Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

7 Jul, 2021

By Yannic Rack

| A charging station in Stoke-on-Trent, England. A number of companies are tapping public markets to grow in the space. |

A flurry of upcoming blank-check mergers involving companies targeting the rapidly growing market for electric vehicle charging is set to accelerate a wave of acquisitions sweeping through the sector, according to executives and analysts.

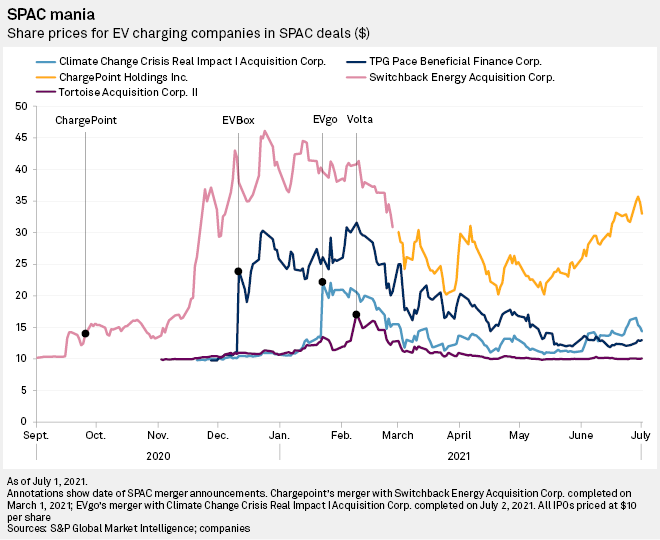

Following the listings of ChargePoint Holdings Inc. in February and EVgo Services LLC on July 2, at least three more EV charging companies are planning to go public by merging with a special purpose acquisition company over the coming months. Despite still making heavy losses, they hope to tap into the same investor enthusiasm for the switch to EVs that has buoyed carmakers such as Tesla Inc.

The four latest companies to go public via SPACs, which include Volta Industries Inc., EVBox BV and Wallbox Chargers SL, expect to raise roughly $2 billion between them. With their newfound financial firepower, they could start to snap up smaller peers in the increasingly competitive charging space.

Cathy Zoi, CEO of EVgo, the newly listed U.S.-based charging network operator, said her company could move into Canada or even Europe if it spotted the right takeover target. Although it has no such plans at the moment, other SPAC targets are already expanding more aggressively: ChargePoint wants to use its merger proceeds to finance an ongoing push into Europe, while European players such as EVBox are muscling in on the U.S. market.

"We're not taking a nap as more competition enters the marketplace," Zoi said in an interview ahead of EVgo's listing. "We've got a terrific growth plan that this will fund."

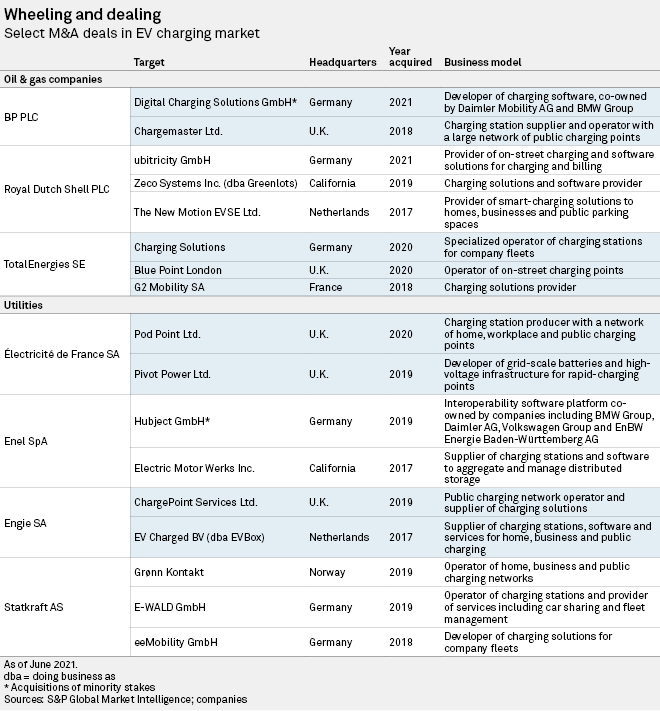

The market for EV charging has already undergone heavy consolidation, with major utilities and oil companies buying dozens of infrastructure installers and software providers in recent years. Other startups in the sector are now under growing pressure to carve out a dominant market position or risk becoming targets themselves, according to Sherief Rahim, a director at M&A firm Improved Corporate Finance.

"Because of these SPACs, the growth companies of the past are also becoming consolidators," Rahim said in an interview. "Their large war chests enable them to look at M&A and position themselves along the value chain."

A crowded space

Activity in the charging space is ramping up as government incentives and an explosion in electric models from carmakers drive up sales of EVs. The number of public and semipublic charging stations in Europe is expected to grow tenfold to 2 million between 2020 and 2030, according to researchers at IHS Markit. Arthur D. Little, a consultancy, forecasts revenues from charging passenger cars will reach close to €50 billion across the continent by then.

"After many years, the patience of early EV charging investors will soon pay off," the consultancy said in a recent report.

That prospect has led to a steady flow of deals from the likes of BP PLC, Royal Dutch Shell PLC and Electricité de France SA.

István Kapitány, global executive vice president for Shell's retail business, said the oil major has specifically targeted areas where Shell had no in-house expertise, such as mobility services and on-street charging. Its ventures arm is still scouting for other suitable additions and has recently funded a Chinese charging point manufacturer and a California-based startup with a charging station that swaps out vehicles' empty batteries.

"It's a relatively crowded space," Kapitány said. "We don't believe that we know all the elements and all the answers."

Most of the largest players in the sector have set their sights on serving company fleets or installing high-speed chargers along highways, as well as so-called destination charging at shopping malls, restaurants and other public sites — a strategy that has sparked a land rush for the best locations, according to analysts.

While oil companies and utilities have pursued a more integrated approach, most independent companies have specialized in a smaller slice of the value chain, which ranges from making equipment to installing hardware, operating stations and selling the power, software and services connected to them.

"There's a lot of competitors doing a lot of different things," Richard Bartlett, senior vice president of future mobility and solutions at BP, said in an interview. "But I don't think everyone can play all over the value chain. That's why you're seeing more niche business models."

Among the SPAC targets, EVgo and Volta build and operate charging networks, whereas EVBox and ChargePoint provide stations and software to third-party operators. Wallbox, part-owned by Spanish energy giant Iberdrola SA, primarily makes chargers for homes and businesses.

Despite their more specialized business models, some independent players have already started to expand their scope. Compleo Charging Solutions AG, a German hardware producer that went through a conventional IPO in 2020, recently acquired a competitor that also does software and billing.

"We have enlarged our business model a little bit," Peter Gabriel, Compleo's CFO, said in an interview. Gabriel expects half of the charging companies in Europe — where the market is both more mature and more fragmented than in the U.S. — will disappear in consolidation over the next few years. "The small ones will not be able to keep the pace," he said.

Competitive edge

As more companies gain access to bigger pools of capital, oil companies and utilities have highlighted their homegrown advantages in the industry. Fuel retailers such as Shell and BP argue their vast customer base and roadside real estate put them in pole position, while power companies point to their expertise in managing the grid.

Alberto Piglia, head of e-mobility at Enel X Srl, the technology division of Italian utility Enel SpA, said competition in the charging sector will mostly focus on providing services, both to customers and to the power grid. Enel X already bundles car and building batteries in California to provide demand response, but it is also active in public charging and home and fleet solutions.

"The ability to offer an integrated service is actually a competitive advantage," Piglia said in an interview. "It's something utilities have in their DNA."

U.S. power companies, often prohibited from owning and operating charging stations, have moved more cautiously into the market and have largely stayed away from similar business models, although some have run pilot programs to build and operate public chargers.

Competition is also increasing from other corners. Charging network operators Fastned BV and Blink Charging Co. have also listed through IPOs, while InstaVolt Ltd. and Allego BV are backed by financial investors. Both Tesla and Electrify America LLC, the U.S. company created by Volkswagen AG after its diesel emissions scandal, run their own charging networks.

While Tesla's network is proprietary, most charging operators rely heavily on roaming agreements with each other and carmakers to ensure their customers can charge at competitors' plugs — a key selling point while the network remains spotty. But analysts say the companies will increasingly have to balance that approach with their own growth ambitions.

Once the market reaches scale, those partnership bonds will "begin to fray," said Christian Renaud, a research director at 451 Research.

Making money

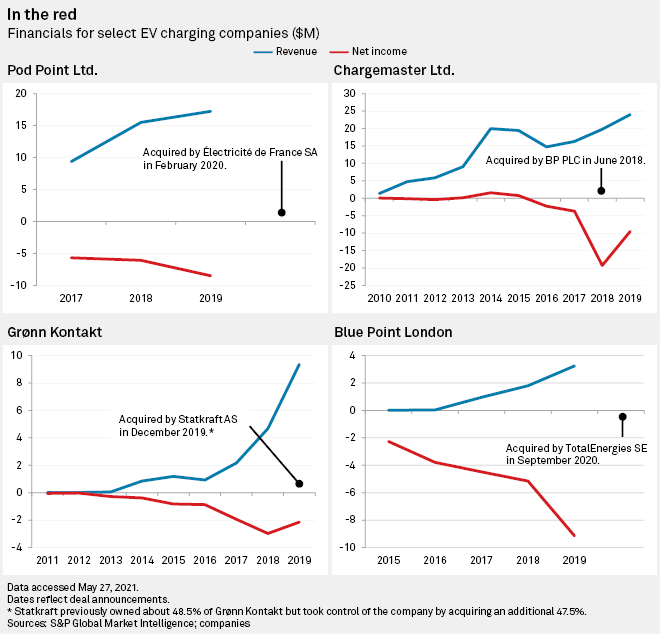

The other question hanging over the industry is when independent operators will actually start making money.

ChargePoint more than doubled its revenues between 2018 and 2020 to $145 million but saw its net loss grow from about $75 million to $134 million over the same period. Fastned's revenues grew from just over $80,000 in 2015 to $8.4 million last year, and its net loss totaled just over $15 million.

Several of the startups snapped up by EDF, Statkraft AS, BP and TotalEnergies SE were also losing money at the time they were acquired, according to S&P Global Market Intelligence data.

"It's really tough," said Dan Bowermaster, senior program manager for electric transportation at the Electric Power Research Institute in the U.S. "On the cost side it's thousands of dollars and on the revenue side it's cents."

While independent entrants have increasingly tapped public markets to stay competitive, some utilities can recoup grid-related investments from their ratepayers, and oil companies turn a hefty profit on snacks sold at their retail stations. Kapitány said some of Shell's high-speed charging stations in the Netherlands and the U.K are already net-income positive as a result.

"We don't do this for strategic purposes alone," Kapitány said. "My job is to make money with this."

EVBox and EVgo both expect to break even on an adjusted EBITDA basis in 2023 on respective revenues of €372 million and $166 million. ChargePoint, which boasts a market capitalization of about $11 billion, says it will get there one year later. Companies going public through SPACs have more freedom to show projections than in traditional IPOs.

But plenty of analysts and investors are still skeptical they can turn profitable before running out of money. Blink, which went through an IPO in 2018, was the third-most-shorted stock on all major U.S. exchanges at the end of April, with skeptics on Wall Street also making large bets against EV manufacturers such as Workhorse Group Inc. and Lordstown Motors Corp.

Meanwhile, the SPAC deal involving EVBox is hanging in the balance because the company has been unable to produce audited financial results for 2020, according to a regulatory filing by the SPAC that is set to take the company public. The merger date has been pushed back to August, but the SPAC said in its filing that there is "significant uncertainty" whether it will go through at all. EVBox, which is owned by Engie SA, declined a request for an interview.

Many in the industry suggest the only way out for ambitious startups is to keep growing as fast as possible. M&A adviser Rahim said he expects companies will be keen to keep expanding their reach and explore new areas such as vehicle-to-grid technology and connected cars in the coming months.

"You need to be there now with the right solution offering," Rahim said. "The next 12 months are going to define who will be the leaders out to 2030."

IHS Markit is subject to a merger with S&P Global pending regulatory and other customary approvals.