Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

16 Dec, 2022

Snap Inc. will soon have a new leader overseeing its Asia-Pacific operations from India, and analysts expect the executive to direct fresh investment for Snap in the region.

Former Meta Platforms Inc. executive Ajit Mohan will join Snap as president of its Asia-Pacific business in February 2023. Before that, Mohan worked for four years as head of Meta's business in India, during which the executive guided the company's operations through a challenging regulatory environment in the country. Mohan also oversaw the initiation of some key strategic partnerships, including a $5.7 billion investment in Indian telecom operator Jio Platforms in mid-2020.

To better compete in India, analysts say Snap should pursue more music partnerships and roll out additional augmented reality technology.

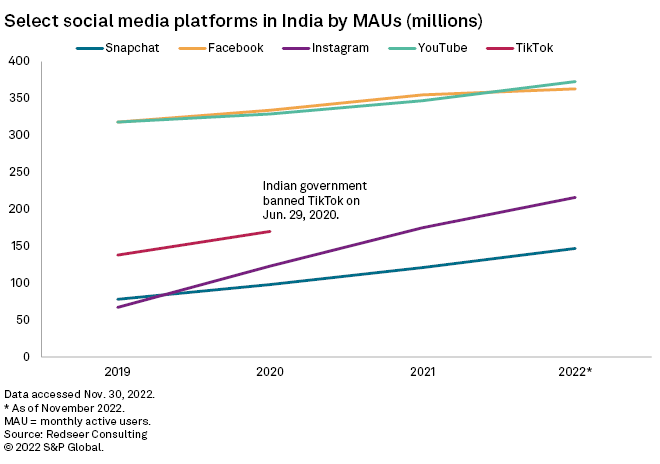

Snapchat's local Indian rival, ShareChat's Moj, grabbed some market share following its signing of a music licensing deal signed in 2020. Moj and other domestic platforms also gained traction in India following the country's ban of Beijing Byte Dance Telecommunications Co. Ltd.'s TikTok in June 2020.

"Snapchat will need to differentiate itself from Instagram LLC by targeting tier 2 and tier 3 cities via more music partnerships and from local rivals by using more augmented reality features," said Nikhil Dalal, director at India-based data firm Redseer Consulting.

The Indian government classifies Tier 2 cities as those with a population of 50,000 to 99,999 and tier 3 cities as those with 20,000 to 49,999 people. Tier 1 cities or metropolitan centers have more than 100,000 people.

Snapchat counted 147 million monthly active users, or MAUs, in India as of Nov. 28, according to data from Redseer. That is up from 121 million at the end of 2021 and 98 million at the end of 2020.

In comparison, Meta's Facebook had 363 million MAUs in India as of Nov. 28, Redseer estimated, while the company's Instagram platform counted 216 million. Local apps Moj, MXtakatak and Josh had about 280 million unique MAUs combined as of Oct. 31, or about 1.7x their combined MAUs compared to early 2020, before TikTok was banned, according to Redseer.

A Snap spokesperson told S&P Global Market Intelligence that Mohan's appointment will help accelerate Snapchat's growth across the Asia-Pacific region, which accounts for about 75% of the total addressable market of smartphone users who are 13 years old or older and do not already use the Snapchat platform.

During Mohan's tenure at Meta, the company responded to stricter content regulation rules from the Indian government that included adapting to more compliance requirements.

"Ajit Mohan's move is telling of Snap's efforts to boost its presence in India — he has experience navigating technology and regulation," said Faisal Kawoosa, chief analyst and founder at technology analytics, research and consulting firm, Techarc.

"The hire makes a strong statement about Snap's commitment to the business," Kawoosa said.

Moj's deals with Indian music label Saregama India Ltd. and Super Cassettes Industries Ltd., known as T-Series, gave the domestic platform access to catalogs of more than 100,000 retro and new-age songs in over two dozen languages. Snapchat needs to pursue something similar to compete, analysts said.

"By populating its music content library, Snapchat will be able to offer music that appeals to a broader audience in smaller cities," said Redseer's Dalal.

Snapchat can also compete by investing in technology and rolling out enhancements to the app's functionality and interface, analysts said.

In particular, enhancing its augmented reality features will give Snapchat a competitive edge over its local and larger rivals, said Pranav Bhavsar, founder of independent advisory and investment firm ASA Capital Management. AR offers users interactive experiences that combine the real world with computer-generated content.

"Investing in AR will enrich Snapchat users' ability to create unique short videos," Bhavsar said.

Snap has already moved in this direction. In the company's first-quarter earnings report, Snap announced a new augmented reality creator program in India powered by Lens Studio. The program includes an online developer course and a series of challenges that aim to help developers and local creators in India.

As of the third quarter, over 250 million people engaged with augmented reality on Snapchat every day, company executives said during Snap's most recent earnings call. They did not provide figures for India or APAC specifically.

Snap's focus on augmented reality — and augmented reality advertising — will help the company increase user engagement, said ASA Capital's

"Snapchat's focus on AR in India will help it retain more users and drive engagement. If the company continues to strike more AR deals like the one it made with Flipkart, it will definitely have a competitive edge over its local rivals," the executive said.

Snapchat announced a partnership with Walmart-owned Flipkart last October to create AR-driven shopping experiences on its platform.

The company also may benefit as some marketers turn away from its rivals due to concerns about content moderation and brand safety, industry experts said.