Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

14 Dec, 2021

By Pranav Nair and Marissa Ramos

Banco Bilbao Vizcaya Argentaria SA is increasingly reliant on its Turkey, Mexico and South America business as it bets on emerging markets to fuel its growth.

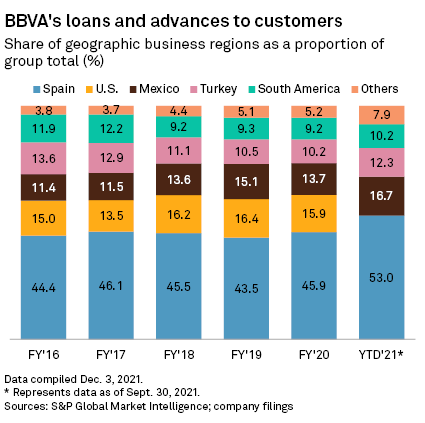

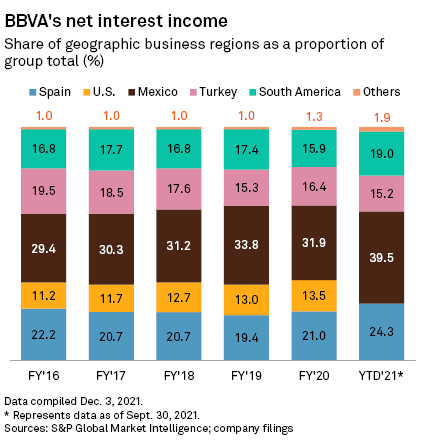

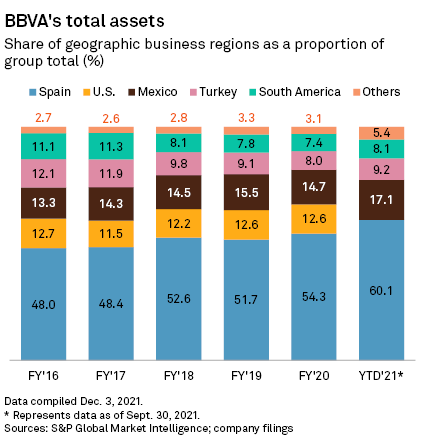

The Spanish bank's assets in these three regions totaled 34.4% of the group total at the end of September, up from 30.1% at the end of 2020. Loans saw a similar shift, and net interest income from the Mexico business increased to 39.5% from 31.9% of total assets over the same period, according to S&P Global Market Intelligence data.

The movement was partly explained by BBVA's exit from its U.S. operations. It sold BBVA USA Bancshares Inc. and BBVA USA to The PNC Financial Services Group Inc. in a deal that completed in June. But BBVA also expects strong growth in emerging markets and doubled down on its Turkey exposure by offer to buy the 50.2% stake in Turkiye Garanti Bankasi A.S. that it does not already own.

The bank expects revenue growth in the "high teens" in Turkey between 2021 and 2024, "mid teens" in South America, and "close to double digit" in Mexico, it said at a Nov. 18 investor day presentation. It only expects "slight growth" in revenues in Spain. It is also targeting 14% return on tangible equity — a measure of profitability — in 2024 for its whole business.

Mexico should enjoy good momentum, but the compound annual growth rate for Turkey is likely to be 12%, rather than the high teens projected by the bank, according to analysts at investment bank Jefferies cited by Dow Jones Newswires. BBVA's new ROTE target is higher than the consensus view of about 13%, but the plan to grow in emerging markets fits with Jefferies' view, they said.

BBVA's expected numbers in Turkey and South America "seem to need a significant leap of faith to be credible," Deutsche Bank analysts cited by Dow Jones Newswires said, adding that BBVA had "disappointed" by lacking detail in its plan of how it would reach its targets.

There are some concerns about BBVA's reliance on emerging markets, according to Renta 4 analyst Nuria Alvarez. The goals look like a "tall order" as the bank will be affected by inflation-related costs and higher expected cost of risk in Turkey in 2022, Alvarez was cited by Dow Jones Newswires as saying.

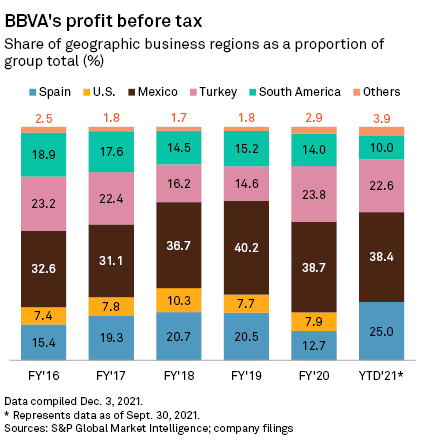

In the first nine months of 2021, BBVA's home market of Spain represented 60.1% of total assets, but just 25.0% of profit before tax. Mexico and Turkey represented 17.1% and 9.2% of assets, respectively, and 38.4% and 22.6% of profits.

Its home market represented 25.0% of the group's profit before tax, Mexico represented 38.4% and Turkey represented 22.6%.

The pro forma net profit contribution of the Turkish operations for the first nine months, including the whole of Garanti, would rise to 24.6% from the current 14%, the bank said. This puts the country just short of the contribution of the Spain business, at 25.8%.

BBVA is satisfied with the mix of its earnings and balance sheet and is not planning mergers and acquisitions to rebalance the portfolio, according to Chairman Carlos Torres Vila.

The bank is also looking to bring down its cost-to-income ratio in Spain to 45% from 54.3% at the end of the third quarter.