Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

1 Feb, 2021

By Jacob Holzman and Kip Keen

Silver could be the next high-profile target for retail investors after the GameStop Corp. stock spike, but analysts are skeptical that social media's meme economy will translate to another legendary result in the market any time soon.

A blizzard of trading activity driven by users on the social media website Reddit triggered a meteoric rise in the stock of GameStop and other equities including AMC Entertainment Holdings Inc. and Nokia Corp. When trading apps such as RobinHood restricted user activity with those companies, some members of the popular subreddit group r/WallStreetBets wrote they would leap to silver exposure, seeking to benefit from an especially volatile commodity with a history of potential market manipulation.

|

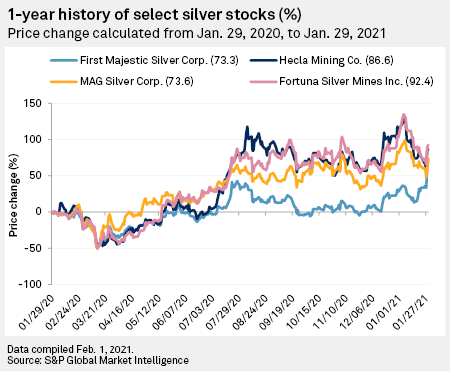

At the close of market on Friday, Jan. 28, the silver price was inching upward and the stocks of silver miners such as First Majestic Silver Corp. were on a positive trajectory, and silver coin dealers were overwhelmed with requests over the weekend. The market opened Feb. 1 with prices of silver futures hitting an eight-year high, March silver future prices climbing, and silver equities and exchange-traded funds aimed further skyward.

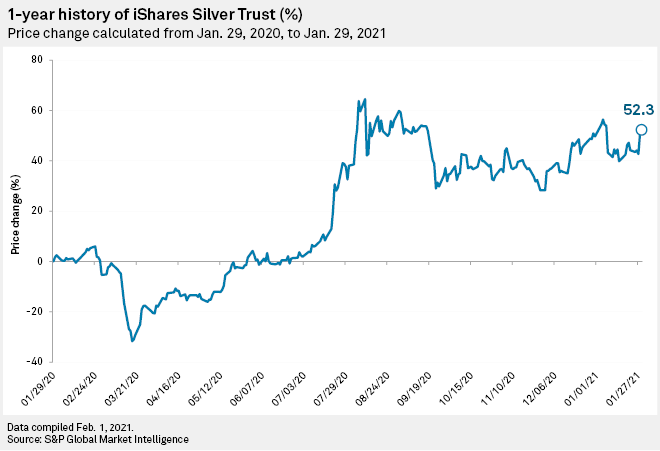

One of the popular ETF choices cited by Reddit users was iShares Silver Trust. On Jan. 28, the fund had roughly 32 million ounces of inflow boosted by retail investment support. This was a $950 million move in an annual silver market totaling about $25 billion, BMO Capital Markets analyst Colin Hamilton said in a Feb. 1 note.

"Silver is certainly the hot topic in commodities at present," Hamilton wrote. "[This] is equivalent to two weeks of demand simply from ETFs in a single day. Moreover, we would expect other flows into physical silver, such as bars and coins, on expectations of a scramble for material over the coming month even though several years of global demand are thought to be held in vaults."

The #SilverSqueeze

Silver typically attracts a lot of retail interest and the metal entered 2021 with considerable tailwinds amid positive market fundamentals and the green energy priorities of the new Biden administration in the U.S., Scotiabank Equity Research analyst Trevor Turnbull told S&P Global Market Intelligence.

The silver price pop was still a shock, however. "I have been surprised by the size of the move in silver relative to gold," Turnbull said Jan. 28. "Things like I mentioned, the fundamental things, looking at green initiatives with the new administration in Washington, that's not unique to this week. We've known there was going to be a new administration for a couple of weeks."

Whether the social media silver swoop, also known as the "#SilverSqueeze" online, will persist akin to GameStop will likely be determined at least partially by the attention span and organization of retail investors. The silver market is a far larger target than one single stock and there are existing shorts that could prove easier achievements for the hype-addled crowd online.

Complicating matters further, Citadel Advisors LLC, one of the Wall Street enemies of Redditors due to its apparent short position on GameStop, reportedly holds millions of shares in iShares Silver Trust. This has led to division on the online forum as some users declare a move to silver and away from GameStop as potentially stemming the momentum of their movement.

"Some of the #HedgeFunds that are short [GameStop] are said to be long silver," Mohamed El-Erian, chief economic adviser at Allianz, tweeted Feb. 1. "Bottom line: A dissimilar trade that eats away at [GameStop] gains."

Hunt brothers 2.0?

The rising silver price carried echoes of the famous attempt by the Hunt brothers to corner the silver market in 1979 and 1980, which led to chaos in commodity markets as companies scrambled for the metal.

In that case, the Hunts took a longer term view, Jeffrey Christian, Managing Partner of CPM Group, told Market Intelligence.

"[The Hunts] looked at silver and said, 'Oh, we think this price is gonna rise sharply.' And they bought a lot of silver and they bought some silver futures, and they bought some silver options, and then they told everybody what they were buying," Christian said in a phone interview. "[But] these guys are just punks … They have the same short-term thinking process as the guys who stormed the Capitol."

Christian said the recent volatility in the silver price could also be tied to movements in the U.S. dollar index and doubted whether Redditors could drive the price high enough to shake out bearish silver positions. Investors with puts on silver outright, instead of with borrowed money, can wait out the price vibrations typical of the metals market.

"A savvy investor who doesn't have credit constraints will simply sit there and wait, knowing that the price is probably going to come back in their favor," he said.

Christian also noted some players in the metal markets have long alleged price manipulation in silver with big banks exerting outsized control. There has been at least one high profile case, where a JPMorgan Chase & Co. trader plead guilty in 2019 to manipulating precious metals prices between 2009 and 2015.

However, major precious metals firms can take a fatter cut as silver prices rise, similar to a jump in silver prices in 2011, Christian noted. "J.P. Morgan actually recorded record earnings on its gold and silver trades that year," he said.

David Harquail, chairman of precious metals streaming company Franco-Nevada Corp., told Market Intelligence that a Reddit-driven silver craze would be "non-productive" and would go against a value-driven investing philosophy.

"My whole life is focused on trying to find good mining properties and invest in those good mining properties and build them," Harquail said. "Unfortunately, 99% of the rest of the world is off playing these casino games."