Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

29 Jul, 2021

|

The 2,900-MW John E. Amos coal-fired power plant near Charleston, W.Va., has been producing power since the early 1970s. Such plants are becoming more scarce as the nation retires much of its coal fleet in a transition to other forms of electricity generation. |

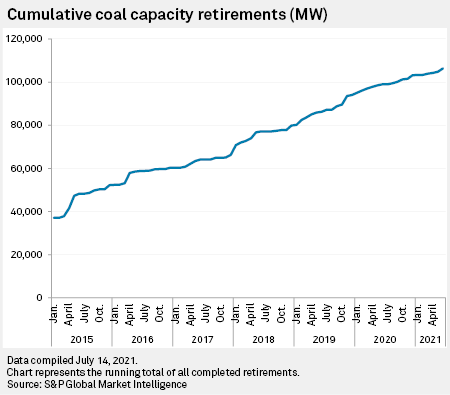

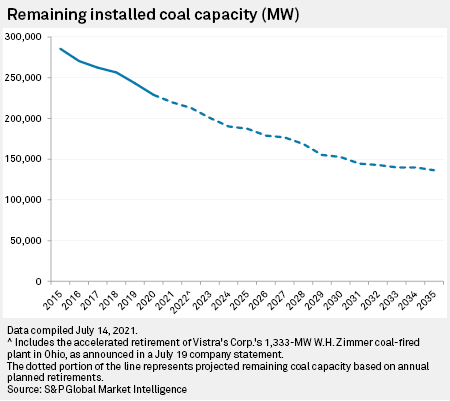

Based on already planned and announced retirements, less than half of the U.S. coal-fired power generation capacity that existed at the start of 2015 will remain online by 2035, a new S&P Global Market Intelligence analysis shows.

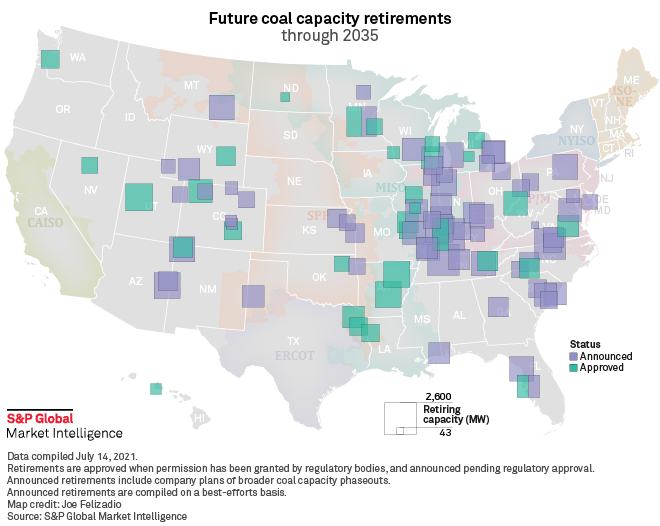

Utilities are rapidly closing coal-fired power plants, and while 2020 and 2021 offer a relative reprieve from retirements compared to 2018 and 2019, utilities already have over 10 GW of announced retirement plans lined up in each of 2022 and 2023. Moreover, later years, such as 2028, are also already slated to host a relatively big wave of coal plant retirements.

Recent months have seen a fresh round of new and accelerated retirement announcements driven by utilities adopting new climate policies and goals, said Seth Feaster, a data analyst at the Institute for Energy Economics and Financial Analysis.

"We are absolutely certain that there's going to be a considerable number of more retirements for this decade," Feaster said. "We just haven't gotten there yet."

At the start of 2015, the nation's coal fleet totaled 285.6 GW of capacity, according to Market Intelligence data. By the start of 2020, that fell to 228.8 GW, a decline of 19.9%. Closures already announced by power generators will drop that figure to 136.5 GW by 2035, or about 47.8% of the size of the fleet at the beginning of 2015.

The continued fall of coal in the U.S. will likely be steeper than most people think, said Robert Godby, an energy economist and dean at the University of Wyoming.

"The only question now is the glide path and how steep it is," Godby said.

Tougher for coal to compete

Regulations drove some retirements, such as a wave of 2015 closures related to the U.S. Environmental Protection Agency's Mercury and Air Toxics rule. However, coal plants are also increasingly uneconomic compared to alternatives in some places, and at the same time, increased scrutiny on sustainability is driving corporate decisions to retire more coal.

"It's incredibly difficult for many of these plants to compete with the new generation coming from advanced combined cycle plants for natural gas or some of the new utility-scale solar," said Brian Lego, an economic forecaster at West Virginia University's Bureau of Business and Economic Research. "It's really a tough space for many of these plants to operate in."

Utility giant Duke Energy Corp. is among the companies accelerating coal plant retirements to meet company and North Carolina emissions-reduction goals.

"Certainly, we are looking to reduce our carbon footprint ... and in order to do that you're going to need to retire coal, and you're going to need to replace it with renewables or potentially natural gas," Duke Energy Executive Vice President and CFO Steven Young said in a phone interview. "But step one is to plan the retirement for coal units."

Comprehensive energy legislation in North Carolina calls for Duke Energy to retire more than 5,000 MW of capacity at five coal-fired power plants by Dec. 31, 2030, with retirement and replacement plans subject to review by the North Carolina Utilities Commission. Duke Energy will retire all of its power plants in the Carolinas that "rely exclusively on coal" or about 9,000 MW of capacity within the next ten years under the six scenarios outlined in its utilities' 2020 integrated resource plans.

Replacing coal generation

"I think the days of coal being a primary generation source are over," Morningstar analyst Travis Miller said. "The question is, what replaces coal generation?"

The analyst said, "natural gas is the most obvious answer," but "each of the potential long-term solutions has its positive and negative issues." For example, solar and wind generation can be cost-effective and popular, but they also come with intermittency issues related to sun and wind resource availability. While large batteries are solving some of those issues, Miller said they might not be able to replace natural gas by themselves.

"Utilities will have to find a way to manage that risk," Miller said.

America's Power President and CEO Michelle Bloodworth said the coal-fired power advocate has long warned of the long-term risks the grid faces from the retirements of large baseload plants and the rise of intermittent sources of energy such as wind and solar.

"We understand the energy grid is in transition, but we also believe it's critical to heighten the level of awareness about how a transition away from dispatchable resources like coal can adversely impact system reliability and resilience," Bloodworth said. "Keeping coal in the mix supports grid reliability and resilience, helps keep electricity prices affordable, provides fuel security and serves as an insurance policy when other electricity sources are not available or are too expensive."

Bloodworth said goals such as the Biden administration's aim for a carbon-free grid by 2035 are "neither achievable nor realistic." The organization supports technologies like carbon capture and storage, even though it may take time before that is developed and deployed at a larger scale. In the meantime, the organization calls for reforms to power markets that would support coal through mechanisms such as crediting plants for reliability and resilience.

"We think market operators need to revisit payment mechanisms to ensure these dispatchable generators don't retire due to artificially driven economics," Bloodworth said.

Meanwhile, power generators are speeding up the exit from coal.

For example, NRG Energy Inc. announced June 17 that it would retire about 1,600 MW of coal capacity in the PJM Interconnection following the results of the May capacity auction. In addition, Vistra Corp. said July 19 that it plans to shut down the 1,333-MW W.H. Zimmer coal-fired plant in Ohio on May 31, 2022, five years ahead of a previous retirement schedule. The announcement comes after the plant failed to secure any capacity revenues in PJM's latest auction.

CreditSights analyst Andrew DeVries said industry observers are expecting an acceleration of coal plant retirements under U.S. President Joe Biden and following the recent "ugly PJM auction" results.

"What nobody is talking about is the fact natural gas prices are now over $3 and absent a CO2 tax, a scrubbed coal plant can come close to competing with a gas plant, so maybe coal plant retirements continue but actually slow down," DeVries said.