Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

17 Aug, 2021

BBVA agreed with unions in June to axe

Source: Cristina Arias/Cover via Getty Images

Amid union protests Spain's banks have cut jobs and closed branches, but further restructuring and associated costs await.

Four of the country's largest lenders have reached agreements with trade unions on large-scale job cuts. CaixaBank SA said in July it was cutting 14.5% of its workforce as part of its merger with Bankia SA. Meanwhile, Banco Santander SA, Banco de Sabadell SA and Banco Bilbao Vizcaya Argentaria SA have reached similar deals. The Spanish banking industry as a whole cut 4% of its jobs and closed 10% of its branches in the first half of 2021, according to Europa Press.

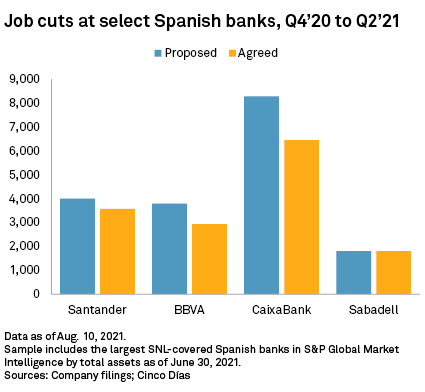

The banks' push to restructure amid the economic fallout from the COVID-19 pandemic has not been frictionless. Resistance from trade unions, which saw strike action at both CaixaBank and BBVA, forced reductions to the number of job losses initially proposed and improved severance packages for employees.

Still, the case for significant changes at the banks had become almost impossible to oppose, Javier Santacruz, an economist at the Instituto de Estudios Bursátiles in Madrid, said in an interview.

"It's been easier to achieve an agreement with trade unions and with the rest of stakeholders because the banks have convinced politicians, and especially regulators, that it is necessary to make these adjustments," Santacruz said, citing the shift by consumers away from branch banking toward digital channels, which significantly accelerated during the COVID-19 pandemic. "And, especially, that this adjustment will be positive for the economy."

Branch cuts

Spain's largest banks have seen branch usage plummet and the use of digital channels soar in the last two years, mostly as a result of the COVID-19 pandemic forcing the temporary closure of physical outlets. BBVA reported a 48% fall in customer transactions in its branches in the first half of 2021 year over year, with use of digital channels up 115% over the same period.

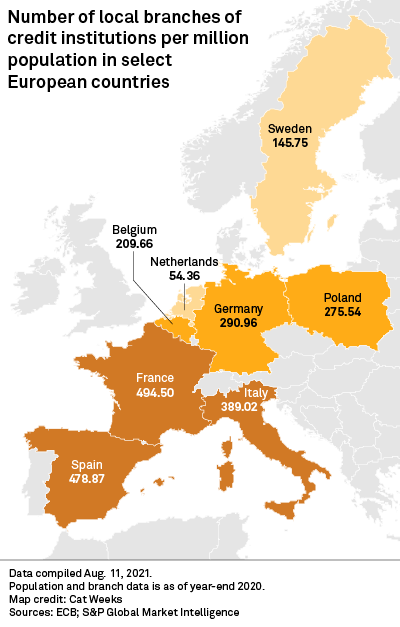

S&P Global Market Intelligence data shows that Spain is one of the most overbanked markets in Europe. The country had 478.87 bank branches per 1 million people as of Aug. 11, 2021, second only to France among Europe's largest economies, which had 494.50 per million. The Netherlands had the lowest number of branches per million at 54.36.

The pandemic-related shift away from branch banking has compelled Spain's largest lenders to adjust their business model accordingly. Sabadell was the first to move, confirming the loss of 1,800 jobs in Spain on the same day its merger talks with BBVA collapsed. Santander followed shortly after, announcing the loss of 3,572 jobs and closure of 1,033 branches in Spain in December 2020.

In April, BBVA reportedly intended to make 3,798 redundancies and close 530 branches in Spain. A one-day strike by employees in June preceded an announced with unions on 2,935 redundancies and 480 branch closures.

Job losses at CaixaBank have come primarily as a result of its merger with Bankia. Still, cost synergies through branch closures and a reduction in personnel have driven the deal. After proposing 8,291 job cuts and 1,534 branch closures in April, the bank settled for 6,452 job losses and the shuttering of 1,500 branches after negotiations with unions.

The swathe of restructuring has not come cheap. CaixaBank recorded a pretax €1.9 billion extraordinary cost in the second quarter, which CEO Gonzalo Gortazar said was mainly for personnel restructuring. Santander posted a €1.15 billion pretax extraordinary charge in the fourth quarter of 2020, €700 million of which was for restructuring in Spain. BBVA's Spanish restructuring cost the bank €994 million before tax in the second quarter, CEO Onur Genç said during an earnings call, while Sabadell's cost €314 million in the fourth quarter of 2020.

While the banks forecast those costs to be recouped over the course of the coming quarters, the outlay suggests Spanish banks will continue to face significant restructuring costs in the years ahead as they shrink their branch networks further.

Sabadell has already announced a further restructuring program to begin in the third quarter at a cost of €100 million, targeted mainly at its retail branch network. BBVA CEO Genç said recently the bank does not rule out further restructuring.

BBVA, Santander and Sabadell did not respond to requests for comment. CaixaBank was unable to respond to a request for comment in time for publication. Spanish unions Confederación Sindical de Comisiones Obreras and Unión General de Trabajadores did not respond to requests for comment.

Workers' rights

Restructuring costs are likely to remain proportionate to current levels given the relationship between Spanish banks and their employees. Spain's banking sector tends to offer its employees more favorable collective bargaining dismissal conditions than other industries, according to Isabel Rodriguez León, a Spanish employment lawyer with over a decade's experience at one of the country's largest law firms. Rodriguez León recently left the firm and requested that it remained unnamed.

Among the advantages that Spanish bank workers enjoy are clauses in collective dismissal agreements that prioritize voluntary acceptance of the dismissal conditions during consultation periods and higher severance pay, according to Ángel Olmedo Jiménez, partner, labor and employment law, at Spanish law firm Garrigues.

In the last year, the Spanish banking sector has also offered a new guarantee to employees targeted for redundancy that ensures they will be relocated to another job within the bank if their attempts to find alternative employment through an outplacement program fails, Olmedo Jiménez added.

Unions retain significant influence in employment disputes, in contrast with some other European countries, despite reforms to Spain's labor laws in 2012 that gave employers greater flexibility, said Rodriguez León. "They've always been an important player in the Spanish employment and labor relations framework," Rodriguez León said.

Still, with Spain remaining overbanked relative to its European peers and online banking becoming the norm, the country's lenders should get the support they need to undertake further restructuring in the years ahead, Santacruz said.

"It's possible now for politicians to be more tolerant of the movements from the banking sector [to cut jobs] as they recognize that these labor adjustments should have been done some years ago."