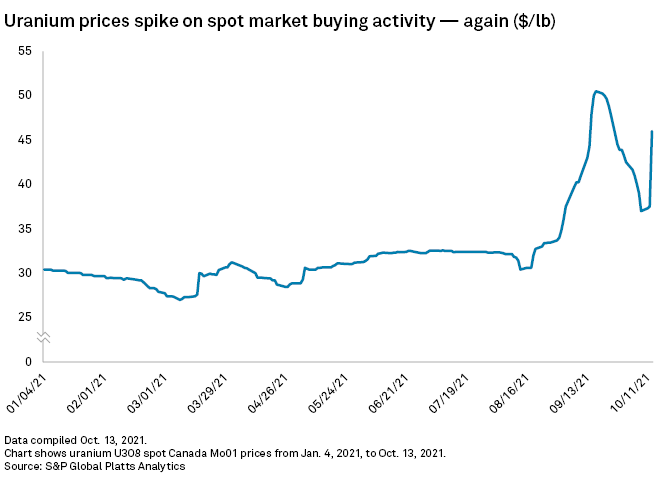

Sprott's activity has single-handedly moved the price of uranium this year. After taking a two-week break from buying, the Sprott Physical Uranium Trust purchased 400,000 pounds of uranium on Oct. 4 and 1.15 million pounds of material on Oct. 13. On the day of the second purchase, the uranium price assessed at 1 p.m. had risen to $46/lb, a 22% increase from $37.5/lb the previous day, according to S&P Global Platts data.

It was the second massive price spike: An August and September buying spree drove a 64.5% increase to a nine-year high of $50/lb as of Sept. 16. But then the trust took a break, and the price dipped down into the mid- to high $30s, close to the range it traded before Sprott entered the fray.

The market is so hot that the Republic of Kazakhstan state-owned miner Kazatomprom said Oct. 18 that it would finance a separate fund for physical uranium purchases. Investors and uranium mining executives say the new purchasing outfit could further grow prices, by creating more competition for material in the spot market.

"It brings another vehicle for price discovery into the market. $50 [per lb] is yesterday's news," Mike Alkin, chief investment officer at hedge fund Sachem Cove Partners LLC, said in an interview. "This horse has left the barn."

Paul Goranson, CEO for uranium producer enCore Energy Corp. and head of Uranium Producers of America, a trade association, told S&P Global Market Intelligence that Kazatomprom's new physical uranium fund will "certainly push the price of uranium up."

"It'll go sweep some more spot material out of the market," Goranson said. "They [Kazatomprom] want to be able to control what's happening in the market. They need to preserve higher prices, and this gives them a vehicle for that."

'No endgame'

Sprott said its long-term plan for the trust is to stay the current course. Sprott CEO John Ciampaglia said during a TD Securities investor roundtable on Oct. 7 the trust has "no endgame." The asset management firm structured the vehicle as a "passive" entity that will operate "in perpetuity" until investor interest in the fund ceases to exist. The fund will not sell uranium to other entities, Ciampaglia said.

"We obviously caught the market off-guard a little bit and we obviously cleared out the market, I think it's fair to say," Ciampaglia said.

Grant Isaac, senior vice president and CFO for uranium producer Cameco Corp., said at the same roundtable that the structure of the Sprott trust was the most important reason its purchases were moving the market. While the trust may also introduce "more volatility" into the industry, it has created "the best demand" by taking material off the market that "never comes back."

"We don't have to worry about it coming back, and we don't have to worry about it being the next big carry trade in the market," Isaac said. "It is a fundamental shift in the market dynamic."

A win for miners

Volatility in the uranium market is not new. Spot prices wildly swung upwards at the start of the worldwide coronavirus pandemic when fears of viral spread shuttered major uranium mines including the largest single producer, Cameco Corp.'s Cigar Lake asset in northern Saskatchewan. Another wave of interest in the uranium space crashed in February, when social media excitement collided with strength in uranium equities amid ticker-tape hype around 'meme stocks' like GameStop Corp., AMC Entertainment Holdings Inc.., and silver stocks including First Majestic Silver Corp.

Even still, the pressure may have gotten to power providers, netting a win for the miners. Uranium producers are beginning to ink new long-term supply contracts with utilities, who have been drawn in by the rising price environment, according to Chris Gadomski, lead nuclear analyst at BloombergNEF.

"The reason we have the situation we have right now with rising uranium prices [is] the utilities did not replenish their inventories when prices were very, very low. There was a hesitancy among the uranium producers to sign long-term contracts at historically low prices." Gadomski said. "You've had a turning off of the spigot of uranium supply over the last few years."

The Nuclear Energy Institute, a trade association for the U.S. nuclear power utilities which must buy uranium for fuel, declined to comment.

This article was amended on Oct. 19 at 1:12 p.m. to reflect the correct government owner of Kazatomprom, and again on Oct. 20 to clarify the scale of Sprott's holdings. S&P Global Platts and S&P Global Market Intelligence are owned by S&P Global Inc.

Location

Segment