S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

18 Feb, 2021

By Brian Scheid and Gaurang Dholakia

The retail trader-fueled short squeeze of GameStop Corp. and other so-called meme stocks has caused a sharp decline in short positions in U.S. equities, S&P Global Market Intelligence data shows. The trend is likely to linger as some hedge funds now view short-selling as increasingly risky.

"I think a lot of hedge funds are stepping back until the retail euphoria calms down," said Pauline Bell, an equity analyst at CFRA Research, in an interview. "Hedge funds are on the lookout. They don't want to get burned."

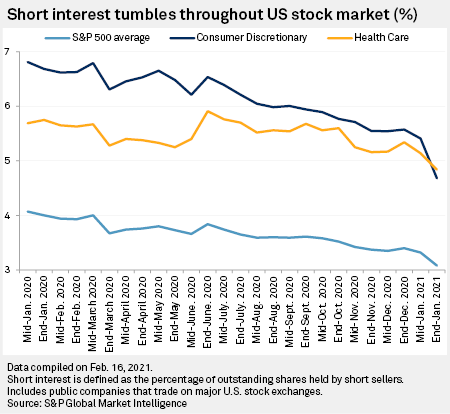

As of the end of January, the percentage of outstanding shares of S&P 500 constituent companies held by short sellers averaged 3.08%, down from 4.07% a year earlier, according to the latest S&P Global Market Intelligence data. Short sellers borrow stock and sell it in anticipation that they can replace it at a later date at a lower cost if the share price falls. If their plays are successful, short sellers profit from the difference between the price at which they sell the stock and the price at which they repurchase.

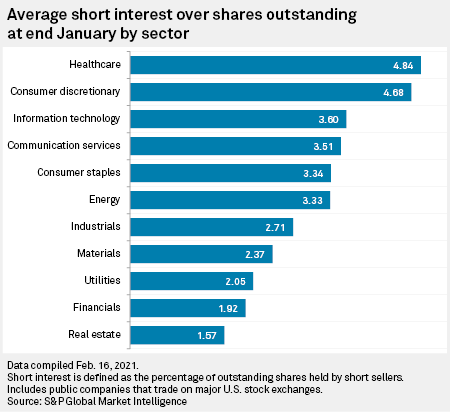

Short interest in the consumer discretionary sector, the most shorted of the S&P 500's 11 sectors in 2020, fell to 4.68% at the end of January, down from 5.41% in the middle of the month and from 6.68% at the end of January 2020. Short interest in consumer discretionary stocks remained high throughout 2020 on expectations that rising coronavirus cases and stalled government stimulus would hinder U.S. consumer spending.

Healthcare was the most shorted sector as of the end of January, the first time in over a year that consumer discretionary was not the most shorted. But short interest in healthcare stocks, as with all sectors in the index, fell as well, down to 4.84% at the end of January, from 5.14% as of mid-January and from 5.61% at the end of January 2020. Healthcare stocks continue to see relatively high short interest as the sector has underperformed the broader market and questions remain about the path forward for the pandemic, including the efficacy and distribution of vaccines.

"Playing stocks from the short side has always had inherent risks to it and that's even before you consider the costs of borrowing the stock," said Michael Hewson, chief market analyst with CMC Markets, in an interview. "Given recent events, it makes sense — as well as sensible risk management — to pare back risk at a time when the focus has been on overexposure with respect to positioning."

The practice of short selling drew the ire of thousands of retail traders who campaigned on Reddit and other online platforms to buy distressed stocks. The clash between retail traders and institutional investors drove many stocks frequently targeted by short sellers to record highs. Most notable among them was GameStop, which traded just above $17 per share at the start of 2020 but was driven up to an intraday high of $483 on Jan. 28, inflicting losses on short sellers before the retail investors retreated. GameStop shares closed at $45.94 on Feb. 17.

The vast majority of these stocks have seen their short interest greatly diminished.

GameStop, for example, had a short interest as a percentage of float of 132% as of Feb. 8, meaning there was more short interest than the company had shares. That percentage was down to 46% as of Feb. 16, according to an analysis by CFRA Research. Over the same period, soft-drinks maker National Beverage Corp. saw its short interest fall from 83% to 46%, while department store operator Dillard's Inc. saw a decline from 72% to 38%. Short interest in home furnishings retailer Bed Bath & Beyond Inc. fell from 69% to 29%.

While the GameStop saga may have changed Wall Street's speculative strategies, it also has been the proverbial "shot across the bow" for a subset of hedge funds oriented around short-selling, said Matt Weller, global head of market research at GAIN Capital. "After a year of increasingly large losses on their short books, many large investors appear to be throwing in the towel on their short books," Weller said in an interview. "Whether this turns out to be a prudent risk management decision or a perfect contrarian indicator remains to be seen."

Short interest as a percentage of shares outstanding is in decline, but the amount of money in short interest positions appears to be increasing, according to an analysis by Ihor Dusaniwsky, managing director at S3 Partners. Dusaniwsky's analysis found that short interest in the Russell 3000 index, as a percentage of float, fell from 7.2% as of Dec. 29, 2020, to 5.83% as of Feb. 16, 2021, but the amount of money in short interest positions in the index jumped by about 4.1% over the same timeframe.

Dusaniwsky equated this to a blackjack player on a winning streak, betting higher value chips as profits accumulate. "If an observer was just looking at the number of chips you are betting they would surmise that you were reducing your bets, but an observer looking at the dollar value of your bets would understand that the size of your bet was increasing," Dusaniwsky said in an interview.