Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

26 Jul, 2021

|

Container ships near the Port of Long Beach in California. The U.S. government is stepping up efforts to stem the flow of imports, including solar panels, that are allegedly linked to forced labor in China's autonomous Xinjiang region. |

The dominance of China’s

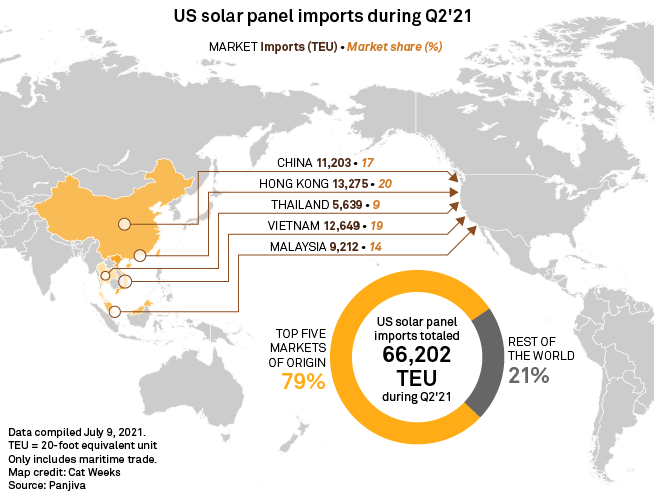

LONGi, the U.S.'s top solar-panel supplier, is exposed to possible human rights violations through its supply chain. LONGi and its subsidiaries sent at least 21% of the shipping containers that carried solar panels to U.S. ports during the second quarter of 2021, according to research firm Panjiva. Including panels from another leading manufacturer that buys material from LONGi, the company could account for as much as 30% of recent shipments.

LONGi buys polysilicon, a key ingredient in most solar panels, from at least three producers that source their raw material from Hoshine Silicon Industry Co. Ltd., according to a recent report from the Helena Kennedy Centre for International Justice at Sheffield Hallam University in the U.K.

Hoshine was hit with a U.S. import restriction in June after U.S. Customs and Border Protection, or CBP, said it found evidence that the company used forced labor at factories in China's autonomous Xinjiang region, where Beijing is accused of suppressing Uyghurs and other Muslim minorities. LONGi has denied the allegations and the Chinese government previously has denied that it is committing human rights abuses in Xinjiang.

Analysts say Hoshine sells metallurgical-grade silicon, or silicon metal, to the world's biggest polysilicon producers, and an aggressive crackdown by the U.S. government could cause major disruptions in the country's solar market.

"It's very hard to pinpoint … one manufacturer that could not be at risk" of exposure to Hoshine, Frédéric Dross, vice president of strategic development at auditor Senergy Technical Services, said on a June conference call hosted by ROTH Capital Partners LLC. "There is a probability that every single [solar] module that enters the U.S. is potentially affected."

Investigations into U.S. solar supply chains appear to be just getting started, and other Chinese suppliers are on Washington's radar. In conjunction with CBP's June order to detain imports containing material from Hoshine, the U.S. Commerce Department added the subsidiaries of two of the world's top polysilicon producers, GCL-Poly Energy Holdings Ltd. and Daqo New Energy Corp., which supply LONGi and other leading panel manufacturers, to an export blacklist for "participating in the practice of, accepting, or utilizing forced labor in Xinjiang and contributing to human rights abuses" in the region.

Hoshine, LONGi and GCL-Poly did not respond to requests for comment. Daqo declined to comment.

On an earnings call in April, LONGi Chairman Zhong Baoshen said U.S. allegations of forced labor in Xinjiang are "a political issue, not a reality" nor "a matter based on facts."

That echoes Beijing's position. China Foreign Ministry spokesperson Zhao Lijian said at a July 16 press conference that the U.S. has "fabricated lies about Xinjiang." The Chinese Embassy in Washington did not respond to an email seeking comment.

A CBP spokesperson said the agency has detained shipments under the import restriction issued against Hoshine. The spokesperson said the agency is barred by law from disclosing information about importers, and declined to say where the detentions occurred.

"[We] have prevented certain products from Xinjiang from coming into the United States, and I know there is a consistent and constant review of those kind of policies and how they should be expanded or changed," Robert Faucher, the acting assistant secretary for the State Department's Bureau of Conflict and Stabilization Operations, said at a press briefing July 12.

Congress also is pursuing trade restrictions on Xinjiang. On July 14, the Senate passed a bill that would ban all goods from the region, which produces about half of the world's polysilicon, unless importers can prove they were not made with forced labor. The legislation identifies polysilicon as a high-priority sector for enforcement.

"We reiterate high and rising trade risk to solar product imports," analysts at ClearView Energy Partners LLC said July 15, noting that a version of the Senate bill is working its way through the House of Representatives with strong bipartisan support. "However reluctant some Biden administration officials might be to put domestic solar deployment at risk with new import constraints, we think President Joe Biden would probably sign the legislation even if it did not have likely veto-proof majorities in both chambers."

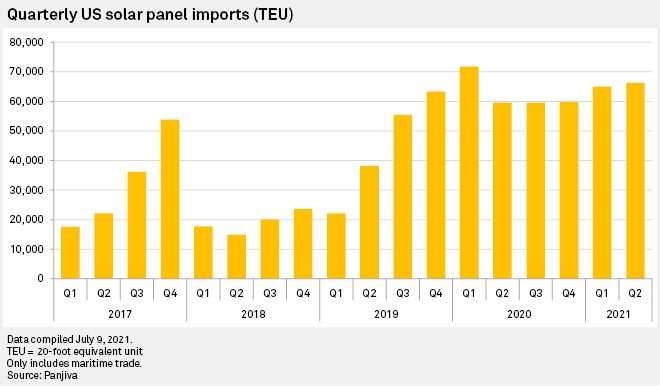

U.S. companies are depending on the cooperation of Chinese suppliers to implement tracing and auditing programs to verify that their supply chains are not exposed to potential labor abuses. U.S. solar panel imports rose by 2% in the second quarter

|

Source: Pool/Getty Images News via Getty Images |

'This is not a problem'

According to the U.S. government, China is committing genocide and crimes against humanity in Xinjiang, including "arbitrarily" detaining more than 1 million Uyghurs and other minorities since 2017 and subjecting them to forced labor and sterilization.

The Solar Energy Industries Association, or SEIA, a U.S. trade group, has been pushing companies to cut themselves off from the region since late 2020, when S&P Global Market Intelligence reported on the solar industry's deep ties to polysilicon producers there.

John Smirnow, SEIA's general counsel and vice president of market strategy, recently said the industry had made "good progress" toward its goal of eliminating Xinjiang products from U.S. supply chains by midyear.

"[Non-Xinjiang] silicon materials can fully satisfy the U.S. market. This is not a problem," LONGi's Zhong told investors in April, adding that most of the products the company sells into the U.S. come from factories in Malaysia and Vietnam.

However, analysts say silicon supply chains are difficult to trace. "There [are] not that many big players in [polysilicon], and almost all of them buy or have bought in the past from Hoshine," Alex Barrows, director of research at the consulting firm Exawatt, said on ROTH's June call. "It's a little bit hard with some of them to tell whether they're buying from them still or not."

In addition to buying polysilicon from at least three producers that researchers say are identified in corporate documents as Hoshine's customers, LONGi signed a contract earlier this year to source some material from a Malaysian subsidiary of OCI Co. Ltd., a South Korean chemicals company.

In an online investor forum in February, Hoshine named OCI as one of its customers, researchers at the Helena Kennedy Centre said. Daqo CEO Zhang Longgen also identified OCI as a customer of Hoshine on an earnings call in May.

OCI told Market Intelligence that it bought some material from Hoshine in the past but is "currently purchasing from other suppliers by diversifying its purchasing sources to European and Latin American companies."

All roads lead to China

Panjiva data also raises questions about LONGi's claim that it relies primarily on factories in southeast Asia to serve the U.S. market.

On July 8, solar panels that had been loaded on a ship at the Port of Shanghai and sent to the U.S. by a subsidiary of LONGi arrived in Long Beach, Calif., the firm found. A month earlier, on June 7, another shipment from LONGi that was loaded at a port in Yangshan in eastern China arrived in Norfolk, Va. And on May 19, a LONGi shipment from Xiamen in southeast China arrived in Los Angeles.

Those were not anomalies. Three of LONGi's subsidiaries, which are among the top five suppliers of solar panels to the U.S., loaded between 61% and 81.5% of their shipments at ports in China and Hong Kong during the second quarter, according to shipping records collected by Panjiva.

"If you're worried about [labor conditions at] their Chinese bases, you would probably also be worried about the base in Malaysia, for example," Exawatt's Barrows said of Chinese manufacturers that have opened factories elsewhere in Asia.

While plenty of silicon material is made by companies other than Hoshine and its competitors in Xinjiang, Barrows said the solar industry will have to walk a fine line implementing tracing and auditing programs "in a way that pleases the U.S. government and doesn't displease the Chinese government too much."

In the U.S., the process of proving imports were not made by forced labor is "onerous and it's evolving, because information on the ground is evolving," said Ken Rivlin, a partner at Allen & Overy who founded the law firm's sanctions practice and co-heads its international trade and regulatory law group.

The U.S. government said in a recent advisory that businesses buying goods directly or indirectly from Chinese companies "are likely to face obstacles to conducting adequate due diligence to fully identify and avoid complicity" in human rights abuses connected to Xinjiang.

"The lack of transparency in China, and the deserved skepticism that some have towards documentation provided by Chinese companies adds an element of uncertainty that's difficult to remove or to solve," Rivlin said.

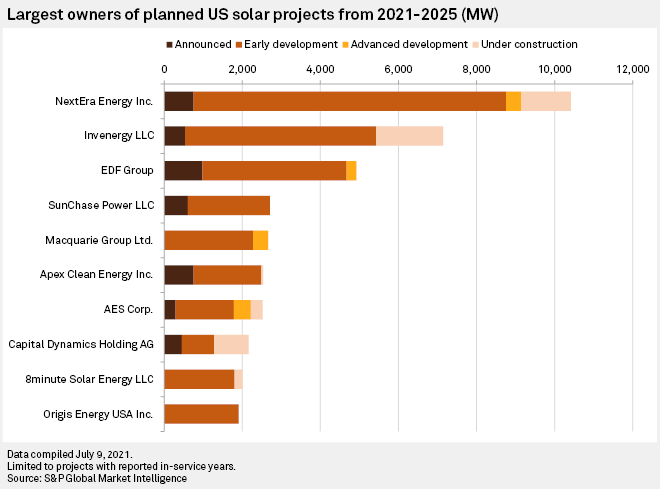

Market Intelligence reached out to the top 10 owners of planned solar projects in the U.S. to find out what steps they are taking to ensure their supply chains are not at risk of being implicated in alleged labor abuses. Most did not respond.

Kathy Lin, 8minute Solar Energy LLC's vice president of strategic procurement and technology, in a statement said the company uses quality assurance and control firms to track suppliers' compliance with forced-labor laws, including through on-site audits and "an independent assessment of the security of their supply chains in relation to the origin of polysilicon."

Two other companies, Origis Energy USA Inc. and Apex Clean Energy Inc., said they are working with their suppliers and U.S. trade groups to address the issue.

"The alleged labor abuses in China and the severity of this issue must not go unrecognized or unaddressed," Lin said. "All players in the global solar industry need to acknowledge our collective responsibility to ensure our supply chains do not violate fundamental human rights."

Beijing is pushing back: a law passed in June takes aim at companies that comply with foreign sanctions. Chinese countermeasures could include property seizures and transactions bans within the country, according to the law firm Mayer Brown. Hung Tran, a nonresident senior fellow at the Atlantic Council, said companies boycotting goods allegedly made by forced labor in Xinjiang are among those that could be targeted.

"It's a potential nightmare," Rivlin said of the competing pressures on the solar industry from Washington and Beijing. "I just don't think it's going to be easy for companies over this next period."

Panjiva is a business line of S&P Global Market Intelligence, a division of S&P Global Inc.