Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

21 May, 2023

By Ranina Sanglap and Marissa Ramos

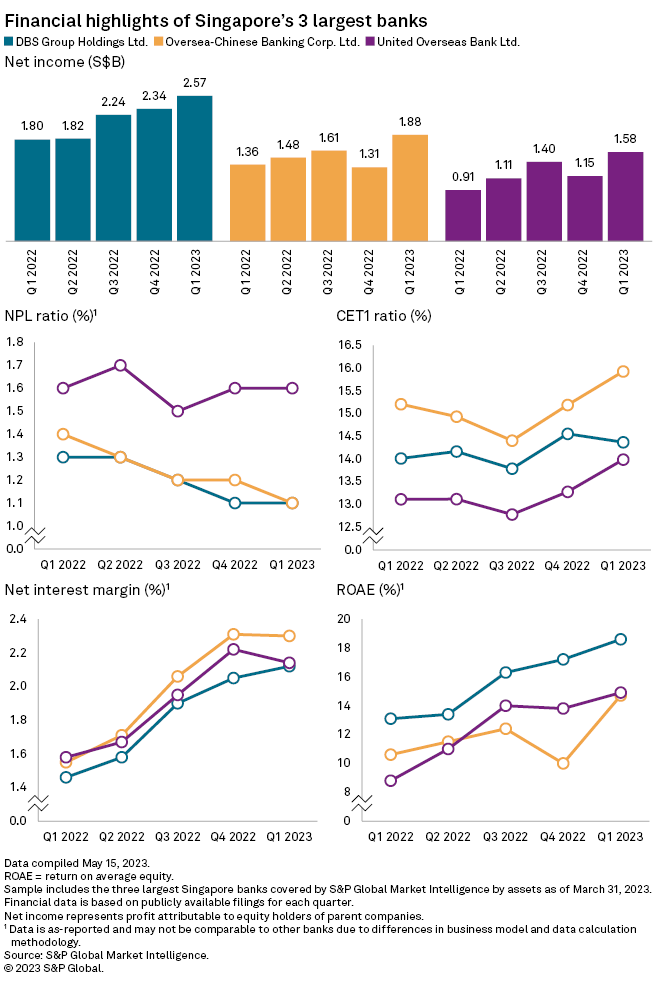

Singapore's biggest banks are watching for a possible decline in asset quality and plan to use their strong profits to build on provisions as economic growth slows and inflation remains elevated.

DBS Group Holdings Ltd., Oversea-Chinese Banking Corp. Ltd. (OCBC) and United Overseas Bank Ltd. (UOB) reported year-over-year increases in first-quarter net income. DBS saw its net income rise to S$2.24 billion from S$1.70 billion, OCBC's net income increased to S$1.61 billion from S$1.22 billion and UOB's net income rose to S$1.40 billion from S$1.05 billion.

"Asset quality has been surprisingly benign despite harder operating conditions," Thilan Wickramasinghe, head of research at Maybank Securities told S&P Global Market Intelligence. "We think this could be a key concern going into the second half of 2023 and non-performing loans could rise as customers adjust to a recessionary environment together with high borrowing costs. Expect provisioning costs to increase for the rest of the year."

High rates

High interest rates boosted net interest margins (NIM) at Singapore banks.

The lenders face muted economic growth as monetary policy tightening to tamp down on inflation hurts demand. The Monetary Authority of Singapore (MAS) expects the island nation's export-reliant economy to grow in a range of 0.5% to 2.5% in 2023, from 3.6% in 2022, according to central bank's April 14 monetary policy statement. The MAS said trade is expected to contract further, while higher prices and interest rates could restrain consumer spending.

The central bank's core inflation measure, which strips out the volatile accommodation and private road transportation costs, is expected to average 3.5% to 4.5% this year before moderating to 2.5% by the end of the year, the MAS said.

Inflation and rising costs are among the challenges facing DBS Group, especially its small- and medium-size loan book.

"Because when inflation goes up, the cost of goods goes up, interest rates goes up, the funding costs go up, and they have less pricing power than large corporates. We get squeezed," DBS CEO Piyush Gupta said during the bank's May 2 earnings call.

Healthy loan book

Southeast Asia's biggest lender by assets has not seen any significant delinquencies in the small and medium-sized enterprise sector yet, but Gupta said the bank continues to be cautious and will build general provisions. "We are really not seeing stress anywhere in our portfolio. We're not being able to pick up any systemic risk in any sector," Gupta said.

Gupta said in February the bank "has a shot" at S$10 billion in net profit in 2023 after the lender reported its highest ever net profit of S$8.19 billion for 2022, a 20% gain over 2021.

OCBC CEO Pik Kuen Wong echoed Gupta's assessment that "asset quality is benign" with no sign of systemic issues so far, Wong said during the bank's May 10 earnings call.

DBS has reported general allowances of S$99 million to strengthen general provision reserves to S$3.83 billion. OCBC's total allowances for the quarter was S$110 million, lower than S$314 million of total allowances in the fourth quarter of 2022. Wong said provisions were lower in the first quarter because as "we look at our books, our quality is still quite good."

"Singapore banks' profitability continues to be driven by robust interest income from core lending businesses, while credit costs and expenses remained contained," Ivan Tan, an analyst at S&P Global Ratings, said via email. NIMs improved year-over-year for the first quarter, Tan said, adding that margins will likely remain at current levels for the rest of 2023, with "potentially some moderation" in 2024.

As of May 19, US$1 was equivalent to S$1.34.