S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

2 Mar, 2023

By Alex Blackburne

|

Surging green certificate prices could provide European renewables developers with a significant source of revenue this decade, according to Ecohz. |

The European renewables certificates market — long considered inconsequential because of perennially low prices — is attracting investor attention after an unprecedented price spike in 2022 that observers said could translate into a significant revenue stream for clean energy developers.

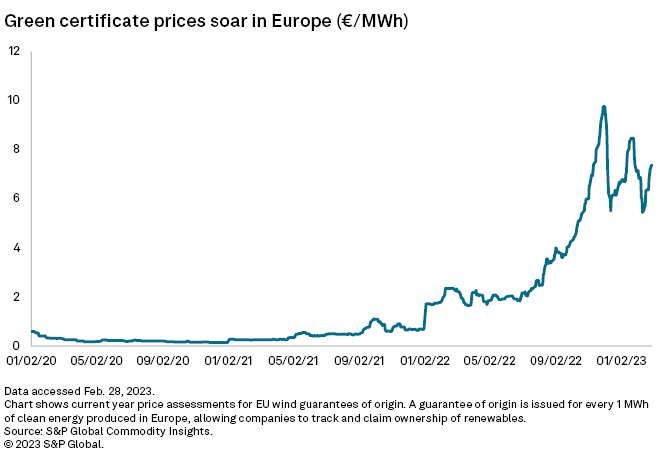

The price of guarantees of origin, or GOs, surpassed €9/MWh last year on the back of growing demand for renewables, having spent most of the previous decade or more languishing below €1/MWh. GOs are issued for every 1 MWh of renewables produced in Europe.

With prices forecast to remain far above long-term averages, asset owners in the European Union could raise €57 billion from the GO market by 2030 for investments in clean power generation, according to new analysis from Ecohz, a renewable energy portfolio manager.

That would represent a "significant source of revenue" for producers, the company said, and enough to secure close to half of the additional production the EU needs to reach its 2030 climate goals.

"We see a trend in Europe of countries getting off subsidies ... and here there is a great opportunity to fill the gap with money that doesn't cost the taxpayer anything," Ecohz CEO Tom Lindberg told S&P Global Commodity Insights.

'Uncharted territory'

Structured in the same way as the U.S. renewable energy certificates market, GOs allow project owners to track and claim ownership of their renewable production.

GO prices surged in 2022 on the back of what Ecohz described as robust and growing demand, following a dry summer in the Nordics and Iberia that stifled hydropower production and hit Europe's supply of GOs.

Ecohz estimates that GO prices will average €5.5/MWh toward 2030, driven by consumers' continued willingness to pay for documented renewable energy, despite rising costs.

"We're kind of into uncharted territory," Lindberg said. "The interesting thing is there has been no one that we've seen backtracking on their renewables targets [due to rising GO prices], meaning they're still in there, they're still buying."

According to Ecohz, the higher forecasted GO prices provide EU producers with an opportunity to reinvest the revenue made from selling GOs into new renewable generation.

Europe generated 1,500 TWh of renewable electricity in 2022, with close to 800 TWh of that documented with GOs. The European Commission expects the EU to produce about 2,380 TWh of renewable power per year by 2030, which would raise about €10 billion annually from GOs using Ecohz's price forecast.

That would equate to a total of €57 billion across the rest of the decade, which based on a debt gearing of 75% represents €228 billion in possible investment, Ecohz said.

"The big question is: is there an interest, a willingness, to follow the money, to expect more from that money ... or is it just going to be lying there as profit?" Lindberg said. "There is no reason for that money not to be reinvested into renewables."

Growing prominence of GOs

European renewable players are already starting to see positive effects from higher GO prices.

For instance, a bullish view on GO revenue is said to have enabled Vattenfall AB to submit and win a zero-subsidy bid in a Dutch offshore wind auction, according to the RECS Energy Certificate Association. Vattenfall declined to comment, saying the information is commercially sensitive.

Meanwhile, Norway's Statkraft AS said GOs are an "increasing factor" when forecasting revenues.

"Over the last five years we have seen a growing tendency of banks to require off-take agreements for not only power, but also the GOs in order to grant developers loans for building out renewables," Lars Magnus Günther, Statkraft's head public relations adviser, said in an email.

Günther added that it has become less acceptable for corporate and industrial buyers to sign power purchase agreements without GOs as proof of origin.

"The GOs are therefore a key element in showcasing the narrative behind corporates investing and consuming electricity across Europe," Günther said. "The price rise is key to the ability to roll out merchant assets, without the need for government support schemes, and provide a key revenue stream for renewable developers across Europe."

S&P Global Commodity Insights produces content for distribution on S&P Capital IQ Pro.