S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

15 Sep, 2022

By Brian Scheid

Investors have been pulling back on their bets against U.S. equities as short interest has declined across the board.

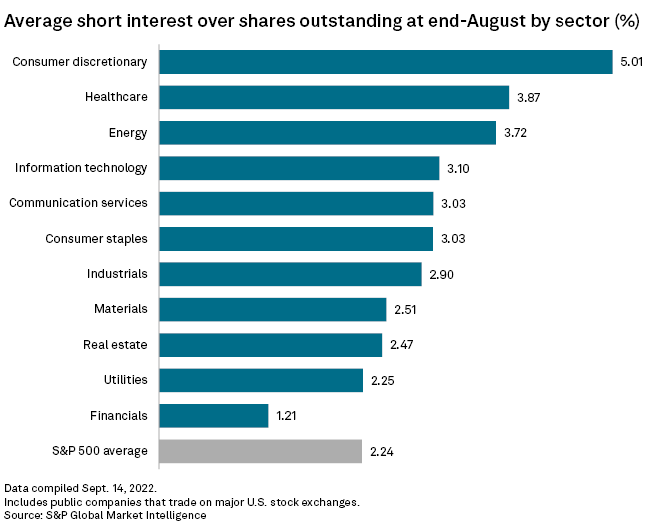

As of the end of August, short interest in communications stocks traded on major U.S. exchanges settled at 3.03%, down 35 basis points from mid-June and at their lowest point in the sector since mid-January, according to data from S&P Global Market Intelligence.

Short interest measures the percentage of outstanding shares of a certain held by short sellers, who make money when a stock's price falls by selling borrowed shares and buying them later at a lower price.

Consumer discretionary stocks

Short interest in every sector fell throughout August, except for utilities, where short selling was essentially flat.

Consumer discretionary stocks remained the most-shorted sector on major U.S. exchanges as sellers continue to bet that inflation will eat into consumer demand. Even still, short sellers backed away a bit from that sector in the latter part of the summer. Short interest in consumer discretionary stocks fell to 5.01% at the end of August, down 61 basis points from the end of June and their lowest level for the sector since the end of January.

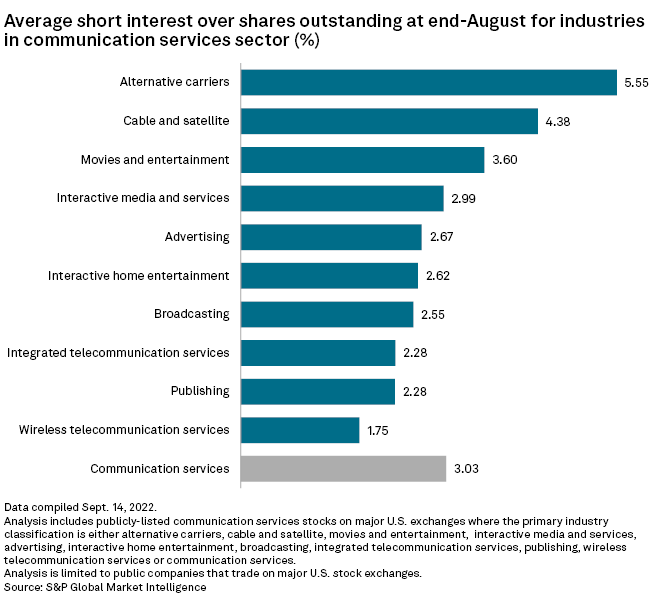

Within the communication services sector, alternative carriers stocks were the most shorted, at 5.55% of short interest, followed by cable and satellite stocks, with 4.38% short interest.

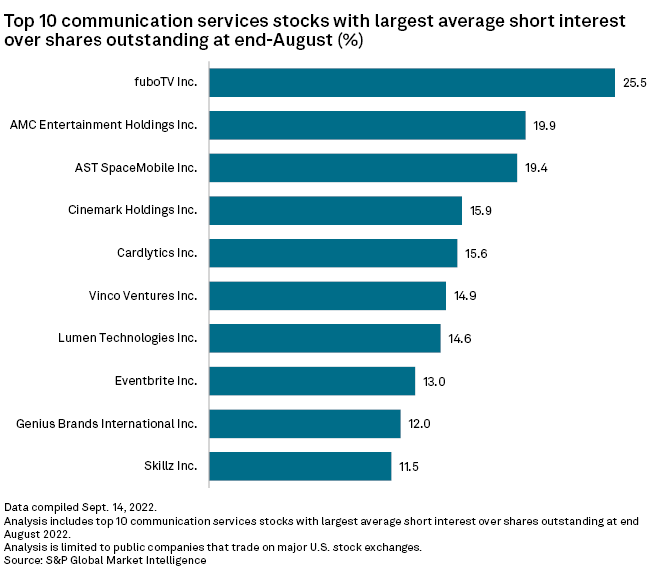

FuboTV Inc. was the most shorted of all communication services stocks in this analysis with a 25.5% short interest, followed by AMC Entertainment Holdings Inc. and AST SpaceMobile Inc., which had short interests of 19.9% and 19.4%, respectively.

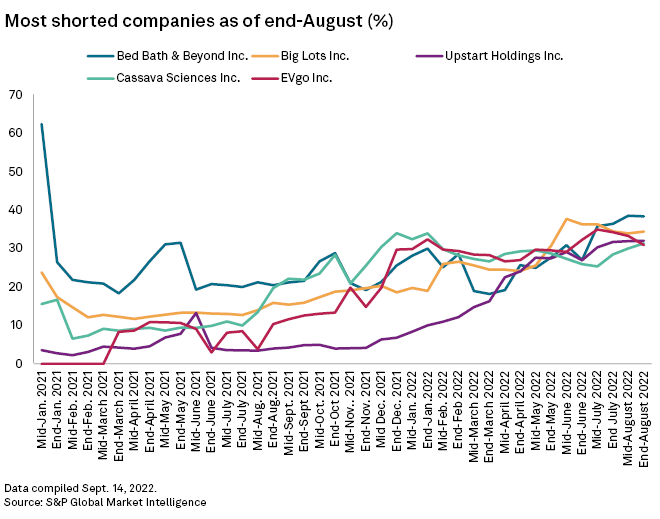

Bed Bath & Beyond Inc. was the most shorted stock on all major U.S. exchanges at the end of August, with short interest of 38.43%, followed by Big Lots Inc. at 34.44%.