S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

18 Nov, 2021

Paytm's parent will seek to step up competition with PhonePe Pvt. Ltd. and Alphabet Inc.'s Google Pay, after raising $2.47 billion in India's biggest-ever IPO.

One97 Communications Ltd. plans to spend 43 billion rupees of the sale proceeds on attracting more merchants and another 20 billion rupees on new initiatives, partnerships and acquisitions, according to the IPO prospectus.

The Indian payments startup backed by Alibaba Group Holding Ltd., Berkshire Hathaway Inc. and SoftBank Corp. sold 83 billion rupees of new shares, with existing shareholders offering another 100 billion rupees of old stock. Shares opened at 1,950 rupees on the National Stock Exchange, a 9% discount on the 2,150 rupees per share offer price, before falling further amid concerns that the IPO was overpriced.

India's third-biggest payment provider has targeted small businesses to fuel growth — in contrast to PhonePe's and Google Pay's consumer focus — taking advantage of a sector offering lower churn and marketing costs. The drive, which included the introduction of smart payment devices in 2019, helped merchant transactions via the Paytm app surge more than 100% from a year earlier to about 1.5 trillion rupees in the March quarter.

"Merchant arrangements can be stickier if you provide value," said Sampath Sharma Nariyanuri, an analyst at S&P Global Market Intelligence. Paytm also "captures greater value in the payment transaction chain than its rivals as its payment offerings are wider," Nariyanuri said.

Paytm declined to comment for this story, citing the IPO.

POS advantage

The company had 21.8 million merchants on its platform as of June 30, 2021, up from 11.2 million on March 31, 2019, according to the IPO filing. The pandemic has helped drive use of payment platforms in India.

Investment in point-of-sales devices has been a key growth driver for Paytm, as the company moved into the space earlier than its rivals, according to Pranav Bhavsar, founder of equity research company ASA Capital.

Paytm will likely use some IPO funds to add more small and medium-sized merchants, particularly in India's 10 largest cities, according to Kristine Lau, associate at ThirdBridge, a research firm. It could also seek to work with larger companies to increase transaction volumes and boost network effects, Lau said. For instance, Paytm customers can already order food using the payments app via a tie-up with delivery company Zomato Ltd.

Paytm could also work to make its consumer app more user-friendly, said Jayanth Kolla, founder of tech consulting firm Convergence Catalyst. This is increasingly important in India because the introduction of the Unified Payments Interface, or UPI, nationwide interbank platform means that payment providers can no longer differentiate themselves.

"Now that the UPI system has levelled the playing field, Paytm can use its IPO proceeds to improve its user experience," Kolla said. Marketing is also key, as seen in a successful Google Pay promotion during the Diwali festival, he said.

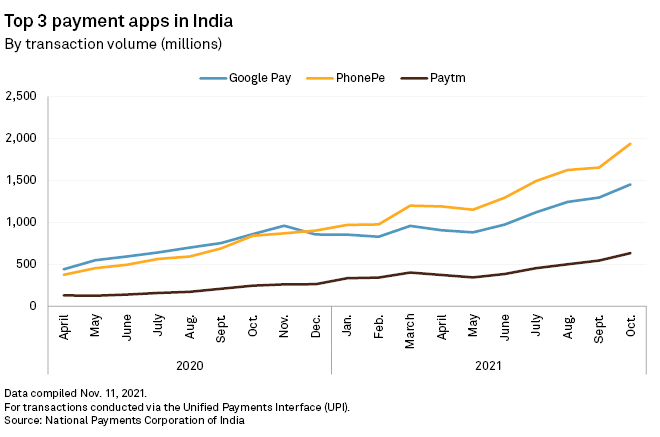

Paytm handles 14.7% of payments made via the UPI system, according to October data from government-owned National Payments Corporation of India. PhonePe leads with 45% ahead of Google Pay at 33.7%.

Moving beyond payments

Like other payment providers in India, Paytm is seeking to drive up user numbers by adding more services for consumers and merchants. The danger is that the push into areas such as stockbroking, wealth management and insurance will expose the company to new risks, as it will no longer just provide transaction services.

The key challenge for Paytm will be "its shift to a risk-bearing business model," Market Intelligence's Nariyanuri said.

Still, the greater emphasis on services may ease discounting pressure for payment providers, according to Tanuj Bhojwani, Oliver Wyman's principal of private capital for Asia-Pacific. Competition is already starting to shift toward those who offer "superior value propositions," such as business services, and away from those who have the biggest financial incentive, he said.

"Initial shoots of this trend can already be observed," he said. "The vision to become a 'one-stop app' for customers will ensure continuous value addition and innovation."

The push also reflects increasing competition in India's payments market. Local industry players, such as Reliance Industries Ltd., and global tech giants, including Facebook-owner Meta Platforms Inc., are vying for a share of the burgeoning market.

In 2020, mobile payments rose 67% to $478 billion in India, despite an economic contraction, according to a Market Intelligence report.

That growth shows why the market is so alluring, while the competition explains the constant need for operators to invest in developing their services, said Dheeraj Joshi, regional head of payments solutions consulting at Finastra, a fintech solutions provider.

"We can expect technological advancements to accelerate the growth of payments," Joshi said. "However, only those players that continuously innovate, provide better customer experience, diversify and seamlessly embed their capabilities in the ecosystem will be the eventual winners."

As of November 17, US$1 was equivalent to 74.34 Indian rupees.