S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

S&P Global Offerings

Featured Topics

Featured Products

Events

1 Mar, 2022

By Brian Scheid and Annie Sabater

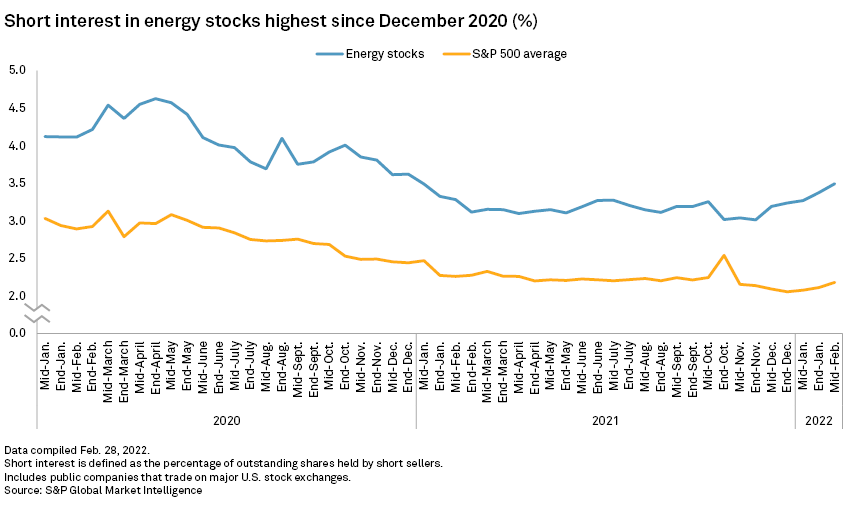

Short sellers are increasing their bets against energy stocks to the highest level in more than a year.

The latest data from S&P Global Market Intelligence shows that short sellers seem to believe that the recent rally in energy stocks may be petering out, even with oil prices surging to their highest levels since 2014.

Energy shorts

Short interest in energy stocks traded on all major U.S. exchanges was at 3.49% at mid-February, up nearly 50 basis points from the end of November and the highest point since the end of December 2020.

The move by short sellers into energy stocks comes as the sector has significantly outperformed the rest of the market. From the start of the year to Feb. 28, the S&P 500 declined 8.2% while the S&P 500's energy sector rallied by 26.5%.

Shorts climb

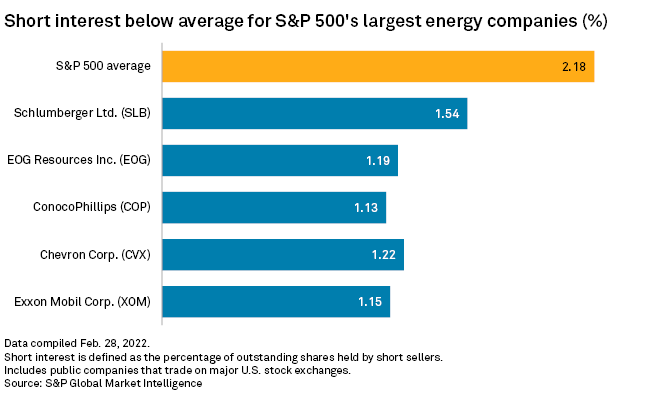

Short sellers, who bet on a stock's decline by selling borrowed shares in hopes of buying them later at a lower price, have decreased their positions in the U.S. stock market since early 2020. But the recent decline in equities has led to a modest increase in short selling with short interest in the S&P 500 inching up to 2.18%, up 12 basis points from the end of December 2021.

The consumer discretionary sector remained the most-shorted sector as of mid-February, as short sellers continued to bet that soaring inflation would eat into demand for nonessential goods. Short interest in the consumer discretionary sector was over 5% for the first time since mid-January 2021, according to Market Intelligence data.

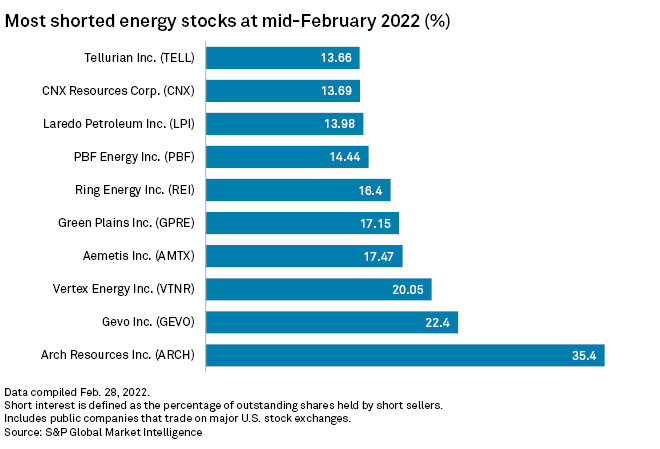

Most shorted

Arch Resources Inc., a St. Louis-based coal and processing company, was the most-shorted energy company and second most-shorted company across sectors as of mid-February. Short interest in the company was at 35.4%, up from 21.6% a year ago.

Blink Charging Co., an electric vehicle-charging company, was the most shorted company as of mid-February at 36.2%, as short sellers continued to bet against the EV sector.

The 10 most-shorted energy stocks had an average of 18.5% short interest as of mid-February.

Largest energy stocks

Short sellers appear to have little interest in the five largest energy stocks on the S&P 500, which all have short interest below the S&P 500 average of 2.18%.

Exxon Mobil Corp., for example, had short interest of less than 1.2% as of mid-February.