Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

19 Jul, 2023

Short sellers steered clear of betting against the mega-cap stocks that largely carried the equity market rally in the first half of 2023, instead targeting other areas of the S&P 500.

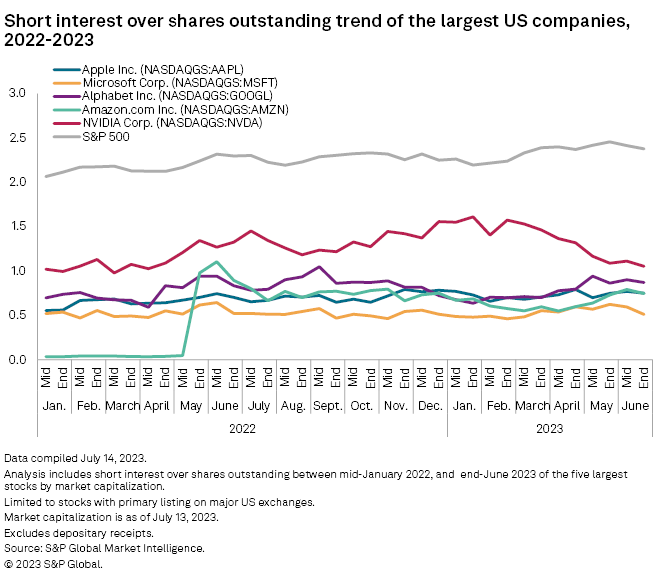

Short interest in the S&P 500 increased 20 basis points, from 2.2% at the end of December 2022 to 2.4% at the end of June. Meanwhile, the short interest for five of the index's biggest companies, Apple Inc., Microsoft Corp., Alphabet Inc., Amazon.com Inc. and NVIDIA Corp., averaged just 0.8% at the end of June and posted an average reduction in short interest over the first six months of the year.

Throughout the first half of the year, the biggest stocks surged to highs well above the broader equity indexes, yet short sellers reduced or kept flat their positions against them while increasing their overall bets against the stock market, according to the latest S&P Global Market Intelligence data.

Short interest measures the percentage of outstanding shares of a given company or industry held by short sellers.

Mega-cap rally

The overall decline in short interest for these big stocks took place even as these mega-cap stocks saw disproportionate rallies earlier in the year. Short interest in NVIDIA, for example, was at 1.1% at the end of June, down from 1.6% at the start of the year. NVIDIA's stock rallied nearly 190% over that time.

Most shorted

Consumer discretionary remained the most shorted sector at the end of June, with 5.32% short interest, as sellers continued to believe that persistently high inflation would hinder demand.

Healthcare and communication services were the second and third most shorted sectors, while financials remained the least shorted sector, at 1.72%, amid the Federal Reserve's push to raise interest rates.

Novavax Inc. was the most shorted stock at the end of June with 42.2% short interest, up from 35.3% at the start of the year.

The second most shorted stock at the end of June was Carvana Co. with 39.1% short interest, although that was a decline from peak short interest in the stock of 52.4% in mid-January.