S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

12 Jan, 2023

By Lauren Seay and Syed Muhammad Ghaznavi

U.S. bank M&A slowed drastically in 2022, and deal advisers do not expect activity to rebound any time soon.

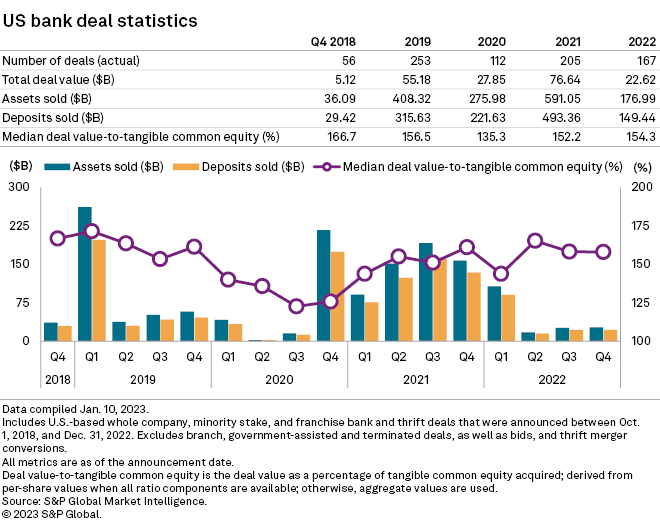

The combination of economic uncertainty, rapidly rising interest rates and heightened regulatory scrutiny ground U.S. bank deal activity to a near halt in 2022. Though U.S. banks announced just 38 fewer deals compared to 2021, total deal value dragged significantly and plunged to the lowest yearly total seen in eight years.

U.S. banks announced 167 deals in 2022 for a total deal value of $22.62 billion, the lowest yearly deal value total since 2014, when announced bank M&A totaled $19.02 billion in deal value across 283 deals.

The decline in deal activity was a sharp contrast to 2021, which recorded a total announced deal value that was 3x higher than 2022 at $76.64 billion among 205 deals. While the strong momentum from 2021 carried into the first quarter of 2022 with 49 announcements and $15.18 billion in deal value, activity slowed drastically in the second quarter.

The factors that put many buyers and sellers on the sidelines as the year continued have persisted into 2023 and will continue to weigh on bank M&A, deal advisers said.

"We'll continue to see very few deals getting done until somehow people feel like they can see what the future looks like," said James Stevens, a partner at Troutman Pepper Hamilton Sanders LLP. "Uncertainty is really kind of like a wet rag on the whole M&A scene in banking right now."

Unrealized securities losses hinder negotiations

In 2022, Stevens had more bank deals in his pipeline called off than those that made it to the finish line, largely due to the impact of unrealized losses in banks' securities portfolios and the subsequent hits to accumulated other comprehensive income, or AOCI, he said.

When rates rise, the value of many bonds banks own can drop, which leads to unrealized losses in banks' available-for-sale securities portfolios and can take a chunk out of AOCI while driving down tangible book values.

"It makes people less interested in doing M&A to the extent that either they have a currency that's not as valuable because they have AOCI issues or they're looking at a target and they don't want to buy a target that's got a big securities portfolio that's going to take further hits," Stevens said in an interview.

Moreover, would-be buyers and sellers are grappling with how to factor those hits into deal pricing. For this issue to resolve before rates come back down, buyers either have to get comfortable with paying a higher price that could lead to outsized tangible book value dilution and taking the initial hits that come with marking the targets' books to market at close, or sellers have to bring down their price expectations and focus on the long-term opportunities that can come with joining a larger institution, advisers said.

"A buyer reaching that conclusion or a seller reaching that conclusion, that's a tough hill to climb," Stevens said.

In many cases, potential sellers are holding off on coming to market until these challenges subside.

"Sellers are seeing that they're not going to get the price that they wanted before and, really, I'd say 95% is the AOCI," said Craig Mueller, a managing director and co-head of the financial institutions group at Oak Ridge Financial. "[They're saying,] 'If we're going to give up a certain percentage of our capital just because of a book entry issue then the heck with that, we're going to sit by and wait for rates to either change or ride the yield curve.'"

Despite those challenges, the median deal value-to-tangible common equity among bank deals announced in 2022 was 154.3%, above both 2021 and 2020.

Rising rates' impact on deal math

The impact of rising rates on merger math stood as another hurdle to dealmaking in 2022, and deal advisers expect that dynamic to continue in 2023.

As interest rates surged, previously estimated interest rate marks changed, driving up tangible book value dilution and earnback periods. Similarly, banks involved in deal discussions had a tough time knowing where interest rate marks could fall at close since it was unclear when the Fed could stop raising rates.

That uncertainty has persisted into 2023, and there is still widespread unwillingness among buyers to stomach the large TBV dilution that comes with AOCI losses and interest rate marks, said Frank Sorrentino, a managing director in Stephens financial institutions group. For publicly traded banks, it is even tougher to stomach given the Street's reaction to outsized TBV dilution, he said.

In mid-December 2022, First Bank announced its acquisition of Malvern Bancorp Inc. and Shore Bancshares Inc. announced its merger of equals with Community Financial Corp. The First Bank deal carried TBV dilution of 9.2% with a 2.5-year earnback period, compared to 2.8% TBV dilution with a 1.4-year earnback period excluding AOCI and interest rate marks. First Bank's stock price tumbled 9.8% following the deal announcement.

Separately, the Shore MOE carried TBV dilution of 13.9% with an earnback period of 2.1 years, compared to TBV dilution of 3% with an earnback period below a year excluding AOCI and rate marks. Shore's stock price fell 9.5% the day after announcement.

Similar stock reactions to those will "continue to make people cautious about doing M&A," Sorrentino said.

However, if the Fed stops raising rates in 2023, that would remove some uncertainty and bode well for dealmaking by giving buyers some clarity about where interest rate marks stand when it comes to close an acquisition.

"If you mark-to-market a loan book a year ago, the math has completely changed. Whereas I think we're probably maybe coming closer to the end, the sixth or seventh inning of rate rises. And so you could have a little more confidence that you know what the ultimate end answer is going to be," Sorrentino said.

Moreover, the increased pressure on funding and potential need for deposits in 2023 could push some buyers to become more comfortable with higher TBV dilution, he said.

Economic uncertainty to intensify in 2023

Economic uncertainty was abound in 2022, though credit quality remained largely pristine. In 2023, the threat of a recession and a potential downturn in credit performance could hinder M&A even more than it did in 2022, said Andrew Christians, a managing director at Donnelly Penman & Partners.

"While people are worried about what their own loan books look like in a down environment, they're going to be hesitant to take on somebody else's loan books," Troutman Pepper's Stevens said.

Regulatory environment will not get any easier

A more stringent bank M&A regulatory review process put some would-be buyers and sellers on the M&A sidelines in 2022, namely the largest banks. Only three U.S. bank deals with a value above $500 million at announcement were announced in 2022. That was a sharp drop from 23 such deals in 2021.

The largest bank deal announced in 2022 was Toronto-Dominion Bank's $13.67 billion pending acquisition of First Horizon Corp. It was one of only two U.S. bank deals with an announced deal value above $1 billion last year.

M&A among regional and superregional banks is likely to remain "off the table" as regulators are not expected to loosen their focus on M&A in 2023, said Matt Resch, managing director and co-head of M&A and capital markets with PNC Financial Institutions Advisory Group.

"Looking forward to 2023, we expect banks to continue to take a cautious approach to purchasing other banks until regulatory clarity can be obtained," Barclays analyst Jason Goldberg wrote in a Jan. 3 note.

Waiting for the dam to break

Once the uncertainty surrounding interest rates and the economic and regulatory environments clear, "you'll see the dam break, and there'll be a lot of M&A," Stevens said.

Anywhere from the end of 2023 through 2024 could see a massive uptick in bank M&A, much like the wave of deals in 2021 that was largely a result of pent-up demand from 2020 when COVID-19 put a temporary stop to M&A, advisers said.

"What ultimately happens is when you have a down period like we've had, whenever that does change, that pent-up demand follows," Resch said. "It's kind of the classic rubber band effect."

Sorrentino predicts a wave of transformational deals during that period, much like the wave of activity following the Great Recession.

"We saw some really transformative deals with the companies that came out of that kind of 2008 to 2010 time frame who were able to capitalize on once-in-a-lifetime opportunities. I feel like we're heading into another cycle of that," Sorrentino said. "This is all about being prepared and being opportunistic."