Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

1 Sep, 2022

By Dylan Thomas and Annie Sabater

A U.S. effort to bolster domestic semiconductor manufacturing is likely to spur more private equity investment in the capital-intensive industry and the businesses that support it, industry sources told S&P Global Market Intelligence.

The CHIPS Act signed into law Aug. 9 by President Joe Biden is expected to channel roughly $280 billion over the next decade into domestic semiconductor science and production, including $52 billion targeted at manufacturing and $200 billion for research. It creates a 25% tax credit for investment in advanced chipmaking facilities.

"If a PE can structure a deal in a way that they can share in that CHIPS funding, then that obviously could be very attractive to them," said John Ferguson, CEO of TBM Consulting Group Inc., a global supply chain consulting firm.

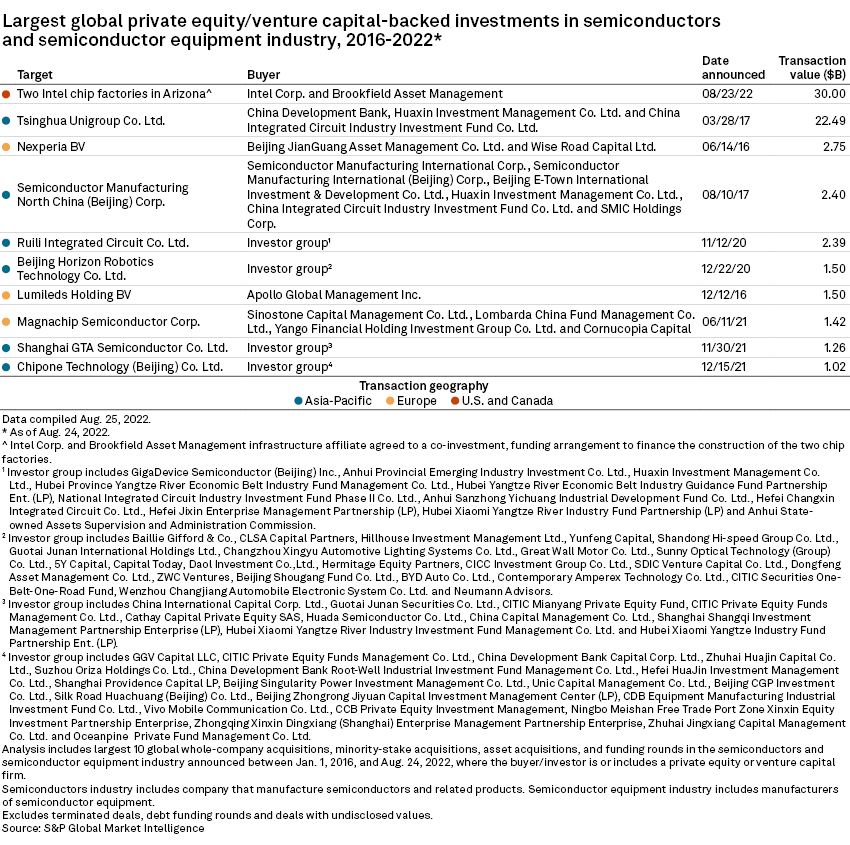

A $30 billion joint investment agreement between Intel Corp. and Canada-based private equity firm Brookfield Asset Management Inc. could be a preview of things to come. In a deal announced just two weeks after the CHIPS Act became law, Brookfield agreed to spend up to $15 billion to help Intel expand two Arizona chip factories in exchange for a 49% stake in the project.

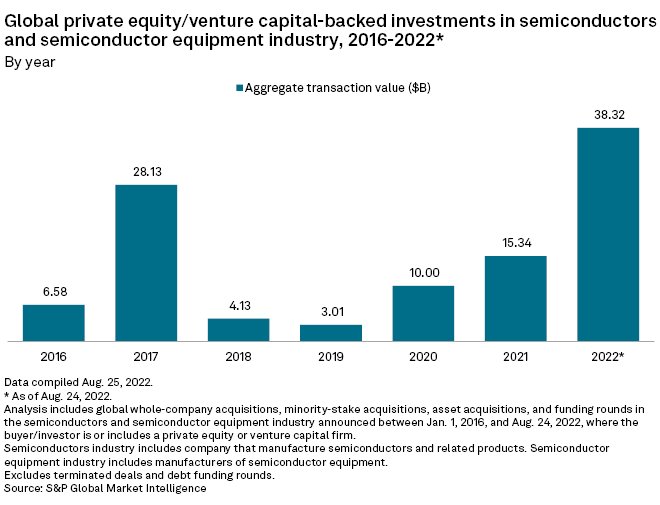

That single deal, expected to close by the end of the year, has driven private equity and venture capital investment in semiconductors globally to its highest level since at least 2016, according to Market Intelligence data.

Intel CFO David Zinsner said the deal "shows how private capital can be a force multiplier to government incentives for semiconductor manufacturing expansion." And it is just the first deal in Intel's recently launched Semiconductor Co-Investment Program, or SCIP, an effort to tap new, large sources of funding for its hugely expensive semiconductor projects.

"This program opens the door to a new source of capital, which we estimate to be sized at $2 trillion, providing ample capacity for additional programs with multiple partners over time," Zinsner said on a special investor call held after the Brookfield deal was announced.

Big and small opportunities

While private equity globally is holding near-record amounts of dry powder, Ferguson said the scale of investment required by semiconductor manufacturing means only the largest firms will be able to pull off deals like Brookfield's coinvestment with Intel. Brookfield reported $111 billion in dry powder as of the end of the second quarter, a firm record.

For smaller private equity firms, the investment opportunities opened by the CHIPS Act are likely to be in peripheral businesses that support chipmaking, said John May, founder and managing partner of CORE Industrial Partners LLC, a Chicago-based lower-middle-market firm that invests primarily in industrial technology and manufacturing businesses.

"What happens is, as the chip plants are built, there's a tangential supply base that also is created to support them, whether it be component manufacturers, servicing those facilities, et cetera. And so those are areas that we've been thinking through how to invest in this space," May said.

* Click here to download a spreadsheet of data featured in this story.

* Click here to read about trends in private equity cybersecurity investment.

* Click here to read about private equity investment in China.

Core is looking for opportunities to invest in the workforce training required to expand the U.S. chipmaking industry. May noted the CHIPS Act also funds regional technology hubs that could spin off other opportunities for private equity to deploy capital.

"We think this is a really positive signal for entering the advanced technologies space," he said.

Supply chain

The U.S. domestic chip manufacturing industry currently produces about 12% of the world's new semiconductors, down from 37% in 1990, according to the Semiconductor Industry Association, a trade group. Roughly 75% of global semiconductor manufacturing takes place in East Asia.

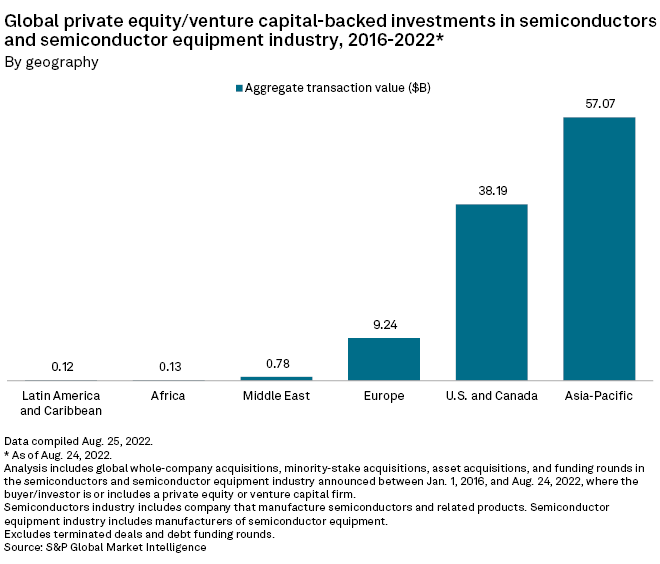

The Asia-Pacific region absorbed more than half the private equity investments in the semiconductor industry since 2016, according to Market Intelligence data. The aggregate deal value totaled $57.07 billion, roughly 50% more than the total invested by private equity in the semiconductor industry in the U.S. and Canada.

The CHIPS Act will not shift the locus of global chipmaking away from East Asia any time soon, according to an analysis by 451 Research. An explicit aim of the act is to fortify the domestic supply of chips against both the supply chain disruptions that cropped up during the pandemic and geopolitical conflict, including tensions between China and Taiwan, a major source of advanced chips. But its impact may be limited, 451 added, noting that U.S. chip designers have a "long-established and highly successful" practice of outsourcing fabrication to specialized plants in Asia, largely in Taiwan and South Korea.

Still, Ferguson argued that onshoring removes some of the risk inherent in investments in both chipmaking and in U.S. businesses dependent on a steady flow of semiconductors, another aspect of the CHIPS Act that is likely to get attention from private equity.

"Less risk also could lead PE to look more favorably at a potential investment and start to discount some of that risk that's been more inherent with so much of the manufacturing overseas in Asia," Ferguson said.