Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

28 Aug, 2023

By Yizhu Wang and Zain Tariq

Some financial technology companies are rethinking their need for a bank charter as a result of the lengthy application process and an expected higher bar for eligibility.

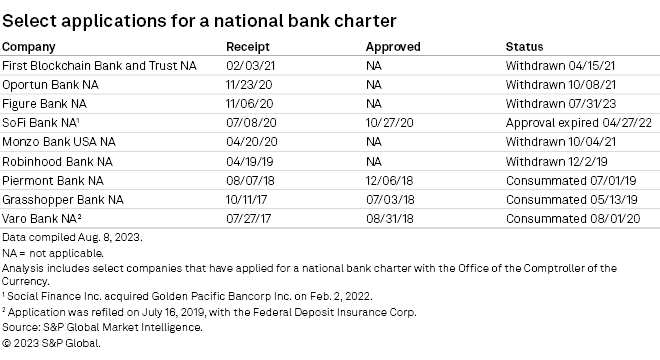

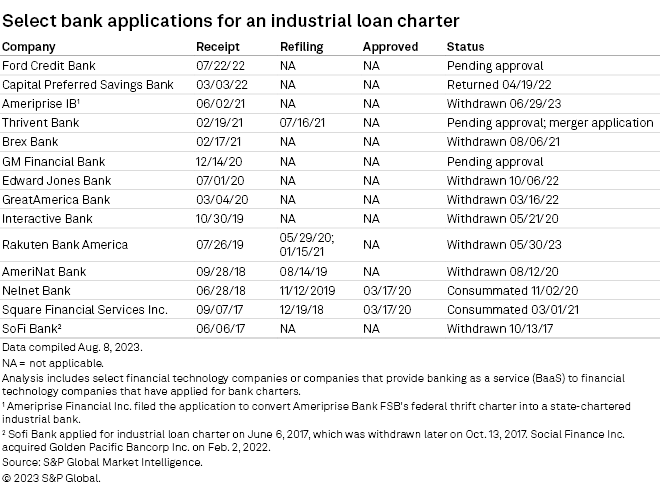

For nearly three years, no fintech companies completed the bank charter application process, according to data compiled by S&P Global Market Intelligence. The last industrial loan company (ILC) charters, supervised by states and the Federal Deposit Insurance Corp., were granted in March 2020 to Square Financial Services Inc., a division of payment giant Block Inc., and loan servicing company Nelnet Inc.

SoFi Technologies Inc. is the last fintech company to complete a bank charter application process. The fintech lender obtained a national bank charter from the Office of the Comptroller of the Currency (OCC) in October 2020 before acquiring Golden Pacific Bancorp in February 2022.

The dearth of bank charter approvals in recent years comes as the convergence of banks and fintechs continues to deepen. Many fintechs considering bank charters are finding that the growing banking-as-a-service market can solve most of their needs for banking operations, industry executives and advisers said. In banking-as-a-service, banks provide deposit accounts or underwrite loans to fintechs' end customers, while fintechs manage the relationships with consumers or businesses.

Choosing the de novo path requires a compelling business case leveraging the charter because applicants typically have to take a conservative approach to assure regulators, said Mike Butler, president and CEO of Grasshopper Bank NA, a digital bank serving small businesses directly and through fintechs. For instance, regulators typically require de novo banks to hold more capital than other banks.

Fintechs still interested in applying for a charter will have to make their cases strong in such areas as capital levels and management's expertise in banking, said Jeffrey Taft, a partner at Mayer Brown. The bar for approval is already high and will only rise more after the March turmoil, said Max Bonici, a counsel focused on financial regulations at Venable LLP.

"There is no way any of the federal bank regulators coming out of the 2023 banking crisis are going to want to pose any new risk in any way to the industry," Bonici said.

ILC, OCC fintech charters ruled out

Another hurdle for fintechs considering a charter application is that the odds for a fintech company to get an ILC charter or an OCC fintech charter are very low in today's market. An OCC national bank charter is the only feasible option, industry experts said.

ILC charters enable nonfinancial services companies, such as car manufacturers or retailers, to operate banking services on the side. ILC charter holders are not subject to the Bank Holding Company Act but can still have the deposits insured by the FDIC. The ILC charter has faced fierce opposition for giving nonbanks like Walmart Inc. a chance to move into banking without being regulated to the same extent as banks.

Fintechs, including Square and Nelnet, secured ILC charters when Jelena McWilliams was the FDIC chairman, but the leadership transition to Martin Gruenberg in January signals a different regulatory mindset around this matter, said Brian Jarmakowicz, director of nonbank financial institutions at Fitch Ratings. Gruenberg voted against Square's ILC charter application because he believed the parent company, Block, has "an unproven business model that would be highly vulnerable to an economic downturn."

Venable's Bonici said fintech companies applying for ILC charters will have to make it abundantly clear that their parent company is able to act as a source of strength. The FDIC is likely to put those ILC applications on the back burner in light of more urgent matters like capital rule changes, he said.

"I think, right now, protecting the Deposit Insurance Fund and keeping actual banks safe and sound is the order of the day," Bonici said.

Alternative charter options

Regulators have underscored the risks of fintechs' attempts to enter banking but did not completely shut the door. In 2021 and 2022, eight fintech companies secured charters through bank acquisitions. Most recently, fintech provider Newtek Business Services Inc. completed its acquisition of National Bank of New York City in January.

The OCC started accepting applications for a special purpose national bank charter, known as the fintech charter, in 2018. The charter would have let digital lenders and payment companies bypass state money transmitter and lender licensing laws, but the OCC was soon sued by the superintendent of the New York State Financial Services Department, which alleged that the OCC had exceeded its legal authority. The fintech charter is effectively in limbo now because lawsuits are expected against any applicants.

With yet another type of charter, the OCC and the Federal Reserve in 2021 permitted European payment company Adyen NV to build a federal foreign branch in San Francisco, based on Adyen's European banking license obtained in 2017.

The arrangement gives Adyen access to many privileges that are otherwise only available to banks, such as access to a Fed master account, for which US fintechs have fought hard, Bonici said. Because of this branch licensing, Adyen has leapfrogged its fintech competitors to use the Fed's latest real-time payment network, FedNow.

"I'm a little surprised that more people aren't talking about that in the US," Bonici said. "There's not an equal playing field."

Weighing between charter and partnership

Brex Inc. is one fintech that walked away from a bank charter application to concentrate on its core payment business leveraging bank partnerships. The company, which offers corporate credit cards and spend management software for businesses, submitted an application for an ILC charter in February 2021 but withdrew it after about six months.

Brex no longer wants to pursue a bank charter, said Camilla Morais, senior vice president of operations.

"We want to be this all-in-one payment solution to our customers," Morais said in an interview. "So when you think about a more traditional bank, they are normally very interested in the deposits and how they can use those deposits to make money with other financial transactions. On our side, we see the innovation coming from the payments, from the transactional side."

Brex provides corporate credit cards to small businesses that are issued by Emigrant Bank and Fifth Third Bank NA. It also offers demand deposit accounts for small businesses through a deposit sweep program via its subsidiary Brex Treasury LLC. Registered with the SEC, Brex Treasury holds a broker/dealer license and helps its customers allocate money-to-money market funds or FDIC-insured funds comprising 27 partner banks, including JPMorgan Chase Bank NA.

Brex was one of the bidders for the former Silicon Valley Bank when the FDIC marketed the bridge bank of the failed institution, though it was bidding only for certain portfolios and not aiming at the failed bank's charter, Morais said.