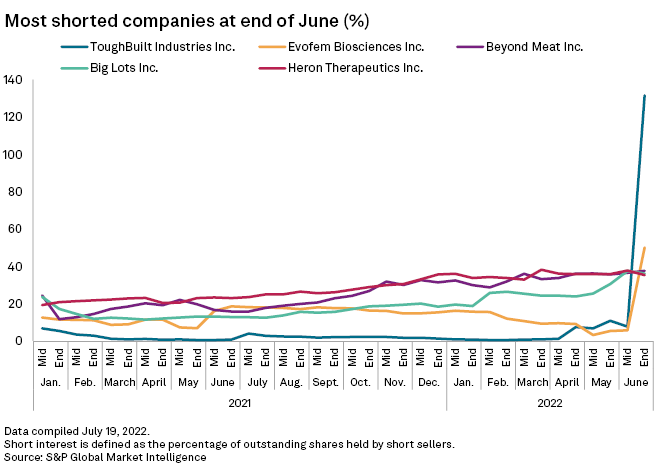

Short interest in a women's contraception developer climbed sharply after the Supreme Court struck down Roe v. Wade, while short selling of a tool company surged to levels not seen since the early days of the meme stock craze.

Short interest in ToughBuilt Industries Inc. hit nearly 132% at the end of June, while short interest in Evofem Biosciences Inc. topped 50%, according to data from S&P Global Market Intelligence. They were the two most-shorted companies at the end of the month.

Short interest measures the percentage of outstanding shares held by short sellers, who make money when a stock declines by selling borrowed shares and buying them later at a lower price.

Surging shorts

ToughBuilt designs, manufactures and distributes tools and accessories. The company's stock price has fallen 95% since the beginning of the year as the housing market has shown signs of cratering.

Short interest in ToughBuilt is now at levels not seen since short interest in GameStop Corp. climbed over 100% in October 2020. Short interest in ToughBuilt was just over 1% at the start of the year and was at only 8% in mid-June before climbing to nearly 132% at the end of June. Short interest in the stock likely exceeded 100% due to a number of so-called naked short sales, where a short-sale transaction was conducted without the seller actually borrowing the shares beforehand.

Short interest in Evofem also skyrocketed at the end of June, from less than 6% in mid-June. Evofem develops and commercializes women's sexual and reproductive health products, including contraception and protection from sexually transmitted diseases. Short interest in the pharmaceutical company spiked following the U.S. Supreme Court's landmark June 24 decision that reversed the constitutional right to an abortion.

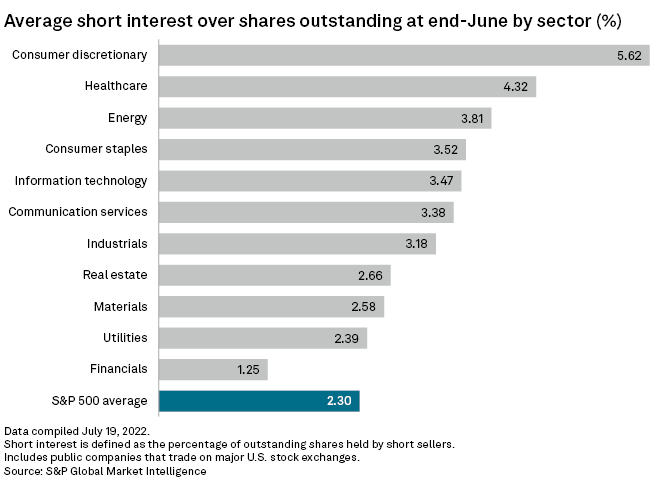

Shortest sectors

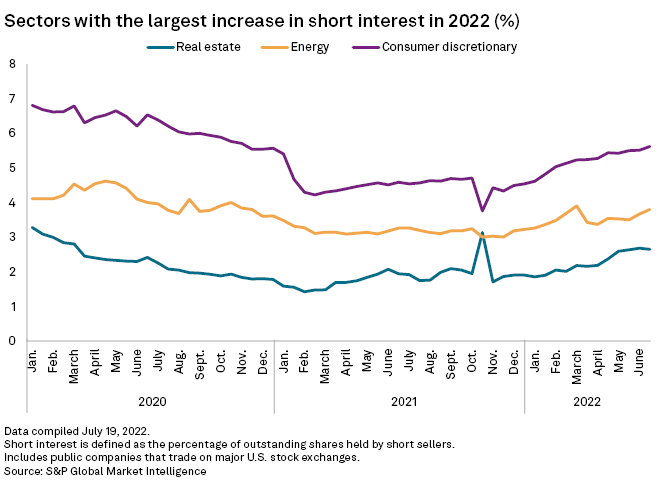

Short sellers continued to bet that soaring inflation and souring consumer sentiment would continue to hurt consumer discretionary stocks. With 5.62% short interest, consumer discretionary was the most-shorted sector on U.S. stock exchanges, followed by healthcare at 4.32%. Short interest has grown by 107 basis points for the consumer discretionary sector, 74 basis points for the real estate sector and 57 basis points in the energy sector, which has seen soaring stock prices as energy prices spiked following the Russian invasion of Ukraine.

Financials were the least shorted, at 1.25%, as investors believe the Federal Reserve's push to raise interest rates will benefit banks.

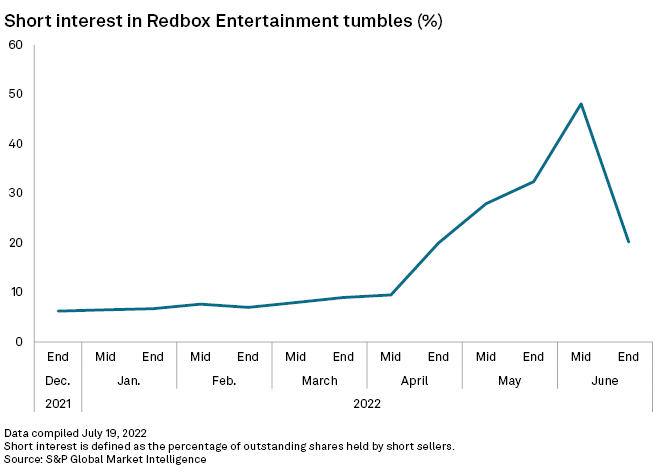

Redbox recovers

Short interest in Redbox Entertainment Inc., which was the most shorted stock as of mid-June, has faded.

Short interest in the company, which operates DVD and Blu-ray rental kiosks and has launched a digital streaming service, jumped from 9.5% in mid-April to over 48% in mid-June. Short interest in Redbox fell to about 20% at the end of June, making it the No. 42 most-shorted company on U.S. exchanges.