Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

11 Jan, 2022

By Cathal McElroy and Rehan Ahmad

| A Ford car showroom promoting the sale of private lease in The Hague, The Netherlands. |

European banks' efforts to boost revenues amid margin-crushing, record-low interest rates is generating a flurry of activity in the lucrative auto-leasing sector, with Société Générale SA's €4.9 billion acquisition of LeasePlan Corp. NV the latest in a series of moves by lenders.

The French bank, already Europe's largest auto lessor through its 80% stake in ALD SA, expects a 5% boost in earnings per share starting in 2024 from the combination of LeasePlan and ALD, according to a statement. SocGen will hold 53% of the enlarged business, which will operate a fleet of 3.5 million vehicles worldwide.

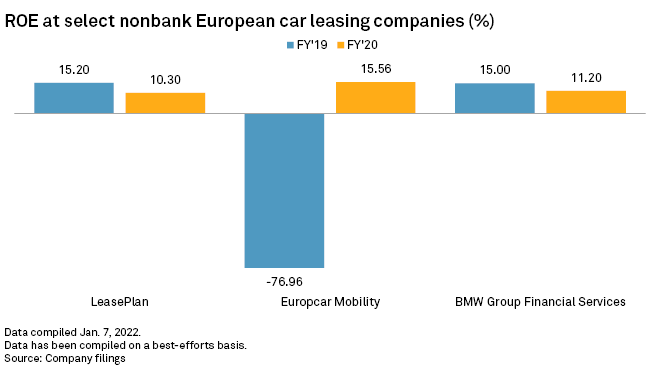

Fellow French bank Crédit Agricole SA announced in December 2021 that it was creating a vehicle-leasing business with Peugeot and Chrysler owner Stellantis NV as lenders capitalize on a market worth about €250 billion in Europe alone. The sector also offers the chance to burnish green credentials, through the rollout of electric vehicles, as well as superior profits to those in the squeezed banking industry — LeasePlan posted underlying return on equity of 15.5% in the first nine months of last year, more than double SocGen's figure.

A high-yield business

Vehicle leasing "typically punches well above its relative weight" in terms of lenders' net interest income, said Benjie Creelan-Sandford, a banking analyst at Jefferies. "It's natural that banks would focus in on that higher-yield part of the business."

Auto leasing offers high margins due to the risky profile of borrowers and the likelihood of vehicles losing value during the lifetime of the loan, Creelan-Sandford said.

Europe's auto-leasing market is growing, with researcher provider Technavio forecasting 3% expansion per year through 2025. The sector has already bounced back from COVID-19 disruptions, with new business volumes surging 15.6% year over year in the first six months of 2021 among a sample of 23 European lessors, according to Leaseurope, a regional trade group.

The growth of leasing is partly because consumers are turning away from direct ownership to usership, said Adrian Dally, director of motor finance and strategy at the Finance and Leasing Association, a U.K. trade association. Broader trends such as urbanization, digitalization and automation are making usership models more attractive to consumers, according to a report by digital consultancy Publicis Sapient.

Electric vehicles may provide a further spur as leasing protects consumers from the faster rate of depreciation experienced by electric vehicles due to the ongoing advancements in EV technology. The chance to finance these deals is also a lure for lenders as regulators look more closely at the carbon footprint of their loan books.

"Banks clearly can score points on the [environmental, social and governance] front if they can show they're involved in financing electric vehicles," said Sam Theodore, senior consultant at Scope Insights.

SocGen, BNP Paribas dominate the European market

The LeasePlan deal will further cement SocGen's position as Europe's biggest lessor. The French bank ranked top of Asset Finance International's 2020 list of Europe's largest business equipment and vehicle lessors with €38.20 billion in lease receivables, mainly through ALD. LeasePlan was eighth

The combination is a "unique and rare opportunity to create a global leader in a growing and highly promising industry that is undergoing a big transformation," SocGen CEO Frédéric Oudéa said during a Jan. 6 call.

BNP Paribas SA was second in the Asset Finance rankings with €32.71 billion of lease receivables. German automaker Bayerische Motoren Werke AG was a distant third on €15.19 billion.

Crédit Agricole aims to jump into Europe's top three aided by its planned venture with Stellantis, Stéphane Priami, the bank's consumer finance head, said in a Dec. 17, 2021, statement announcing the deal. The bank and the automaker will both own 50% stakes in the new operating leasing company, which intends to have €10 billion of payments outstanding on leases by 2026.

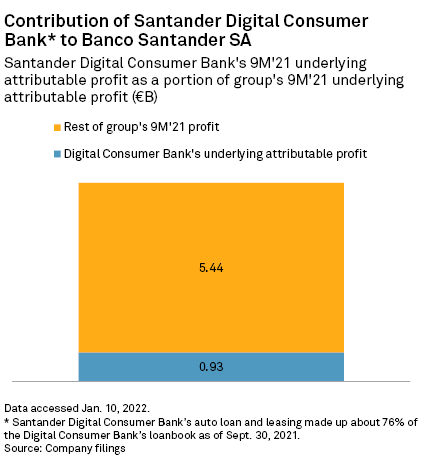

Banco Santander SA and BNP Paribas are in talks with Stellantis about forming separate ventures offering financial leases in various European countries. Santander is also in the process of boosting its exposure to auto leasing in the U.S. by acquiring the 20% of Santander Consumer USA that it didn't already own.

"A kind of tide has turned in recent months," Dally said. "Across Europe, banks are moving further into the space."

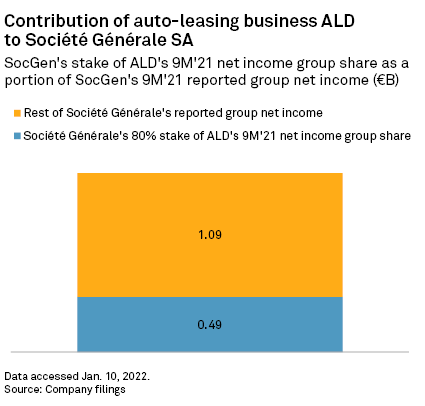

Leasing is already a key profit driver for SocGen. About 30% of the bank's €1.60 billion group net income in the first nine months of 2021 came via its 80% stake in ALD, according to Market Intelligence data. ALD recorded an average return on equity of 17.67% over the last five quarters, compared with 6.98% for SocGen's total business.

LeasePlan grew profits by 74% in the first nine months of 2021 to €551.3 million. Revenue rose 6.2% to €7.53 billion. Investors led by private equity firm TDR Capital bought the company in 2016. It operates almost 1.8 million vehicles across Europe, the U.S., India, Brazil, Mexico and the UAE.

Such lucrative figures are spurring more competition for banks in the global leasing market. In the U.S., Stellantis acquired its own financing arm in 2021, posing a potential threat to Santander's auto-leasing business. The lender financed 33.8% of Stellantis' vehicle sales in the second quarter via Chrysler Capital.

Santander CEO José Antonio Alvarez said during a call in October 2021 that the bank did not expect Stellantis' acquisition of a captive financing capability to have a significant impact on the bank's U.S. auto leasing business. Santander will reach agreements with other auto lease originators, both digital and traditional, to replace part of the volumes it currently gets from Chrysler Capital, Alvarez said.

Stellantis will continue its relationship with Santander in the U.S. for the foreseeable future while its captive financing arm builds sufficient capacity to replace the financing volumes provided by Santander, a source close to the matter told Market Intelligence.

Fintech disruption

Fintechs backed by private equity firms have also disrupted the market in recent years, partly through the use of sophisticated, data-driven models. These allow them to target the entire market rather than just focusing on segments such as prime or sub-prime leasing, Dally said.

Still, banks remain dominant, accounting for two-thirds of business equipment and vehicle leasing in Europe, according to Asset Finance International. The seven banks among the region's top 10 lessors grew combined lease receivables 3.3% to more than €163 billion in 2020, its data showed.

Banks' interest in the sector is unlikely to abate given their wider struggles with record low, and often negative, interest rates. Net interest margins tumbled 19 basis points from 2018 to 2020 at Europe's 30 largest banks by total assets, Market Intelligence data showed. Net interest income, a major source of revenue, fell 4.6% in the period.

Auto leasing is "an attractive, predictable and solid thing to have on your balance sheet," Dally said. "Because you know that businesses and consumers need their vehicles."