S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

16 Dec, 2021

By MAIRIN BURNS

Skillz Inc. on Dec. 15 cleared a debut $300 million print of single-B rated secured notes at a hefty discount and a 10.25% coupon to yield 11.598%. The deal represents just the 10th in 2021 to offer a double-digit yield at pricing.

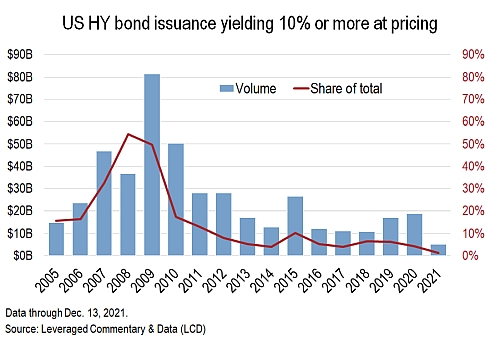

To be sure, just $5.2 billion, or 1.2% of 2021's record-setting issuance, has yielded 10% or more at pricing, according to data compiled by LCD. That's compared with 54.4% of the almost $37 billion of recession-era paper inked in 2008.

Mobile gaming company Skillz faced multiple headwinds as it shopped its liquidity-boosting five-year deal, not least the fact that it is a first-time issuer in a relatively obscure field with no obvious comparisons. The company's stock price is near its all-time low. The company, which merged with special purpose acquisition company Flying Eagle Acquisition Corp. in December 2020, has been burning through cash despite taking a whopping 50% cut of the revenue generated by the games it hosts. On top of that, Skillz derives the bulk of its revenue from just three games. Despite strong double-digit revenue growth, S&P Global Ratings analysts don't expect the company to become profitable until 2024 at the earliest.

In addition to juicing the yield, Skillz ended up making several more concessions in order to get its deal across the finish line, including the addition of "J. Crew blocker language" designed to stop the issuer from removing security by transferring intellectual property into new subsidiaries and raising additional debt.

The bonds broke to a 95.25 context and traded up at 96.5 as generic cash bonds added a quarter of a point on relatively light trading volume.

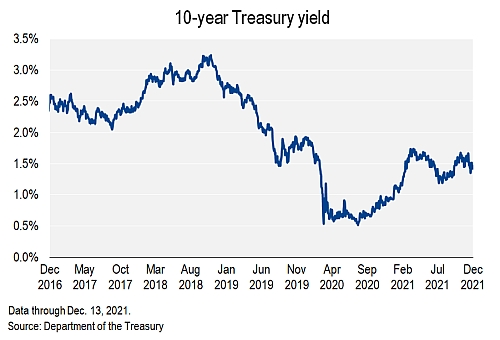

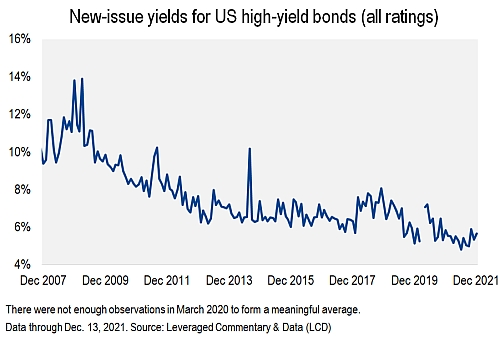

Skillz's struggle to get its deal done has highlighted a lack of willingness on the part of traditional high-yield investors to take on default risk in the current environment. Stubbornly low Treasury rates and improving credit among high-yield issuers have all but eliminated the need for borrowers to make such dramatic concessions. The yield on the benchmark 10-year Treasury note stood at 1.428% at press time after the Federal Reserve said it will accelerate the reduction of its monthly bond purchases and signaled three interest rate increases in 2022. Meanwhile, the average new-issue yield for high-yield bonds this month through Dec. 13 is 5.68%, according to LCD, falling between a record low of 4.83% in June and a high of 5.90% in October.

"There is a lot of rational reaching for yield in the financial markets, but you have to draw the line somewhere," said Bill Zox, high-yield bond portfolio manager at Brandywine Global Investment Management. "If a company has to pay 10% or higher for debt capital, there's probably a really good reason for that, and it's probably not worth the risk."

In early May, prison-food vendor TKC Holdings Inc. had to offer a 10.5% yield on the riskier portion of a two-part bond offering forming part of a capital-structure overhaul after facing pushback over environmental, social and governance concerns and the company's repeated funding of dividends with debt. The borrower originally proposed a 9% coupon for the $700 million offering of eight-year senior unsecured notes it added after downsizing the loan component drew a lukewarm response. It eventually priced the deal at the wide end of official guidance. Those bonds have traded in the 106-108 range since early October, when they slipped from highs around 110.25 amid a campaign by a labor-backed nonprofit to get state and local pensions to stop investing in the for-profit prison system.

But these idiosyncratic issues are few and far between, even in the energy sector, which spawned six of the nine other deals priced with double-digit coupons since the beginning of the year and where borrowers historically have had to pay a premium in terms of yield and spread to get investors comfortable with a plethora of risks from weather to regulation.

"So many of the high yield energy issuers are very focused on paying down debt rather than just refinancing their debt so there has been credit improvement which means there are less justifiable instances where we're going to get double-digit yields for taking that risk," said Bryant Dieffenbacher, a portfolio manager at Franklin Templeton Investments.

It took an almost-13% yield for investors to step up for EnVen Energy Corp.'s relatively small $300 million print of 11.75% senior secured second-lien notes due 2026, inked in April to fund the redemption of the borrower's 11% senior secured second-lien notes due 2023. The bonds priced at an OID of 98 to yield 12.97%, or T+1,146 in spread terms but, as a result, EnVen pushed out its maturity wall to 2024 and earned a revision to stable outlook from negative, from S&P Global Ratings. The bonds hit a high of 105.5 in July and were quoted at 103.5 on Dec. 8, for a yield of about 10.472%, according to MarketAxess.

Great Western Petroleum LLC in February offered a similarly eye-popping 12.73% all-in yield to refinance 2021 maturities with $235 million of 4.5-year senior secured second-lien notes. Other concessions included reductions in the size and tenor of the deal, but Ratings boosted the company to B- with a stable outlook in the deal's wake. After languishing in the mid-80s for a couple of months, the bonds came into their own and were quoted around a point off their 105.75 highs when they last traded at volume earlier this month.

May brought Coronado Global Resources Inc.'s 10.75% five-year senior secured notes, which came at an OID of 98.122 to yield 11.25%, or T+1,044, as well as Tullow Oil PLC's par-priced print of secured notes, inked at the tight end of a 10.25%-10.50% guidance range. The Coronado bonds slipped to recent trades around 107.75 after testing 111 amid the early-September oil rally, while the Tullow deal topped out just north of 106 before hitting a low of 99 on Nov. 30.

London-listed Petrofac Ltd. in October had to offer a double-digit yield to get investors comfortable with buying bonds whose proceeds were earmarked to pay the final portion of a $104.6 million bribery penalty. In the event, the oil-field services provider was able to boost the price of an upsized $600 million of 9.75% secured notes due 2026 at 99.028% of par, to yield 10%, despite initial suggestions of a possible 10.50% yield. The little-traded bonds have bracketed par since coming off post-break highs around 102. Rounding out the year's high-yielding energy slate was a $350 million offering of five-year senior secured second-lien notes with warrants to back the redemption of Athabasca Oil Corp.'s 2022 maturities. Also featuring a 9.75% coupon, those bonds yielded 10.54% at pricing.

Beyond oil and gas producers, idiosyncratic situations have called for a sweetened yield. In August, Ronald Perelman's Vericast Corp. had to pay up to sell the first-lien notes portion of a broad refinancing effort, although slapping an 11% coupon on the par-priced bonds earned the marketing company a two-notch ratings upgrade from Moody's to Caa1. A month before, Byron Allen's Allen Media Group LLC placed a $350 million add-on to its 10.5% senior notes due 2028 at revised 98.5 talk in connection with the company's acquisition of assets from Quincy Media.

As long as equity valuations remain at current levels, lenders suggest new-issue yields are likely to remain in the 4-6% range, where many traditional long-only high-yield investors seem to be comfortable.

"While there can always be volatility, I think spreads will continue to be very narrow until there's a large drawdown in equities," said Brandywine's Zox. "Negative real yields on the Treasury bond side are not much of an alternative for investors looking for returns above inflation."