Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

13 Jul, 2022

By Zoe Sagalow

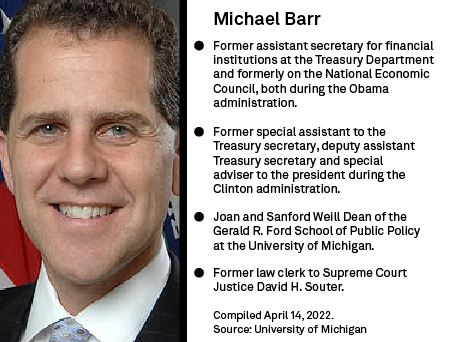

The Senate approved Michael Barr's nomination to become vice chair for supervision of the Federal Reserve Board of Governors by a vote of 66-28.

The Fed has operated with a vacancy in that role since October 2021 when Randal Quarles' four-year term expired. After Barr is sworn in, all seats on the board will be filled for the first time since Aug. 31, 2013. Barr will play a lead role in developing policy in areas such as evaluating merger applications and addressing capital requirements.

The Fed is reviewing several $1 billion-plus bank M&A deals, including U.S. Bancorp's proposed acquisition of MUFG Union Bank NA, The Toronto-Dominion Bank's proposed purchase of First Horizon Corp. and BMO Harris Bank NA's proposed acquisition of Bank of the West.

The delays in approvals over the past several months are likely related to Fed board vacancies, forcing Fed governors to pull "double and triple duty," said Clifford Stanford, partner at Alston & Bird LLP.

Arnold & Porter Kaye Scholer LLP Partner Michael Mancusi cited the vacancy of the Fed's vice chair for supervision as the main reason some deals are facing a prolonged approval process. President Joe Biden has also made scrutinizing mergers and acquisitions a priority, issuing an executive order in July 2021 to call for updated merger guidelines for banks and tougher examination of depository deals.

Other than specific applications, there will be quite a bit on the Fed's plate, after Barr arrives, that will likely be more urgent than changing M&A review processes, including addressing the supplementary leverage ratio and the international capital rules referred to as the Basel III Endgame, said Derek Tang, economist at Monetary Policy Analytics. The supplementary leverage ratio applies to banks with over $250 billion in assets and requires them to hold a minimum of 3% common equity capital against their total leverage exposure. The largest and most complex bank holding companies must hold an additional 2% buffer.

"He really wants to come in and kind of get a holistic view on the systemic risk in the system," Tang said recently. "I think he really does have a focus on that, making sure that the different pieces of the Fed's regulatory apparatus actually work together well."

Leading up to the confirmation

Barr is the Joan and Sanford Weill Dean of the Gerald R. Ford School of Public Policy at the University of Michigan. Barr helped craft the 2010 Dodd-Frank Act as assistant Treasury secretary for financial institutions during the Obama administration.

Biden nominated Barr after the president's first nominee for the role, Sarah Bloom Raskin, withdrew her candidacy. Raskin, a former Federal Reserve governor and former deputy Treasury secretary, faced opposition from Sen. Joe Manchin, D-W.V., and Senate Republicans over her position on regulating bank activities related to climate change and associated risks.

Republicans also questioned Raskin's actions in her former role on the board of The Reserve Trust Co., a financial technology company that was granted a Federal Reserve master account.

Barr's term as vice chair for supervision will last until 2026. Barr was also confirmed to fill the remainder of Quarles' term as a board member, which will expire in 2032.

Biden's other nominees to the Fed — Lisa Cook, Philip Jefferson, Jerome Powell and Lael Brainard — took office in May. Brainard was already a member of the board and became vice chair. Powell was renominated as chair by Biden and was sworn into a second term in May.