S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

13 Oct, 2021

By Pranav Nair, Cathal McElroy, Richard Ferraris, and Rehan Ahmad

Southern European banks with overhangs of toxic loans from previous crises could face higher loan losses due to physical risks associated with climate change.

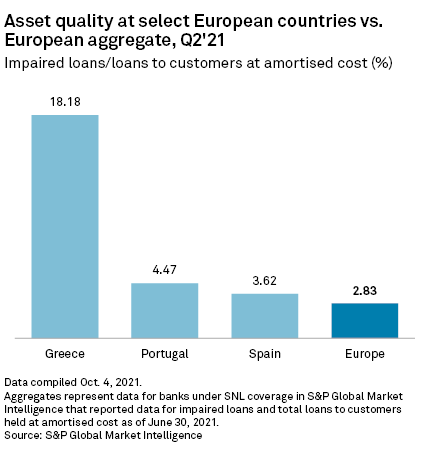

The European Central Bank's climate stress tests showed that more than 60% of bank loans in Greece, Portugal and Spain are exposed to high physical risk, which is defined as more than 1% probability of a firm suffering from the effects of a wildfire or a river or coastal flood in a year. Greece topped the list with more than 90% of bank loans exposed to high physical risk compared to the European average of above 20%.

"The credit risk channel is what concerns us the most when it comes to the retail banks. And what that means is because of the transition to a new green economy and because of the higher physical risk to the underlying borrowers, the probability of default of the borrowers increases," Stefan Nedialkov, director at Citigroup Global Markets, told S&P Global Market Intelligence. "[E]verything else being constant, banks may have to increase their provisions," Nedialkov said.

Companies operating in climate risk-sensitive areas could face interruption in the production processes due to natural calamities, the ECB said. The increase of such financial losses may drive down the prices of collateral and asset values, affecting financial institutions that have lent to these firms.

The ECB stress tests, released in September 2021, assessed around 1,600 euro-area banks on a 30-year horizon and said that in the most severe "hot house" scenario, the probability of default of high-physical risk firms could increase 25% by 2050.

"[Y]ou have to assume that banks will take steps. So it's not realistic to assume that nothing will happen during the next 30 years in banks' management action on loans and loan policies," said Sam Theodore, senior banking consultant at Scope Insights.

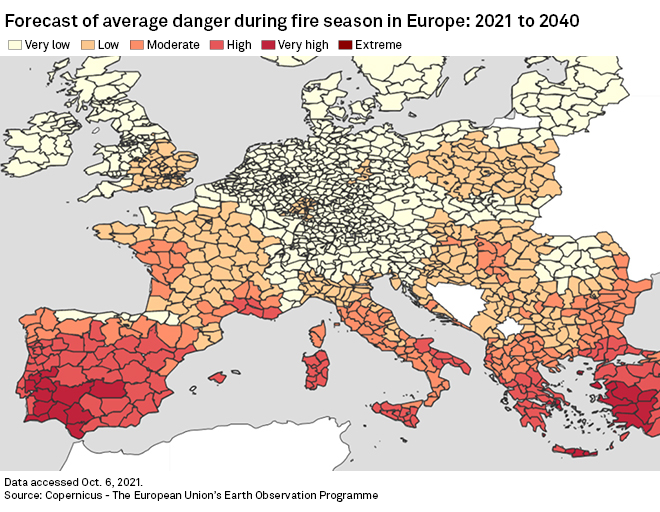

European Union forecasts for the next two decades suggest regions in Portugal, Spain and Greece face a "very high" danger of wildfires in fire season.

"Regions located in southern Europe are expected to suffer relatively more from wildfires: this is mainly based on the projected increased frequency and intensity of wildfires affecting countries located closer to the equator," the ECB said.

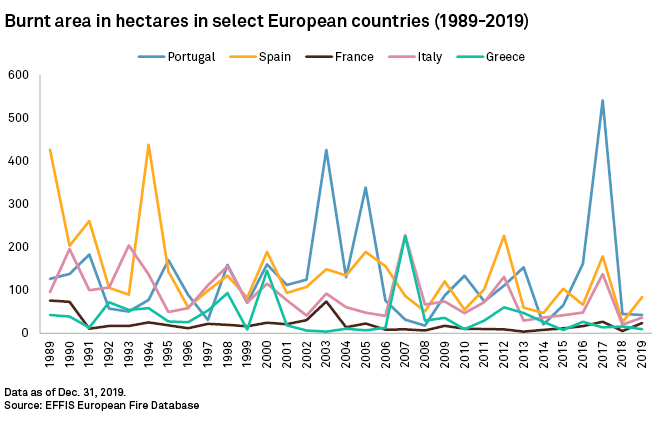

Historical datasets also show that fires in Spain, Portugal and Greece have affected larger areas than those in France, for example. Country-specific risk is particularly acute in Europe, where more than 80% of bank exposures are to domestic clients, according to the ECB.