Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

23 Jul, 2021

| Winter at the Gateway Arch in St. Louis. Spire STL pipeline delivers Rocky Mountain and Appalachian natural gas to the St. Louis area. Source: Feifei Cui-Paoluzzo//Moment via Getty Images |

With this past winter's severe weather still top of mind, Spire Inc.'s Missouri gas utility is already looking to the next major cold snap. If the region experiences a deep chill without access to the Spire STL Pipeline, Spire utility executives warn, hundreds of thousands of customers could lose service.

Spire STL delivers Rocky Mountain and Appalachian natural gas to the St. Louis area, including to its affiliate gas utility, Spire Missouri Inc. A recent court decision found that federal regulators had not sufficiently scrutinized whether Spire STL demonstrated a valid market need for the project. The court sided with the Environmental Defense Fund, finding the group had "identified plausible evidence of self-dealing" in Spire STL's reliance on affiliate contracts to show the pipe was necessary. The court's decision could lead to a shutdown of the pipeline, which went into service in November 2019.

But Spire Missouri President Scott Carter, also Spire's COO of distribution operations, said that the pipe had played a crucial role in maintaining service in eastern Missouri during February's extreme cold snap, and that shutting it down could leave Spire Missouri unable to meet peak winter demand.

"This is reality for me. I don't sit on extra capacity just in case some court two years later shuts down the operation of a pipeline," Carter said told S&P Global news reporters. "I'm hoping that as we move through the process, we can put the facts on the table that support the benefits of the pipeline, the criticality of the pipeline."

When the U.S. Court of Appeals for the District of Columbia Circuit panel vacated the Federal Energy Regulatory Commission's 2018 certificate authorizing the pipeline project, the panel found that FERC did not adequately consider arguments that Spire STL's sole precedent agreement to deliver gas to affiliate Spire Missouri was not enough to establish public need.

While it is not uncommon for pipelines to use contracts with affiliates to pass the public need test or for project opponents to challenge that need, limited demand growth and Spire STL's reliance on a single contract stands out, especially in a climate-conscious era of heightened scrutiny around pipeline development. Natural gas pipeline opponents have already seized on the Spire STL ruling to bolster arguments for more analysis in other pipeline cases.

FERC and Spire, however, have maintained that affiliate contracts should be treated the same as unaffiliated contracts.

Affiliate or no, Carter said, Spire Missouri needs supply. If the region suffered an especially cruel winter — in which the company draws down storage during an early cold snap, and then experiences another deep freeze later in the season — up to 400,000 Missouri customers could lose service without Spire Missouri's 350,000 Dth/day of contracted capacity on Spire STL, according to the company. It could take up to 100 days to restore service disruptions of that scale, Carter said.

His comments offered insight into a case that Spire could make to FERC, should the regulator conduct a new review of Spire STL.

Supply sources matter

Spire Missouri sees no reliable alternative to the capacity of Spire STL system, Carter said.

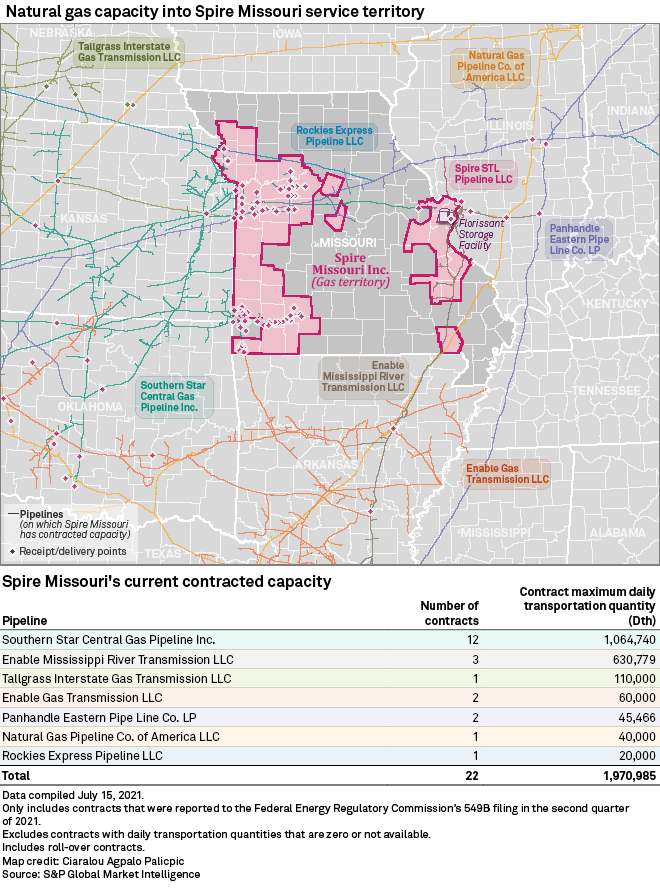

The utility recently retired a propane system capable of meeting about 190,000 Dth/d of demand and has also given up nearly 180,000 Dth/d of capacity previously contracted on Enable Mississippi River Transmission LLC, or MRT, according to data compiled by Market Intelligence.

The utility relinquished that capacity as part of a strategy to diversify its supply sources, shifting away from reliance on MRT and turning to capacity from Spire STL to provide access to low-cost Appalachian shale gas through an interconnection with the Rockies Express Pipeline LLC system, or REX.

MRT was among several parties that opposed the STL project during its FERC application, arguing it would inflict competitive harm on regional pipelines.

While some of MRT's available capacity could be used to supply Spire Missouri during a cold snap, Carter said that much of that is on MRT's East Line, one of the pipes in the MRT system. Carter said his utility has hesitated to rely on the East Line, indicating that the pipe has at times faced challenges getting gas from upstream pipes.

"There's not 350,000 [Dth/d] of posted capacity to come into the St. Louis region to replace" Spire STL, Carter said. "Even the capacity that is posted, in our view, has limitations to it."

Enable Midstream Partners Vice President of Commercial Transportation and Storage Steven Tramonte said MRT has posted available firm capacity of more than 145,000 Dth/d for summer 2021, and additional firm capacity could be available for the 2021-2022 winter season on the East Line. "As this is firm capacity, it is reliable," Tramonte said in an email.

"MRT demonstrated its reliability during the recent extreme weather event in February 2021, delivering 100% of the volume received on behalf of its shippers and not curtailing or reducing East Line primary firm receipts," Tramonte said.

Integrated system key during February freeze

Carter said Spire STL represents the only regional asset that allows Spire Missouri to inject gas into storage during the winter. That strategy played a major role in the utility's plan for maintaining service and mitigating customer costs during February's extreme cold snap, according to Carter.

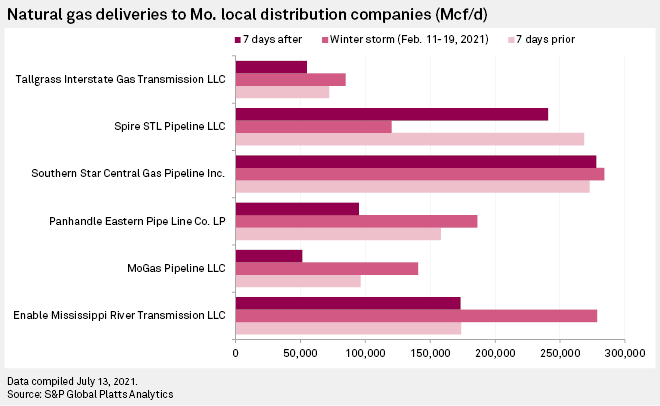

In the week leading up to the storm, Spire Missouri pulled gas from REX through its interconnection with Spire STL to inject gas into storage. With its Florissant Storage Facility nearly topped off, allowing Spire Missouri to withdraw 357,000 Dth/d, the utility said it was able to use Spire STL during the event to push gas back onto interconnected systems. By backfeeding those systems, Spire Missouri said it was able to route gas to western Missouri, including Kansas City, via REX and to maintain pressure to the west side of its St. Louis service territory via MoGas Pipeline LLC and MRT systems.

"Everything in Midcontinent was constrained, so REX was feeding everything. Everybody was pulling everything they could out of Marcellus and moving it as far West as they could," Carter said.

Data from S&P Global Platts Analytics illustrate the dynamic. They show a drop in Spire STL shipments to Spire Missouri during the event. Meanwhile deliveries to Missouri gas utilities on systems including MoGas and MRT surged.

Questions of cost

The Environmental Defense Fund has contended that the Spire STL pipeline is a cost burden on ratepayers, who ultimately pay for new gas infrastructure. FERC Chairman Richard Glick has repeatedly questioned the public interest determination itself, and even in approving a rate increase for customers to cover higher-than-expected construction costs for the pipe, Glick said that building the line would ultimately hurt consumers in the region.

Spire Missouri projected, however, that its customers would have shouldered increased gas purchase costs of up to $300 million without STL, which provided access to Appalachian shale gas at a time when Midcontinent and Gulf Coast gas prices were skyrocketing. Overall, Spire estimated it spent $110 million on gas purchases during the storm.

February gas purchase costs at Spire Missouri's eastern division were equal to roughly 40% of its total costs for 2020, while its western division spent more in February than it spent last year. Ameren Gas spent about twice as much in February on gas purchases as it spent in all of 2020. Summit Natural Gas of Missouri's February gas costs were five times its total 2020 costs. Liberty Midstates said its February costs were roughly 44% of what it would expect to spend in a year.

Prior to the STL project's development, Spire Missouri considered building a new backbone to the region to address pressure issues as the service territory expands westward, Carter noted. However, that would have involved siting a high-pressure line through densely populated areas. Spire STL instead allows Spire Missouri to loop gas supplies around the city via MoGas to address the pressure challenges, Carter said.

Rick Kreul, president of MoGas Pipeline, said he supports Spire STL's efforts to keep the pipeline operating to maintain supply and pressure for the region. MoGas' interconnect with Spire STL "literally doubled the capacity of our pipeline system without the need of adding new pipe or compression," Kreul said in an email.

"If this interconnect goes away," Kreul said, "we will likely be forced to add more pipe, and possibly compression, as part of our system to cover the growing demand for natural gas along our pipeline in the western St. Louis area, where the suburbs are seeing significant growth."

Maya Weber is a reporter with S&P Global Platts. S&P Global Market Intelligence and S&P Global Platts are owned by S&P Global Inc.