S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

14 Jun, 2022

By Allison Good

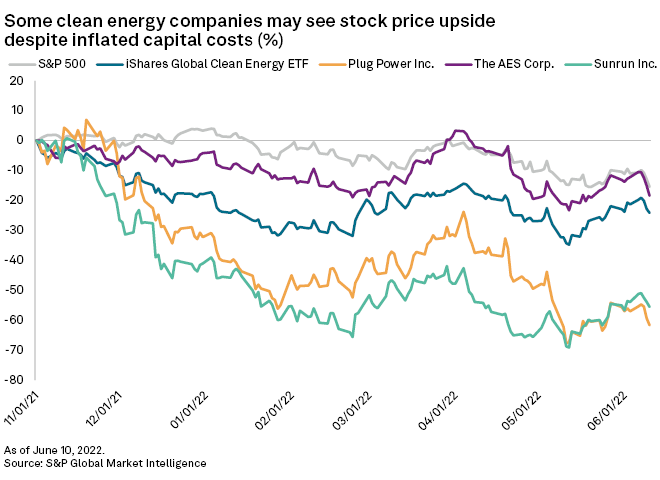

Since November 2021 when inflation concerns intensified, the iShares Global Clean Energy ETF has plunged more than 24% compared to the S&P 500's 15.5% loss as the threat of an economic recession has exacerbated existing commodities bottlenecks and trade policy uncertainty. Many clean tech companies have not yet achieved positive cash flow, so they remain "quite sensitive to changes in the discount rate," which measures value based on anticipated revenues, according to a June 13 Morgan Stanley report.

But renewable energy remains a hedge against inflation compared to fossil fuels like natural gas and coal due to clean tech's high barriers to entry and the potential for Congress to pass a federal tax incentive package.

"In many cases, we think the market has overly discounted the stocks for these near-term factors, while several catalysts are poised to get the industry back onto its strong long-term profitable growth path," the investment bank told clients.

"We are increasingly of the view that clean energy can, in the long term, be disruptive to traditional energy suppliers, especially utilities with high (and rising) customer bills, above-average exposure to physical risks from climate change, and challenges in ensuring adequate power supply to its customers," Morgan Stanley analysts said in the note.

Even so, the analysts lowered their near-term price targets for most of a select group of companies they follow, primarily due to the rising cost of capital environment.

AES Corp., Plug Power Inc. and Sunrun Inc. have the most share price upside with "limited growth priced in." Bloom Energy Corp., Stem Inc., Fluence Energy Inc. and NextEra Energy Inc. are also positioned to benefit from federal tax cuts.

Congress' approaching August recess is raising pressure on Democrats to act quickly. But U.S. Sen. Joe Manchin, D-W.Va., a key swing vote in the evenly divided Senate, has sounded less optimistic in recent public comments, suggesting that a deal might still be far away.

Bloom Energy and Plug Power in particular would benefit from a $3 production tax credit per kilogram for hydrogen production with near-zero emissions, according to Morgan Stanley, because the cost of producing and delivering green hydrogen could fall to less than $1.50/kg, making the fuel competitive with more carbon-intense types of hydrogen.

Green hydrogen could also get a boost from the Biden administration's invocation of the Defense Production Act to accelerate the manufacturing of electrolyzers, fuel cells and the platinum metals they are built with, among other renewable technologies.

Although the Defense Production Act is intended to grow domestic solar panel manufacturing, Morgan Stanley remains cautious after the act was invoked alongside an order directed at the U.S. Commerce Department to freeze antidumping duties for two years on solar cells and panels imported from Malaysia, Vietnam, Thailand and Cambodia.

"We see limited competitive differentiation among solar panel manufacturers and racking providers" like First Solar Inc., Array Technologies Inc. and Maxeon Solar Technologies Ltd., the analysts wrote.

Those federal actions could also benefit Array Technologies as utility holding companies shift capital for their affected solar projects, setting up "a surprisingly strong 2023 deployment year."

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.