S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

15 Nov, 2021

By Regina Liezl Gambe and Rehan Ahmad

Growing fee income and possible write-backs of prior provisions for bad loans will help Singapore's major banks maintain their earnings momentum through the rest of the year.

Interest margins, however, are likely to take longer to recover as global central banks keep monetary policy settings easy to support economic growth.

"We expect earnings to broadly be sustained by broad-based fee income recovery in [the fourth quarter of 2021]," said Andrea Choong, a Singapore-based equity research analyst at CGS-CIMB Securities. Beyond that, "impairments will likely be the key swing factor on the [banks'] bottom line," Choong said.

Choong expects credit costs to hover around the levels seen in the third quarter, helped by the large general provision buffers Singapore's banks have built.

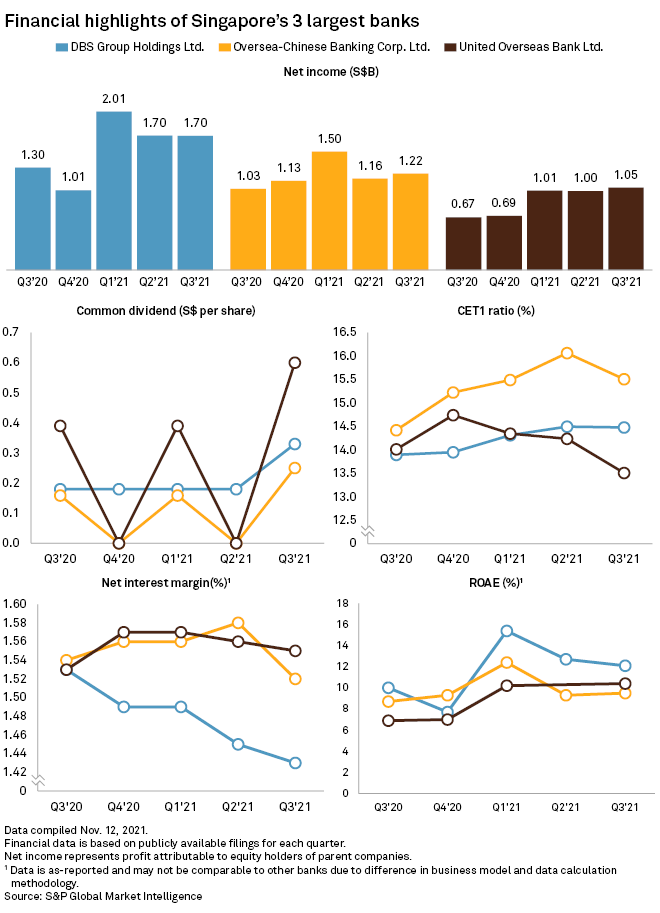

The city-state's major banks all posted net profit gains in the quarter ended Sept. 30. United Overseas Bank Ltd. posted a 57% year-over-year net profit growth in the third quarter, followed by DBS Group Holdings Ltd. at 31% and Oversea-Chinese Banking Corporation Ltd. at 19%.

The increase in net income was partly due to higher fee incomes and lower credit allowances. UOB and OCBC both recorded a 14% year-over-year increase in net fee income for the September quarter, while DBS logged a gain of 11%.

Bad loans stable

Analysts say the lenders are well placed to meet their loan growth targets for 2021 as the economy recovers.

"We can see that the banks are starting to reverse the substantial provisions made in 2020 and it would depend on how the economy improves," said Glenn Thum, a Singapore-based research analyst at Phillip Securities Research

Singapore has changed to a "live with COVID-19" strategy, opening up the economy and welcoming business travel as more than 80% of its population is fully vaccinated against the virus. The island nation is also actively offering booster shots to those above the age of 30 and other high-risk groups.

Net interest margins for the three banks remained stable in the September quarter amid a low rate environment and competition.

"We expect NIM to be stable, as loans growth will be able to offset the lower net interest income due to lower rates," Thum said, adding that bank earnings in the fourth quarter may be moderated by static NIMs as more competitive corporate loans have resulted in lower asset yields.

UOB recorded the highest NIM of 1.55% at September-end, followed by OCBC with 1.52%. DBS's NIM was the lowest among the three at 1.43%. The ratio declined at all banks as global central banks guided interest rates lower to boost economic activity.

The Monetary Authority of Singapore in October tightened its monetary policy amid cost pressures caused by supply constraints and a recovery in the global economy, delivering its first change since 2018.

The MAS increased the slope of its currency band "slightly" from the previous zero to ensure price stability over the medium term while recognizing the risks to economic recovery. Instead of interest rates, the Singapore central bank uses currency exchange as its primary monetary policy tool, guiding the local dollar in an undisclosed currency band relative to peers in the nation's key trading partners.

As of Nov. 15, US$1 was equivalent to S$1.35.