S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

20 May, 2021

A slowdown in the market for special purpose acquisition companies poses little threat to the stream of underwriting and M&A fees Wall Street is collecting.

Investment banks logged some of their best results ever in the first quarter on the back of staggering levels of new issuance, deals and follow-on offerings. Global equity proceeds raised reached $286 billion in the first three months of the year, marking a 172% jump from the prior-year period, according to S&P Global Market Intelligence data. North America accounted for $131 billion of those proceeds, which was 264% higher from the same quarter of 2020.

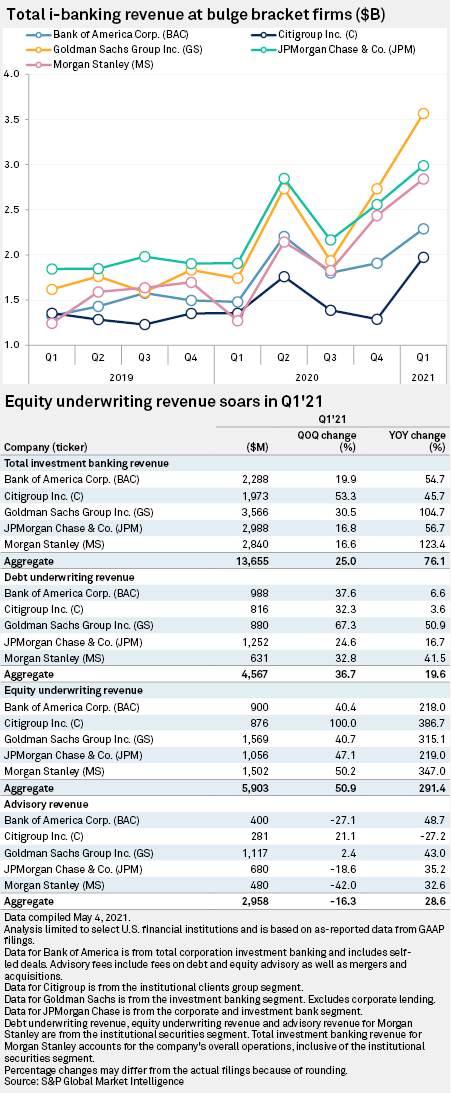

Five of Wall Street's biggest banks, Bank of America Corp., Citigroup Inc., Goldman Sachs Group Inc., JPMorgan Chase & Co. and Morgan Stanley, saw an aggregate year-over-year rise to their total investment banking revenues of 76.1%, with equity underwriting fueling the vast majority of that activity.

Behind part of the banks' swelling earnings were SPACs: the investment vehicle that has captivated everyone from finance titans to retired professional athletes to day traders exchanging investment ideas on Reddit throughout the pandemic. SPACs accounted for $88 billion of the global equity proceeds raised during the first quarter, versus $4 billion a year ago, Market Intelligence data show. And while new SPAC listings have fallen sharply in the second quarter as investors' interests shift and U.S. securities regulators zero in on the structure, the model is not going anywhere for private companies looking to list or the banks helping them do so, market experts say.

|

"Of course the market will ebb and flow, as markets always do," said Carlos Alvarez, head of permanent capital solutions at UBS Group AG, in an interview. But UBS believes "in the long-term of the validity of the SPAC market," Alvarez said.

SPACs quickly became a favorite for venture capitalists, private market investors and bankers looking to bring private companies public a year ago in a market roiled by the spread of COVID-19. Under the model, a SPAC, also known as a blank-check company, lists on a stock exchange with only a plan for its sponsors to strike a reverse merger agreement with a private company, allowing it to avoid many of the fees and hoops of a traditional IPO and get to market faster. But the popularity of the IPO alternative escalated into mania by the first quarter of 2021, when more SPACs entered the marketplace than in the entirety of 2020.

New scrutiny from the U.S. Securities and Exchange Commission — particularly an accounting change related to the warrants issued by SPACs — has added to the market's complicated outlook. The accounting change has created a backlog of work for sponsors, auditors, bankers and lawyers to figure out before listings can pick up again. Only 12 SPACs went public in the U.S. during April versus 107 in March, according to S&P Global Market Intelligence data. And the regulator reportedly is considering guidance on the optimistic projections that SPACs and their target companies issue when announcing deals, another step that could dampen investors' appetites for SPACs.

For Wall Street banks, SPACs were a "nice tailwind" for first-quarter earnings but the "bigger deal for everyone's advisory revenues [was] the cyclical M&A environment," Piper Sandler Managing Director Jeff Harte said in an interview. At Goldman Sachs, for instance, SPACs accounted for a "single-digit percentage" of overall M&A activity that the bank worked on in the first quarter, Chairman and CEO David Solomon said during an earnings call. Still, Goldman posted an 105% spike in investment banking revenue, excluding corporate lending, from the prior-year period, according to Market Intelligence. Citi, on the other hand, called SPACs one of the core reasons behind its 46% year-over-year jump in investment banking revenue during the first quarter.

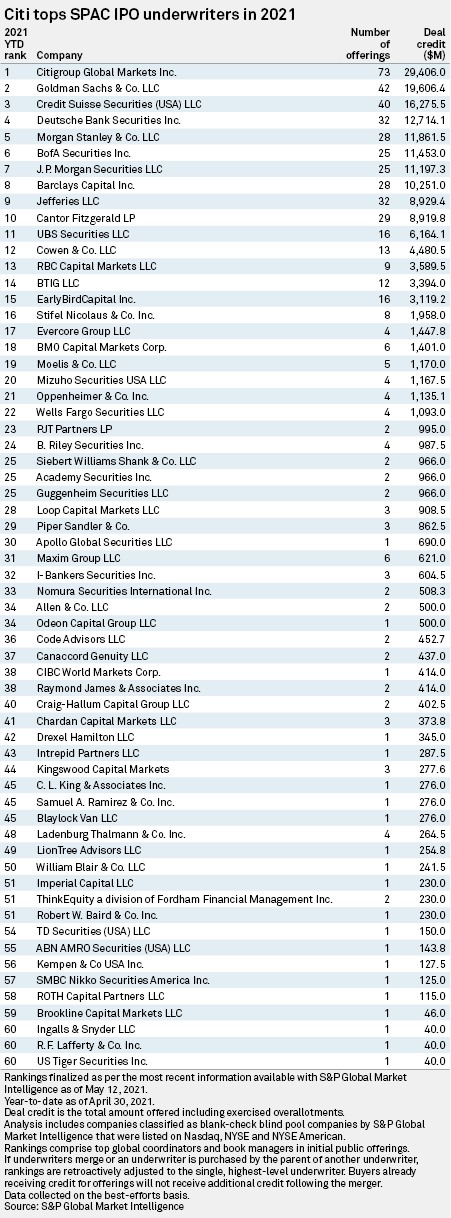

Citi has been the most active underwriter for SPAC debuts in 2021, working on 73 different IPOs where $29.41 billion was offered, including exercised overallotments. Behind Citi stood Goldman Sachs, which worked on 42 SPAC IPOs through April 30, and Credit Suisse Securities (USA) LLC, which worked on 40. Goldman's deal credit from those offerings totaled $19.61 billion, while Credit Suisse had accumulated $16.28 billion in deal credits from the SPAC IPOs it underwrote.

Smaller investment banks caught some of the benefits of the SPAC expansion in the first quarter, too, but it was not the main driver behind their underwriting and advisory businesses. Stifel Financial Corp. posted an 89.1% jump in investment banking revenue during the first quarter, and only about 15% of its equity underwriting revenue in the quarter came from SPACs, Chairman and CEO Ron Kruszewski said on its earnings call. And while Cowen Inc. Chairman and CEO Jeffrey Solomon told analysts that SPACs accounted for more than a third of Cowen's banking revenue during the first quarter, he added that it still would have been the second-best quarter on record for Cowen's banking business even without the SPAC revenue.

"The first quarter was really a period where virtually every business was hitting on all cylinders," JMP Securities analyst Devin Ryan said in an interview. "The record level of SPACs in the first quarter and the record level of equity issuance, I think, only represents a portion of the potential that will come from the transactions we saw in the first quarter. There are a lot of revenues that are going to continue to work through the system."

When a SPAC goes public, the underwriting fee is split into two payments that typically come together at about 5.5% of the amount raised. Upfront, the banks collect a 2% fee from the SPAC, with another 3.5% coming when it closes a deal. The deferred 3.5% payments figure to play a large role in the outstanding SPAC fees expected to be paid out in the coming years. The other part will come from banks advising on the "de-SPAC" M&A and on the private investment in public entities that usually accompany the deals.

Coalition Greenwich, an S&P Global Inc.-owned company, estimates that the banks active in underwriting and advising SPACs that went public between the start of 2020 and the end of the first quarter still have to book anywhere from $8 billion to $10 billion in fees. That could bring the total amount of SPAC-related fees collected by the banks to as much as $15 billion, as somewhere between $4 billion and $5 billion has already been logged, Coalition Greenwich says.

"It's the investment banking fee gift that keeps on giving," Piper Sandler's Harte said of SPACs.