Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

2 May, 2023

Short sellers are boosting their positions against tech stocks, likely betting that a recent rally in the sector will be short-lived.

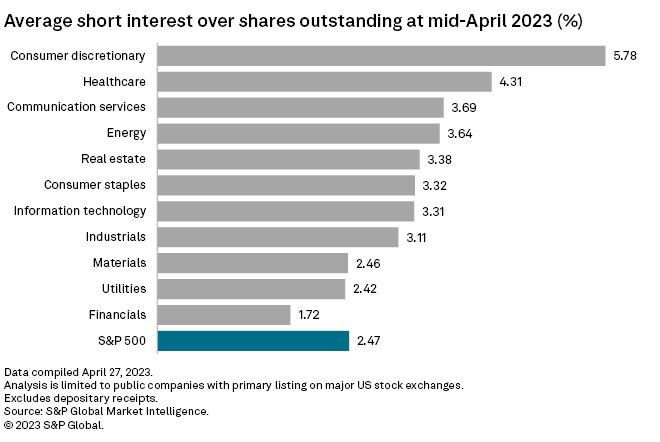

Short interest in information technology stocks was at 3.31% as of mid-April, the highest level since the end of October 2022, according to the latest S&P Global Market Intelligence data.

Since the beginning of the year through April 28, the S&P 500's IT sector has climbed about 23.23% compared with the overall index, which has gained about 9.03%. The S&P 500 IT sector lost 29.63% in 2022. Tech stocks have rallied as companies have cut costs and slashed staffing levels after sliding throughout much of 2022. Short sellers are likely betting that the cuts will not be enough to counter the economic impacts of ongoing rate hikes from the Federal Reserve and the likelihood of a recession later this year.

Short interest, which measures the percentage of outstanding shares held by short sellers, is generally on the rise on major US stock exchanges, the data shows. Short interest rose from the end of March to mid-April in every sector except energy, where it fell to 3.64% from 3.70%. Short sellers seek to profit on a stock's decline by borrowing and selling shares at a higher price, then repurchasing them after a drop and pocketing the difference.

IT breakdown

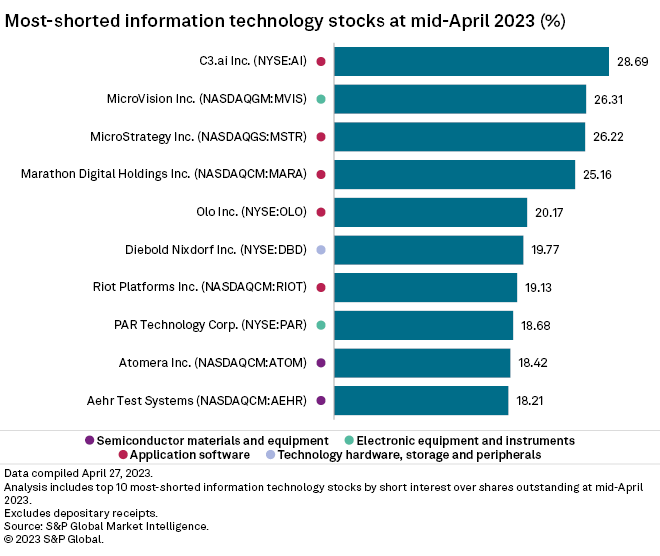

Internet services and infrastructure stocks were the most shorted within the IT sector, at 4.46%, with semiconductor materials and equipment second at 4.22%.

Most shorted

C3.ai Inc., a provider of artificial intelligence software, was the most shorted IT stock as of mid-April, with 28.69% short interest. The company's stock has plunged about 47.38% from its April 3 high as the company denied a short-selling firm's allegations of accounting issues.

Altamira Therapeutics Ltd. was the most shorted stock on major US exchanges as of mid-April. Short interest in the company surged to 50.13% by mid-April from 14.22% at the end of March.