Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

17 Nov, 2022

By Dylan Thomas and Annie Sabater

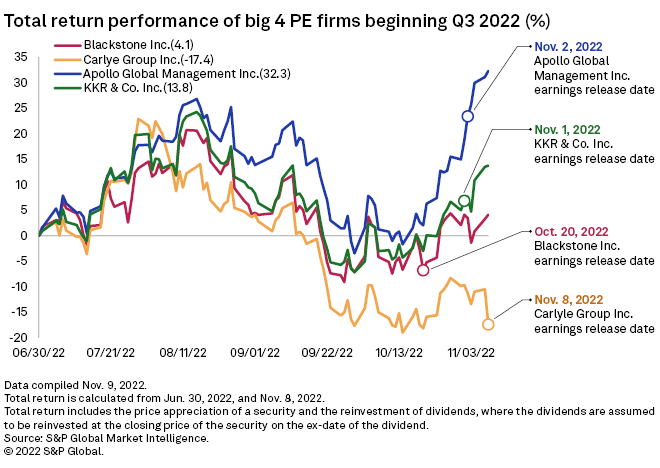

Each of the four largest publicly traded alternative asset managers saw their values decline in the third quarter as choppy macroeconomic conditions rattled profits and the investment performances of Blackstone Inc., Apollo Global Management Inc., KKR & Co. Inc. and The Carlyle Group Inc.

All four posted a negative total return performance over the 90 days ended Sept. 30. Only Apollo performed better than the S&P 500 over that period, shedding 3.4% of its value as the index dropped 4.9%.

That is a slight improvement in their collective performance from the second quarter, when all four trailed the S&P.

The subdued tone of end-of-quarter earnings calls reflected the challenging economic conditions, but it was not all negative. The same factors slowing the firms' third-quarter performances are expected to create discounted buying opportunities for private equity.

"Oftentimes, our best vintages result from investments made during periods of market distress," said Robert Lewin, CFO of KKR, on his firm's third-quarter earnings call.

Negative performance

Carlyle had the roughest quarter of the four, with its total return performance declining by 17.6%, while both Blackstone's and KKR's values slipped by 7.1%. The down quarter occurred despite Carlyle reporting by far the largest net profit of the group, $280.8 million for the quarter, while managing to grow the value of its private equity investments a slight 1%.

The other three wrote down the values of their private equity portfolios during the quarter, with KKR registering a decline of 4%, the largest of the group. By comparison, Apollo and Blackstone discounted their private equity investments by less than half a percentage point over the period.

* Access dividend projections on Eclipse by S&P Global.

* Read about TPG Inc.'s third-quarter results.

* Read about third-quarter results for Ares Management Corp.

Net positivity scores

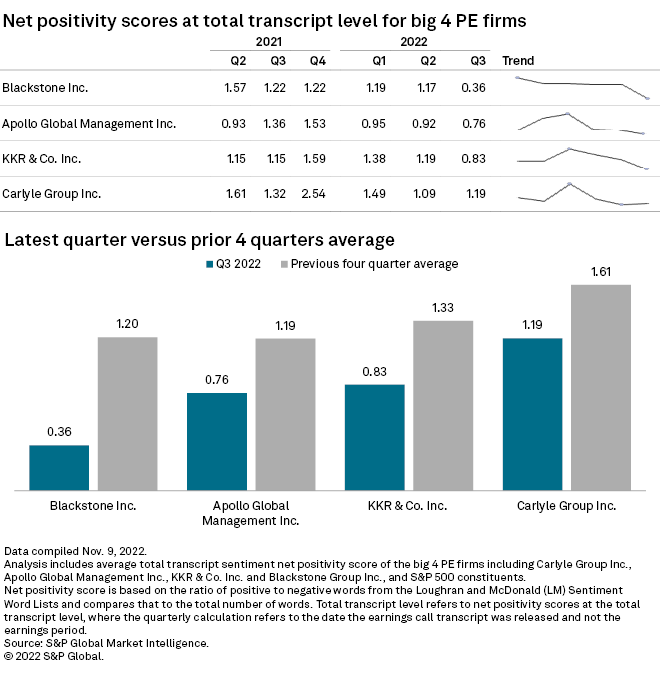

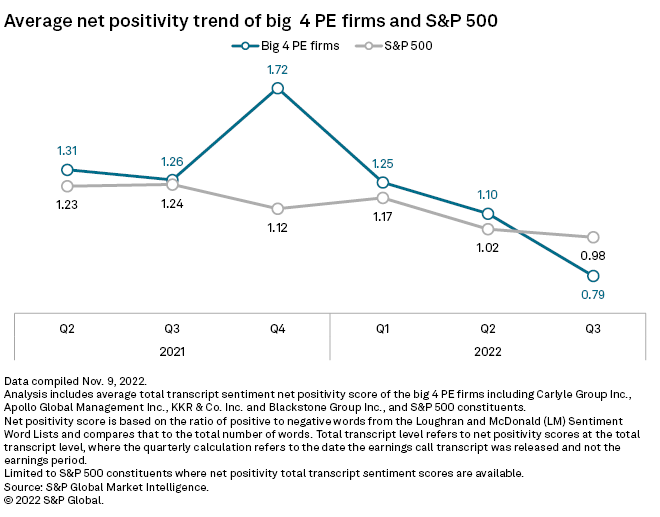

The stark reality of near-term challenges tempered executives' optimistic investment outlook, with Blackstone CEO Stephen Schwarzman describing the moment as "one of the most difficult periods for markets in decades." Each of the firms' third-quarter earnings calls logged a lower net positivity score than the previous four-quarter average, according to an analysis of the language used by executives and analysts on the calls.

Slower deal activity tied to market uncertainty and higher interest rates was a common theme across the calls, as was a tougher environment for fundraising. Peter Clare, chief investment officer of corporate private equity for Carlyle, said the fundraising arena was "clearly congested," even as he expressed confidence that the firm's funds currently in the market would meet or exceed prior vintages.

Carlyle, which is in search of a CEO and saw net profits decline by nearly half year over year in the most recent quarter, was the only one of the four to record an uptick in optimism on its third-quarter earnings call, with the net positivity score increasing slightly from the previous quarter.

Average net positivity grades for the four firms hit a recent peak in the fourth quarter of 2021, just after the close of a record year for private equity.

Dividend forecast

Apollo is projected to boost its dividend from its minimum 40 cents per share in the third quarter to 60 cents in the fourth quarter, according to Eclipse, a part of S&P Global. The forecaster assigned a low confidence grade to the dividend prediction, noting that payouts above the minimum dividend are tied to Apollo's performance and that one-third of the $15 billion in "excess capital" the firm expects to generate over the next five years is dedicated to dividends.

For Blackstone, a 90-cent-per-share dividend payout is expected in the fourth quarter, equal to its third-quarter dividend. Eclipse predicts with medium confidence that the dividend will climb to $1.64 per share by the end of 2023 and bases its forecast on a "consensus of broker estimates."

Carlyle is projected to pay a 32.5 cents per share dividend in the fourth quarter. The firm wrote up its investment portfolio in the third quarter, increasing the firm's carry balance and generating "significant" distributable earnings, Eclipse noted.

KKR's practice is to review its dividend just once annually, and the forecasting firm predicts with high confidence that KKR's dividend in the fourth quarter will be 15.5 cents per share.

Steady AUM growth

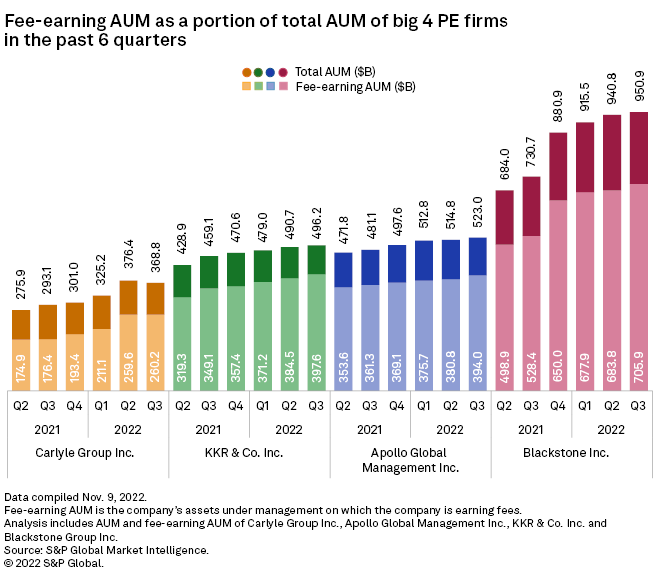

Despite the challenging investment environment, the four firms remain a magnet for investor capital, with all four reporting assets under management at or near record levels at the end of the third quarter. Collectively, the Big Four now control more than $2.3 trillion, and all four have seen growth in the portion of those assets that generate fees for at least six consecutive quarters.

Only Carlyle reported shrinking AUM in the third quarter, with a $368.8 billion total at the end of the quarter representing a decline of 2% from the second quarter.

The four asset managers also reported a collective $420 billion of investable capital across their various business lines, which can include real estate and private credit strategies alongside traditional private equity.

Apollo co-President Scott Kleinman anticipated a growing opportunity to put his firm's dry powder to use.

"We're operating with a pipeline that is three times as large as it was just this time last year, and we expect to commit a significant amount of capital in the coming quarters," Kleinman said.