S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

14 Sep, 2022

By Deza Mones and Cheska Lozano

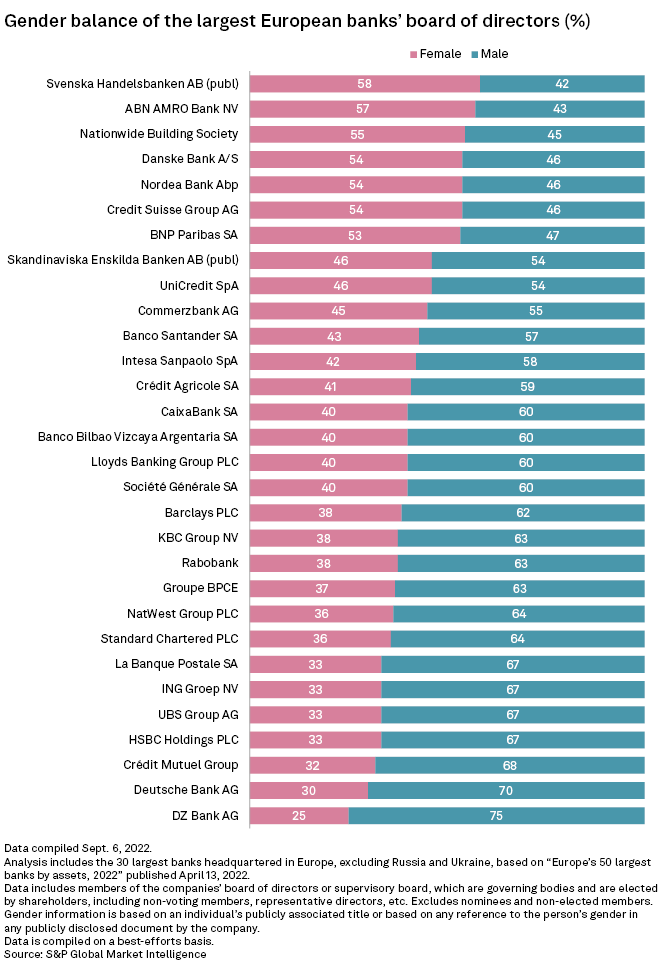

Women make up more than half of the board at just seven of 30 large European banks, according to data compiled by S&P Global Market Intelligence. Several banks could struggle to meet tougher future regulatory requirements.

|

The board of Sweden's Svenska Handelsbanken AB (publ) includes the highest proportion of female directors at 58%. This reflects the country's position as the top-ranked country in the EU on the Gender Equality Index, according to the European Institute for Gender Equality. Sweden has held this position since 2010.

Dutch bank ABN Amro Bank NV, U.K.-based Nationwide Building Society, Denmark's Danske Bank A/S, Finland-based Nordea Bank Abp, Switzerland-based Credit Suisse Group AG and France's BNP Paribas SA also have more than 50% female representation on their boards.

On the other hand, Germany's Deutsche Bank AG falls short of the 2026 target of 33% female representation outlined by the EU, while Britain's HSBC Holdings PLC, Standard Chartered PLC, NatWest Group PLC and Barclays PLC have less than the 40% regulators are calling for by next year.

The Market Intelligence figures, as of Sept. 6, cover members of the banks' respective boards of directors or supervisory boards, including nonvoting members and representative directors. The figures exclude nominees and nonelected members.

'What gets measured gets done'

The U.K.'s Financial Conduct Authority in March set diversity targets for listed companies. This included a goal of having at least 40% female representation on their boards and for at least one senior board position to be held by a woman. The rules will apply from accounting periods beginning April 1, 2022, meaning new disclosures will start to appear from the second quarter of next year. Banks falling short will have to explain themselves.

The proportion of women on HSBC's board is 33%. At StanChart it is 36%, at NatWest 36% and at Barclays 38%. Lloyds Banking Group PLC meets the 40% target.

A spokesperson for StanChart said the bank acknowledges the importance of gender diversity and the importance of balancing gender diversity within the broader context of diversity, "which is particularly relevant given the group's diverse geographical representation." The U.K.-based, Asia-focused bank has a target minimum of 30% of directors from an ethnic minority background.

Barclays, NatWest and HSBC did not respond to requests for comment.

Quotas aimed at improving gender balance can lead to positive results, according to Swedish nonprofit organization AllBright, which focuses on diversity in the business sector.

Swedish corporate governance rules oblige companies to strive for gender parity on boards, although there are no penalties for failure.

"The companies that do succeed often set targets for representation and educate employees and managers in how to create an inclusive company culture," AllBright CEO Amanda Lundeteg said. "What gets measured gets done."

The risk is that quotas treat symptoms rather than actual problems, including those of culture, recruitment and promotions, Lundeteg said.

EU takes action

The EU in June agreed on provisional legislation that sets a quota for women on corporate boards.

The directive, first proposed in 2012, requires all publicly listed EU-based companies to ensure the "underrepresented sex," typically women, occupies at least 33% of all director posts by mid-2026. Those that do not comply risk having their board decisions revoked or face being fined.

On average, women occupy only 30.6% of board seats in the EU's largest publicly listed companies, with significant differences among member states — from 45.3% in France to 8.5% in Cyprus — and just 8.5% of board chairs, according to the EU.

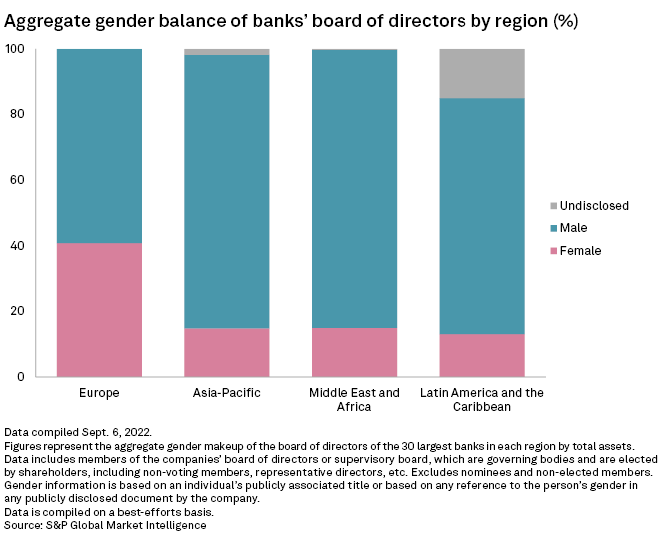

The boards of Europe's biggest banks are, on average, far more gender diverse than those in Asia-Pacific, the Middle East and Africa, and Latin America and the Caribbean.

Various recent analyses show companies with a high level of gender equality perform best on the stock market, and this "is believed to be due to the fact that employees are more satisfied with equal companies [and] that companies have an easier time recruiting talent and have a better innovation climate," Lundeteg said.

National targets

Along with BNP Paribas, listed French banks Crédit Agricole SA and Société Générale SA and German peers Commerzbank AG and Deutsche Bank AG currently meet their respective national quotas. Deutsche Bank, however, is currently below the EU's 33% target.

Deutsche Bank is "committed to the advancement of underrepresented groups" and has "voluntary goals to increase the number of women in leadership positions," a bank spokesperson said.

In six other EU member states — Italy, Belgium, Portugal, Austria, Greece and the Netherlands — national gender quotas of between 25% and 40% apply to the boards of listed companies, according to the EU's latest gender equality report, which cites data from the European Institute for Gender Equality.

Ten others — Denmark, Estonia, Ireland, Spain, Luxembourg, Poland, Romania, Slovenia, Finland and Sweden — have opted to take a softer approach, resorting to a broad range of measures and initiatives "with various degrees of stringency and specificity," the EU noted.

The remaining nine — Bulgaria, Czechia, Croatia, Cyprus, Latvia, Lithuania, Hungary, Malta and Slovakia — have not taken any substantial action, the EU said.

German cooperative banking group DZ Bank AG has just 25% female board representation. However, because it is not listed, it is not subject to the EU target. A spokesperson for the bank said corporate diversity is being dealt with on an ongoing basis.

French cooperative banking group Crédit Mutuel Group at 32%, Switzerland-based UBS Group AG at 33% and Dutch lender ING Groep NV at 33% were among the banks with fewer women on their boards.

A UBS spokesperson said it sponsors numerous activities annually to promote inclusivity and a culture of belonging, in addition to strategic initiatives to increase its pipeline of female leaders. ING Groep, whose female board representation is currently in line with the 33% requirement in the Netherlands that took effect at the start of 2022, is constantly improving its gender diversity and will include and implement new regulatory requirements going forward, a spokesperson said.

Crédit Mutuel Group is not subject to the EU's 33% target. The bank did not respond to a request for comment.