S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

22 Nov, 2021

Spain's largest banks are beginning to see the gains of recent cost-cutting measures in their home market following a series of restructurings and tussles with unions over the past year.

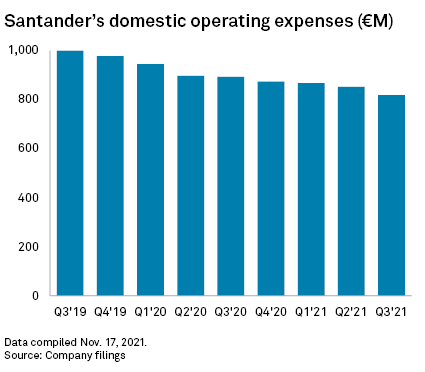

Banco Santander SA achieved an 8.4% year-over-year drop in operating expenses in the third quarter, despite strong income growth over the same period. The Madrid-based bank was one of the first major lenders in Spain to strike an agreement with unions on job losses and branch closures following the outbreak of the COVID-19 pandemic.

Spanish lenders have long wrestled with the cost burden of operating in one of the most over-branched banking markets in Europe. The economic shock caused by the pandemic prompted a wave of consolidation and cost-cutting, which included mergers between CaixaBank SA and Bankia SA, Unicaja Banco SA and Liberbank SA, and ABANCA Corporación Bancaria SA and Bankoa SA. Banco Bilbao Vizcaya Argentaria SA and Banco de Sabadell SA failed to agree on a merger in November 2020 but have since undertaken significant cost-reduction plans in Spain.

The impact of those moves is now materializing, according to Pablo Manzano, vice president at credit rating agency DBRS Morningstar. "Santander is now getting the fruits of its cost-cutting exercises. We will see the other banks do the same in the coming quarters," Manzano said.

Sabadell made some progress in reducing costs in Spain in the third quarter. The bank's operating expenses in the country fell 3.76% year over year to €512 million. Sabadell agreed a deal with unions to shed 1,800 jobs in November 2020, shortly before Santander announced its cost-cutting plan.

Sabadell has since disclosed two further programs of cuts, one set to finish in the fourth quarter of 2021 with a net cost reduction of €70 million and another announced in May targeting €100 million in gross savings per year by the end of the first quarter of 2022. The bank has significant operations in the U.K. through its ownership of TSB, where it has also reduced costs.

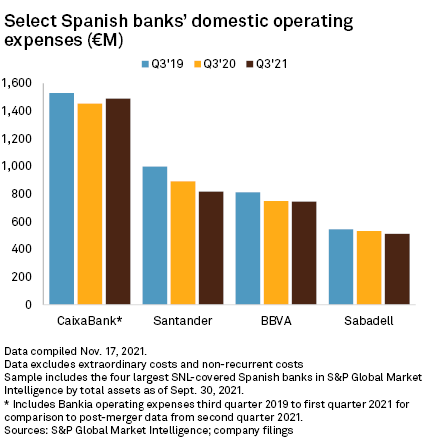

CaixaBank and BBVA, which along with Santander and Sabadell make up Spain's four largest lenders by total assets, reported little to no progress on Spanish costs in the most recent quarter. Domestic operating expenses at CaixaBank, Spain's largest domestic lender by assets, rose 2.4% year over year, while BBVA's fell by just 0.6%.

Both CaixaBank and BBVA lagged their peers in finalizing cost-cutting deals with unions. BBVA reached an agreement in June to shed 2,935 jobs in Spain and close 480 branches after originally proposing plans in April to cut 3,800 jobs and close 530 branches. CaixaBank struck a deal with unions in July to axe 6,452 jobs and close 1,500 branches in Spain, having initially proposed the loss of more than 8,000 jobs in April.

The measures have already helped all but one of the four banks improve the efficiency of their domestic operations. Santander's cost-to-income ratio — a key measure of profitability — in Spain fell by 6.74 percentage points between the third quarter of 2019 and the same period in 2021. BBVA's dropped 4.6 percentage points to 50% over the same period, while Sabadell's fell 2.46 percentage points to 40.22%. CaixaBank's cost-to-income ratio in Spain rose by 2.13 percentage points.

Santander has set the pace of cost-cutting among Spain's largest banks in recent years. The lender has reduced its operating expenses in the country, which is its second-largest source of costs after Brazil, in every quarter since the beginning of 2019. Over the past eight quarters, Santander's operating expenses in Spain fell 18.12%. This compares with declines of 8.24% at BBVA, 6.06% at Sabadell and 2.68% at CaixaBank on a pro forma basis following its merger with Bankia.

"Self-help is important in a low-rate environment, therefore we like the action that Santander has taken around costs," Benjamin Toms, banks analyst at RBC Europe, said in an Oct. 27 note.

Spanish banks' cost-cutting efforts may yet encounter resistance in the form of inflation, said Benjie Creelan-Sandford, bank equity analyst at Jefferies. Inflation spiked to a 29-year high in October as national consumer prices rose 5.5% year over year, according to flash data from the National Statistics Institute.

"That's going to put upward pressure on underlying costs as banks come out of the other side of COVID. And if you assume that profitability improves, and you expect that there is also some potential upward pressure on things like variable compensation, there are some inflationary impacts on cost," said Creelan-Sandford.

Still, the banks' cost-cutting programs should be robust enough to overcome the challenge of a higher-inflation environment, Creelan-Sandford added. "All these banks are undertaking pretty meaningful headcount reduction programs, branch closure programs and, at a minimum, that should be largely sufficient to compensate for some of those underlying pressures."