S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

14 Nov, 2022

By Michael O'Connor, Annie Sabater, and Darakhshan Nazir

The market for U.S. special purpose acquisition companies has fallen from its dizzying 2021 heights.

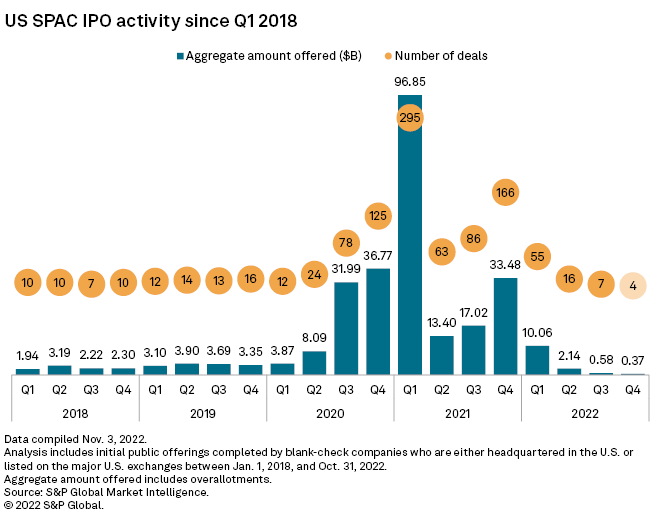

There were 78 SPAC IPOs in the first three quarters of 2022, compared to 444 in the same period a year ago, according to S&P Global Market Intelligence data. The dramatic decline coincided with a broader IPO slowdown and rising interest rates as investors lost their appetite for risk and regulators set their sights on the SPAC market. SPACs, also known as blank-check companies, are shell companies that go public with the goal of raising money to buy a private company in a certain period of time.

IPOs

The aggregate value of SPAC offerings is down from what it was in 2021. IPOs in the first three quarters of 2022 raised a combined $12.78 billion, compared with $127.27 billion in the same period a year ago, according to Market Intelligence data.

"Bitter economic conditions, political unrest, repeat regulatory hits, the uncertainty of the proposed SEC rules, loudly touted examples of a few bad apples, and continued media negativity have left the SPAC market tattered and bruised," Yelena Dunaevsky, a SPAC specialist at the insurance brokerage and consulting firm Woodruff Sawyer, said in an Oct. 27 report.

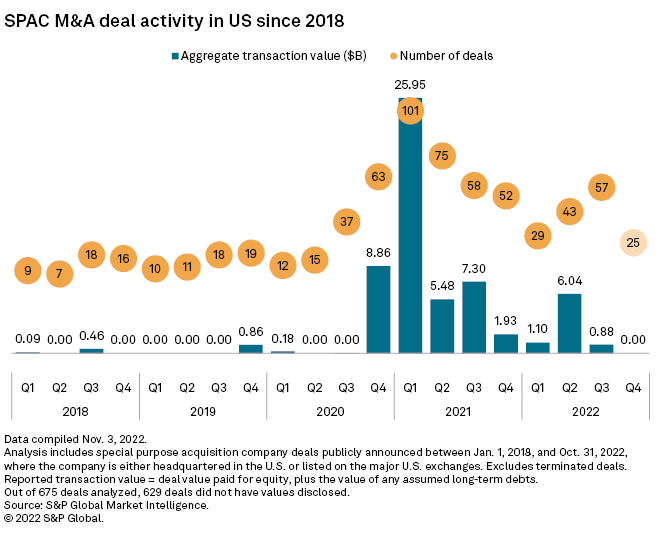

M&A

There were 129 SPAC M&A deals in the first three quarters of 2022, compared with 234 in the same period a year ago, according to Market Intelligence.

The aggregate value of those deals was $8.02 billion, compared with $38.73 billion in the same period a year ago.

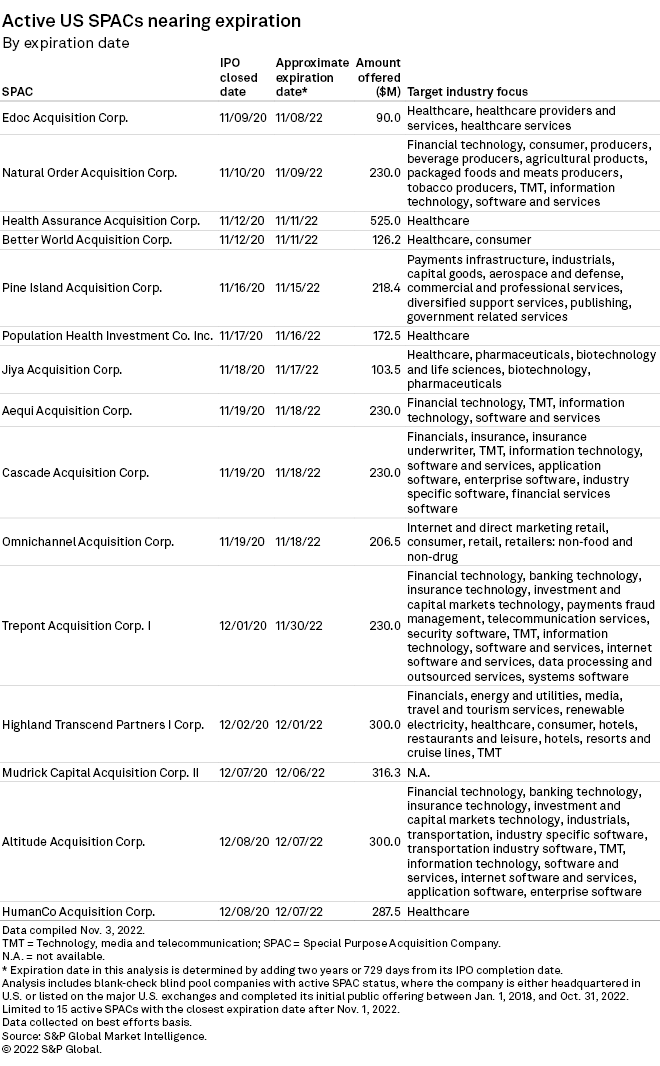

Expiring soon

SPACs typically have two years from the time of their IPO to buy a company. If a blank-check company has not found a deal in that time, the money raised goes back to its investors.

A recent count of 15 SPACs nearing their expirations included those targeting deals in the healthcare and financial technology industries with the value of those offerings ranging from $90 million to $525 million.