S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

17 Mar, 2021

By Lauren Seay and Nathaniel Melican

More community banks could be scooped up by financial technology companies after a handful of recent deals highlight the benefits of bank acquisitions.

With its announced acquisition of Golden Pacific Bancorp Inc., Social Finance Inc., better known as SoFi, is following in the footsteps of two other fintech companies — Jiko Group Inc., which acquired Mid-Central National Bank in 2020, and LendingClub Corp., which acquired Radius Bank on Feb. 1. For fintechs evaluating the various options to secure bank charters, SoFi, Jiko and LendingClub have created a blueprint that outlines a faster, more advantageous path, industry consultants said.

"One of the benefits that you get from acquiring a bank, other than sort of immediately getting their charter, is that you don't have the drag of a start-up," Sam Kilmer, a senior director at Cornerstone Advisors, said in an interview. "I would expect more acquisitions by fintechs of banks just like what SoFi did here. ... A good way to look at it, actually, is as a blueprint."

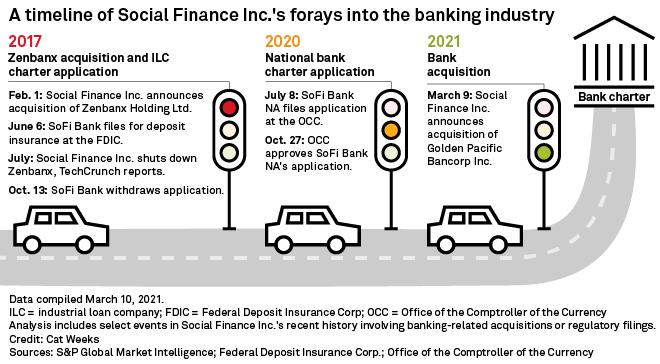

SoFi began its journey for a bank charter in June 2017 when it applied for an industrial loan company charter with the Federal Deposit Insurance Corp. The company withdrew the application in October 2017. About three years later, in July 2020, SoFi applied for a national bank charter with the Office of the Comptroller of the Currency and received conditional approval in October 2020. Now, the company will switch its application with the OCC to a change in control application in a bid to finally secure a bank charter.

With a bank charter in tow, fintechs can expedite their growth and profitability. SoFi estimated that its adjusted EBITDA in the base case — without a bank charter — would be $254 million in 2022 but that it would be $447 million with the bank charter, according to an investor presentation. The presentation cited lower cost of capital and increased lending growth among the benefits of the bank charter.

"[Paying] $22 million for $150 million in assets plus a current national bank charter, given the amount of capital that's on the horizon for SoFi, this seems to be just a very effective path forward," said Lane Martin, a partner at Capco, a management and technology consultancy focused on the financial services industry. "This is just an accelerated path at a time where taking a shortcut is very advantageous, especially with the IPO around the quarter."

For SoFi, Jiko and LendingClub, a bank acquisition was a fast track to a bank charter, and more fintechs could follow in their footsteps as they watch these deals come together, Martin said.

"These early deals that we're seeing are going to answer a lot of these questions around how to do it," he said. "The lessons that can be learned from seeing some of these things come to life are going to really accelerate the industry as a whole."

Jiko's acquisition took almost two years to close, while LendingClub was able to close its deal in less than a year. As more of these deals happen, the timeline between announcement and closing will continue to shorten, Martin said.

"These early deals are paving the way to decrease the cycle time," Martin said. "[And] the fact that [SoFi] already had an approved OCC application is going to expedite things."

While bypassing the time it would take to get a de novo bank charter is the main motivation for these deals, inheriting the bank's regulatory relationship comes in close second, experts said.

"When you look back to some of the other acquisitions that have happened in this realm ... they are looking for competing banks with good bill of health, good relationships with the regulator and no material issues that need to be addressed," Martin said.

The addition of regulatory and compliance expertise is a major benefit for fintechs as they navigate the highly regulated banking world, Kilmer said.

"Regulatory compliance is woven into the fabric of every single thing that a regulated bank does. Banks know how things are done, compliance wise, whereas the fintechs, even significant ones like SoFi, oftentimes have to learn that," Kilmer said. "It's basically just getting inside the club in an easier fashion than going about it the long, organic, legal, start-up way of proving yourself to a regulator."

As more fintechs look to bank acquisitions, they will likely opt for straightforward community bank acquisitions like Jiko's and SoFi's, Kilmer said. When Jiko announced its acquisition of Mid-Central in November 2018, the bank had $115.4 million in total assets. SoFi's target had $151.5 million in total assets at Dec. 31, 2020.

"There are so many community banks out there of that size that can be acquired," Kilmer said. "[And] they are relatively easy to acquire ... The process of acquiring $150 million bank, from the economics, is fairly straightforward."