S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

16 Mar, 2021

By Brian Scheid

After being stunned by the GameStop Corp. squeeze, short selling remains at relatively low levels but may have already hit rock-bottom.

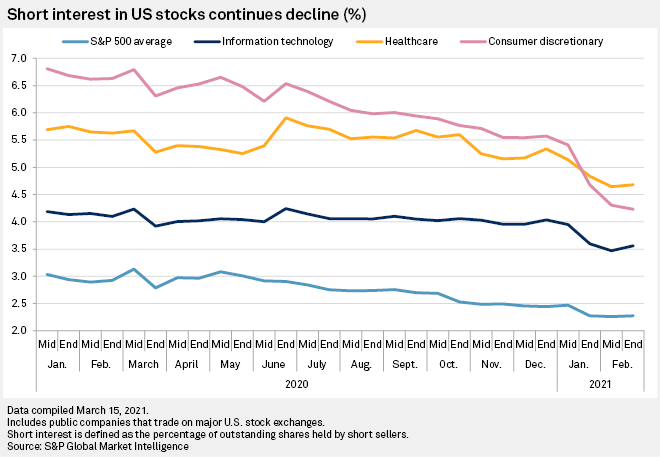

By late February, short interest in U.S. stocks was averaging 2.95%, down 45 basis points from the end of 2020 when short interest averaged 3.4%, but slightly up from mid-February when average short interest dipped to 2.94%, according to S&P Global Market Intelligence data.

Short interest in the S&P 500 was at 2.28% at the end of February, down from 2.47% in mid-January, shortly before GameStop and other so-called meme stocks rattled the market in late January. While still down 39 basis points from the recent peak, average short interest in the large-cap index was up 2 basis points from mid-February levels, the data shows.

While short interest only saw a modest uptick in equities markets, analysts said a bottom may have been reached after many institutional investors abandoned their short trading strategies in late January.

"I think if short-sellers haven't been shaken out by a decade-long rally, they're not going to give up now," said Marshall Gittler, head of investment research at BDSwiss. "With many of the indices at record highs, someone somewhere has got to be taking aim at something."

Short-sellers borrow stock and sell it in anticipation that they can replace it at a later date at a lower cost if the share price falls. If their plays are successful, short-sellers profit from the difference between the price at which they sell the stock and the price at which they repurchase.

Short interest appeared to steady in February as stocks reached new highs. The S&P 500 had five separate record-high settlements in February. That trend is expected to continue as stocks continue to rally on hopes that the $1.9 trillion U.S. stimulus plan will spur more consumer spending.

But while short positions may have steadied amid new record highs in equity markets, a surge in short positions remains unlikely, said Matt Weller, global head of market research at GAIN Capital.

"I don't expect short interest for the broader markets to rise back to pre-Gamestop levels until we enter a sustained bear market," Weller said in an interview. "After more than a decade of bleeding value, capped off by a series of spectacular short squeezes earlier this year, shorts are likely to err on the conservative side until they see the strategy start working again."

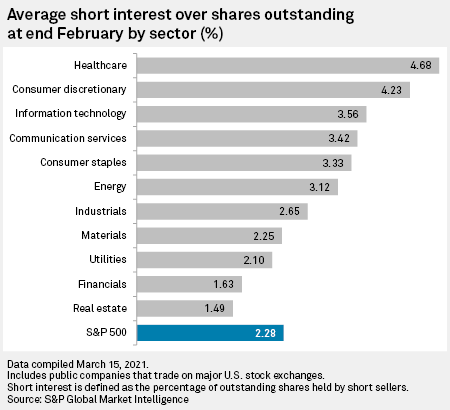

U.S. healthcare stocks lead all sectors with 4.68% in short interest by the end of February.

Gittler with BDSwiss said that the relatively high level of short interest in the healthcare sector may be due to lingering impacts of the coronavirus pandemic, which has forced hospitals to delay some more profitable discretionary operations.

"You might think that a medical disaster and overflowing hospitals would be a boon to the industry, but apparently it wasn't," Gittler said.

Default odds for U.S. healthcare facilities fell significantly in early March from a spike during the early days of the pandemic, according to S&P Global Market Intelligence data.