S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

7 Nov, 2022

By Brian Scheid and Annie Sabater

Short sellers increased their bets against the industrial sector in October, even as the sector's stocks rallied nearly 14% during the month.

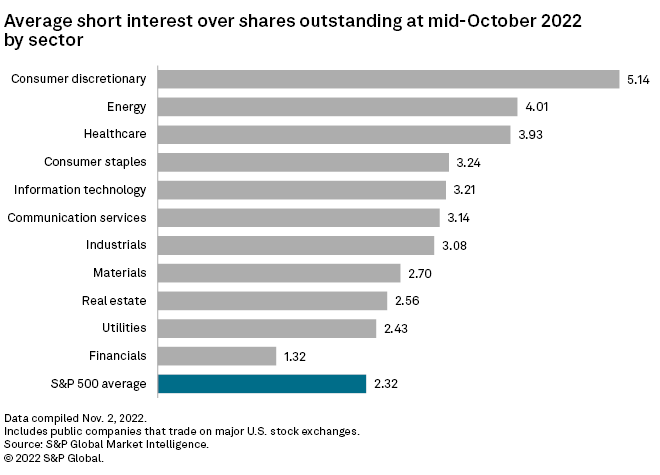

As of mid-October, short interest in industrials was at 3.08%, the highest level since 3.19% in mid-July, according to the latest S&P Global Market Intelligence data.

Consumer discretionary remained the most shorted sector, with 5.14% short interest, as the market continues to bet that soaring inflation will further eat into consumer demand. The energy sector, which saw its S&P 500 stocks rally nearly 25% in October on high oil and gas prices, was the second-most shorted U.S. sector at 4.01%. Short interest in the energy sector has not been this high since the end of October 2020, when it was also at 4.01%.

Short interest measures the percentage of outstanding shares of a particular company held by short sellers, which make money when a stock's price falls by selling borrowed shares and buying them later at a lower price.

Overall short interest in the S&P 500 averaged 2.32% as of mid-October, the highest since the end of October 2021 when it was at 2.54%.

Sector focus

Within the industrials sector, security and alarm services stocks were the most shorted at 6.99%, followed by airlines at 4.95% and heavy electrical equipment at 4.93%.

Agrify Corp., a provider of cultivation and extraction solutions for the cannabis industry, was the most shorted industrial stock with 23.3% short interest.

Most-shorted overall

Beyond Meat Inc. was the most shorted stock on U.S. exchanges as of mid-October, with short interest of 37.29%, followed by Bed Bath & Beyond Inc., which had short interest of 34.27%.