Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

23 Aug, 2023

By Peter Brennan and Chris Hudgins

|

Shopping malls that survived the carnage caused by the rise of online shopping and the COVID-19 pandemic are finding opportunities to flourish.

Population shifts into suburbs and sunnier, low-tax states are boosting demand in some locations, while malls moving toward destination retail are pulling in customers looking for an experience beyond simply shopping.

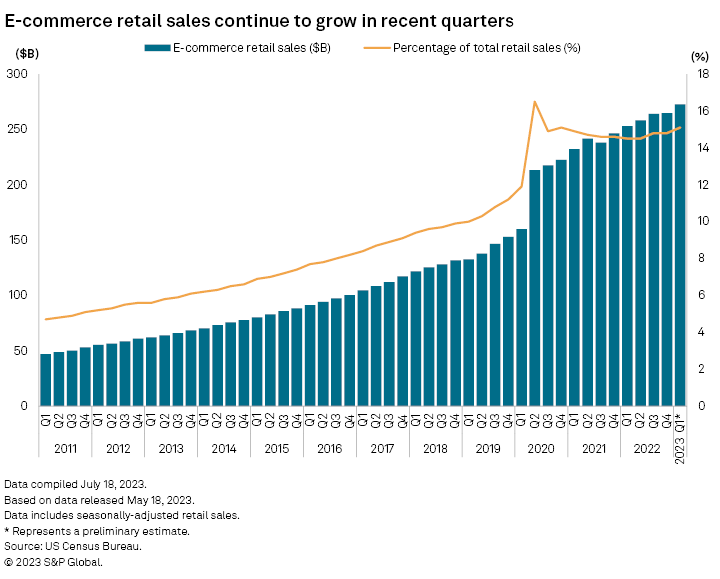

E-commerce has stagnated at about 15% since the second half of 2020, bringing a halt to the relentless climb in the previous decade, which peaked at 16.5% during the pandemic lockdown.

"Brick and mortar retail is not dead, it's just evolving," said Ross Prindle, global head of the Kroll Real Estate Advisory Group, in an interview. "[Shoppers] want to go to the movies and eat at nice restaurants. Destination retail creates a lifestyle venue for consumers looking to shop, seek entertainment and gain community."

Consumers return to shops

The outlook comes against a less than rosy backdrop, with retail one of the hardest hit segments of the commercial real estate sector. The twin existential threats of online shopping and COVID-19 will in the end claim nearly 33% of the 1,200 malls that were in the US in 2016, according to estimates by Compass Point Research & Trading.

Real estate assets endured a miserable pandemic as lockdowns forced mass closures then, as the virus lingered, footfall was sluggish when places reopened. While they have recovered somewhat subsequently, returns in the Dow Jones Equity All REIT index have badly lagged the S&P 500. Indexes for regional malls and strip centers fared even worse, with both lower than they were pre-COVID 19.

For larger malls, rising occupancy levels, improving underlying net operating income growth and positive lease spreads mean they are performing well, according to Floris van Dijkum, managing director and senior research analyst at Compass Point Research & Trading.

"The mall industry is emerging from a period of crisis in solid shape while office is undergoing a similar secular demand hit that retail experienced with e-commerce," van Dijkum said in an interview. "Supply and demand should favor all retail landlords, both mall and shopping center, as the store remains the most profitable distribution point."

The sector has been helped by resilient consumer spending despite high inflation and rising mortgage costs eroding buying power.

"We are seeing that at our centers," said Thomas O'Hern, CEO of Macerich Co., on an Aug. 8 earnings call. "Consumers are shopping, eating out and travelling at pre-pandemic levels. Those trends bode well for the A quality malls."

Changing landscape

Demographic changes have shifted the opportunities in commercial real estate. Working from home encouraged people to move outside of cities where housing is larger and more affordable. The sector continues to struggle in areas such as Manhattan and the Chicago Loop as many employees work remotely, leaving some offices vacant and reducing footfall in local shopping centers.

The decision of city dwellers to move to the suburbs has been beneficial to some strip malls, which can benefit from the presence of an anchor shop like a large grocery store that draws repeat customers.

Department store chain Macy's Inc. launched miniature versions of its brand in strip centers, dumping some of its locations in less fashionable malls, to capitalize on changing shopping habits.

Simon Property Group Inc. is benefiting from its portfolio being positioned in high catchment areas in the suburbs, as well as in states where population growth has bolstered demand.

"Where you're seeing population growth — Texas, Tennessee, Florida — those kind of places are seeing a little bit more of the outsized demand," David Simon, CEO of Simon Property Group, said on an Aug. 2 earnings call.

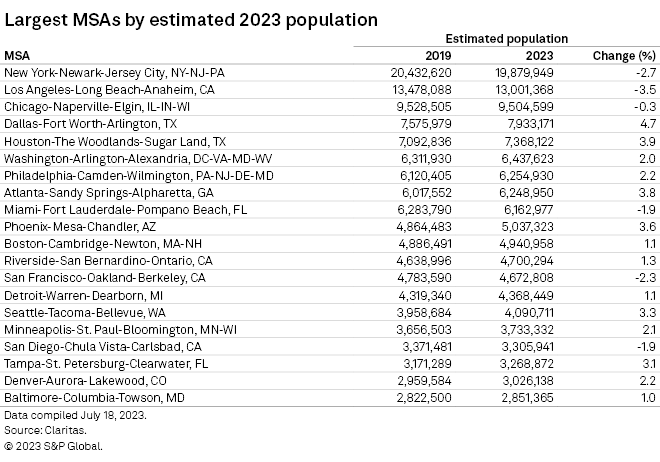

Declining populations contributed to falling foot traffic in major cities like New York and Los Angeles. Between 2019 and 2023 the estimated population of the New York metropolitan area declined by 2.7%, while Los Angeles and San Francisco experienced declines of 3.5% and 2.3%, respectively.

By contrast, populations have grown in low-tax states on the sunbelt including Texas, Georgia and Florida. Growth in the Dallas metropolitan area totaled 4.7% during that period.

Yet while these broad areas now have more people, Simon warned that the success of each retail site is "very location oriented."

"In real estate, you could still have the best location in kind of a microenvironment that does unbelievably well because it still is the center of attention," he said.

And if you are not in the right location, then you will struggle, added Prindle, from Kroll.

"Post-COVID, A+ rated regional malls continue to do well, however B/C rated malls are seeing declining occupancy and lower rental rates," Prindle said.