S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

4 Nov, 2021

By Annie Sabater

Short sellers have increased their bets against consumer discretionary stocks amid falling consumer sentiment and expectations of further shipping delays tied to worsening global supply chain bottlenecks.

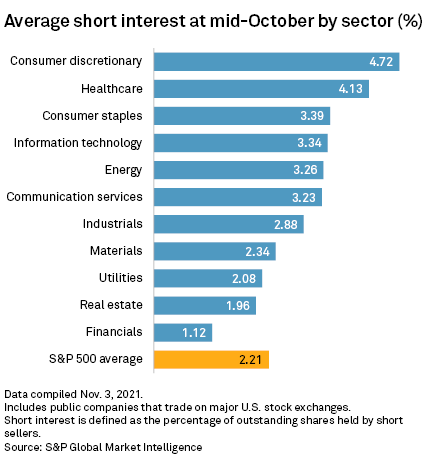

Short interest in consumer discretionary stocks climbed to 4.72% in mid-October, according to the latest S&P Global Market Intelligence data. Short interest in the sector is at its highest level since mid-January when it was at 5.41%. The sector has been the most shorted in major U.S. stock markets since mid-August.

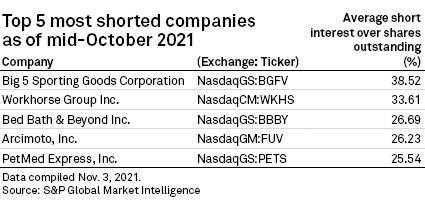

Eight of the 20 most-shorted stocks on major U.S. exchanges as of mid-October were consumer discretionary stocks, including Big 5 Sporting Goods Corp., Bed Bath & Beyond Inc., PetMed Express Inc. and Kirkland's Inc. Consumer discretionary companies, such as Amazon.com Inc., Tesla Inc. and The Home Depot Inc., typically sell goods and services viewed as nonessential, such as clothes and cars.

Short sellers borrow stock and sell it in anticipation that they can replace it at a later date at a lower cost if the share price falls. If the strategy is successful, short sellers profit from the difference between the price they sold the stock for and what they pay to repurchase it.

The data shows that short sellers are increasingly betting the consumer discretionary sector is bound to stumble as inflation heats up and rising energy prices could hinder household spending ahead of the holiday season.

"Despite the healthy job market, consumer sentiment has turned down due to inflation and energy prices," said Michael Crook, deputy chief investment officer at Mill Creek Capital Advisors. "If consumers pull back on spending it'll likely first show up in consumer discretionary stock prices."

The University of Michigan's consumer sentiment index fell to 70.3 in August, 72.8 in September and a preliminary 71.7 in October, the lowest points in nearly a decade. The index reached 101 in February 2020, its highest point in nearly two years, shortly before the pandemic hit the U.S.

At the same time, port closures and congestion, coupled with supply shortages and rising shipping costs, have hampered the movement of goods worldwide.

This pressure worsened in October, said Oren Klachkin, lead economist with Oxford Economics.

"Preliminary data show that logistics difficulties remained the most acute source of stress while prices, activity, and labor challenges increased," Klachkin wrote in a Nov. 3 note. "Inventory pressures fell slightly, but conditions remain far from optimal as supply struggles to keep up with demand."

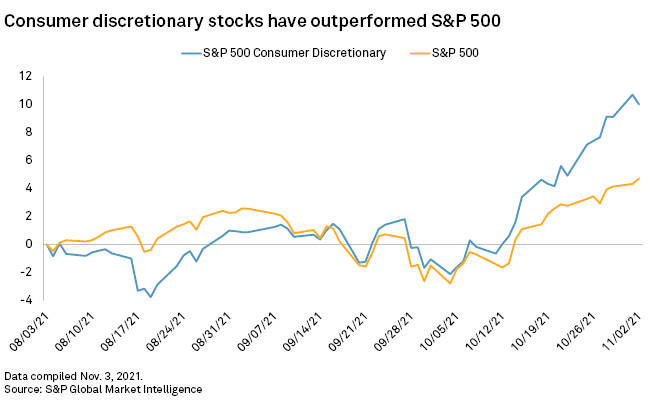

S&P 500 consumer discretionary stocks have rallied nearly 10% over the past three months, outpacing the broader, large-cap index which has jumped just less than 5% over the same stretch.

Still, short sellers likely believe the rally in consumer discretionary stocks may be nearing a peak as the S&P 500 breaks new record highs.

"Parts of Wall Street think this stock market has gone far enough now that stimulus is being taken away and supply chain issues remain the same," said Ed Moya, a senior market analyst with OANDA.

Supply chain issues, along with the Federal Reserve's plans to gradually tighten its ultra-loose monetary policy, may be emboldening short selling in consumer discretionary stocks, Moya said.

"The Fed decision to taper asset purchases alongside supply chain issues is a one-two punch to the economy that will test the strength of the U.S. consumer that has already absorbed so many price increases," Moya said.